Wealth

The nest egg strategy - How to use property to live a richer retirement

In this article, you’ll learn what the Nest Egg strategy is and whether it’s the right strategy for your retirement.

Property Investment

7 min read

Author: Dennis Schipper

Financial adviser for 3+ years. Helped nearly 500 Kiwis buy property.

Reviewed by: Derry Brown

Financial Adviser in industry since 2007. Investor in Auckland & Christchurch. Previous COO of Global Brand

How do property investors live off their portfolio after their houses have gone up in value?

One strategy is the Nest Egg. That’s where you invest in property to grow your wealth. Then you gradually sell your properties and spend the leftover money.

But how does that work? And how do you transition from growing your wealth … to spending it?

That’s where you:

In this article, you’ll learn how the Nest Egg “end” works, aka how equity becomes a lump sum of cash, and how you draw an income from it year after year.

At the end of the Nest Egg strategy, you sell properties, invest the cash, and live off it over time. The key risk is making sure the money lasts.

You need to build your wealth to get to the ‘end’ of the Nest Egg strategy. Often, investors buy growth properties (like houses and townhouses) and hold on to them while they increase in value.

Then, once you have wealth in those properties, you sell down those growth properties. You pay off any remaining mortgages. And after all of that, you’re left with a big lump sum of cash.

Under this strategy, you invest the money in more liquid assets (such as shares and bonds) and draw regular income to fund your lifestyle. Here’s how it works:

Step #1: Plan your “sell down” period

Most people don’t sell all their properties at once. Instead, they sell over several years.

That gives you time to:

Typically, we suggest that investors plan to sell down their portfolios over a 5-year period.

This is where you turn your property’s paper wealth into a lump of cash.

Step #2: Invest the money with an investment adviser

The next step is to find an investment adviser that you trust. These advisers will create a financial plan for you, then help you implement it. That’s often by investing in managed funds, shares bonds and other investments.

You’ll often sit down with an adviser and say: “I want you to transfer $1,000 a week into my bank account. How should I invest my money to make that happen, and how long might it last?”

They’ll recommend an investment mix based on:

They’ll also help you figure out if your spending goals are realistic based on the money you have.

This step ends with them taking your money and investing it in managed funds, shares and the other assets you agreed.

Step 3: Gradually sell your assets to draw your retirement income

Next your investment adviser will begin selling some of the assets you’ve invested with them. This is so they can transfer your spending money.

They might transfer you this consistent income weekly, fortnightly or monthly. It’s up to you.

Most investors I see set it up so the investment adviser:

One of the big questions investors have is: “If I am selling my assets … and spending them … how long will they last?”

Well, it depends on:

But the money may last longer than you think. Because over time, you’ll likely get some returns on your investments.

But here is a simple example to show you how it can work, with numbers.

Imagine you sell your investment properties and end up with $1,000,000. You decide to draw $40,000 a year from those assets (about $769 per week).

So, you:

That $960,000 still gets invested and can earn a return.

Let’s say you get a 3% return (after fees and tax) over the year. That means that:

So, even though you took out $40,000 at the start of the year … your investment balance didn’t drop by $40,000.

It fell by $11,200 ($1,000,000 − $988,800 = $11,200).

And that’s because your portfolio earned that $28,800 return while you were living off your income. That pattern continues.

So you might initially think that if you have $1,000,000 and want to spend $40,000 a year, that it will last for 25 years. ($1,000,000 / $40,000 = 25 years).

But if you were able to get a consistent 3% return, your money would actually last for 44 years. Assuming you’re taking out that same $40k a year.

That sounds great, except for one important real-world truth. You’re not going to get a consistent 3% return each year. Because the value of your managed funds, shares and bonds will go up and down each year.

For instance, what happens if you get a +6% return one year? Then the next you get a -3% return? You may still want to draw down the same amount of money. In which case, your money may not last for exactly 44 years (like in the above example).

That’s why you use an investment adviser and talk to them each year (or more frequently). Because then you can adjust either:

This is exactly what your adviser helps you model, stress-test, and monitor over time.

The biggest risk in the Nest Egg strategy is running out of money. That could be because you spend too much, too quickly, or you get a string of very poor returns.

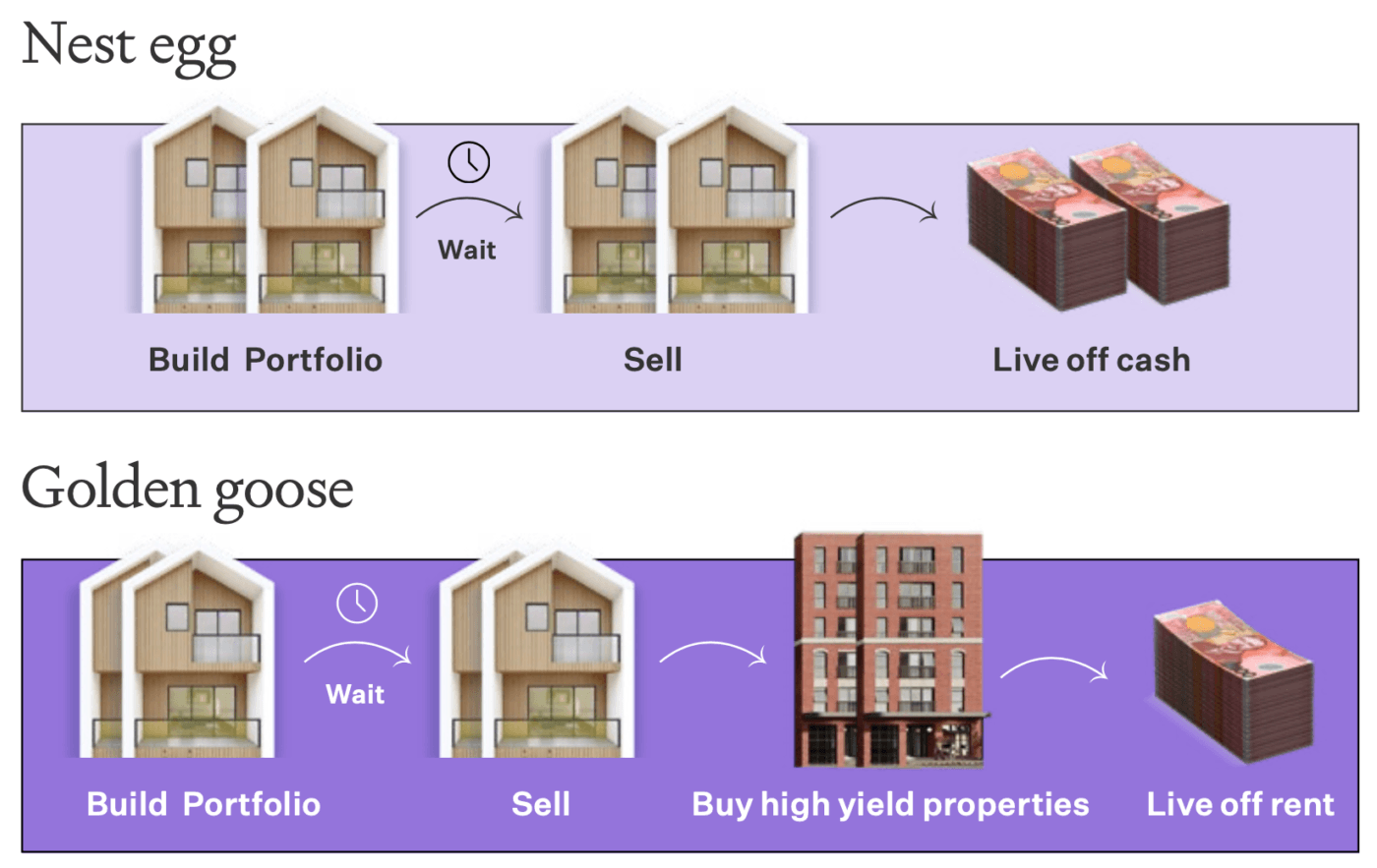

That’s because the Nest Egg Strategy is different from the Golden Goose.

In the Nest Egg strategy, you gradually spend your money and your assets.

But under the Golden Goose, you live off the rental income from your properties. This strategy means you need more money to start with (all else equal), but it is less likely to run out.

So one risk investors who use the Nest Egg need to consider is the risk that the money runs out.

Tax doesn’t disappear in the Nest Egg Strategy … but it does change.

When you withdraw money from your lump sum, you’re just spending your own money.

Think of it like moving money from savings into your everyday account. You’re not “earning” it … it’s already yours. So you don’t pay income tax the same way you would under the Golden Goose (where you are earning rental income).

But where tax can show up is usually in two places:

| What’s happening | How you earn money | Is it taxable? |

|---|---|---|

| Withdrawing from your lump sum | Drawing down your $1m over time | No ❌ |

| Investment returns on the remaining balance | Interest, dividends, and managed-fund income earned while the rest stays invested | Yes ✅ |

| Profit when you sell property | The gain on sale | Sometimes ❓ |

After working with investors as a financial adviser, I’ve realised that there are 4 common mistakes people make when using the Nest Egg Strategy:

Mistake #1 – Spending money based on hope, not maths

Sometimes people pick a number that they want to spend each week (e.g., $1,500/week). They start spending. But they’ve never run the numbers to see how long the money might last.

Mistake #2 – Ignoring “bad years” early in retirement

Let’s say you get poor returns at the start of your retirement. Those early returns can have a big impact on your later years. That’s why you want to review your plan at least once a year with your investment adviser.

Mistake #3 –Not having a cash buffer

Let’s say your investments take a sudden hit. If you keep withdrawing your money, you may be selling investments at a bad time in the market. But, if you’ve got cash savings of 6 months' worth of spending … you can avoid that pressure.

Mistake #4 –Never reviewing the plan

The worst mistake is avoiding the annual reviews with your investment adviser. The Nest Egg only works smoothly if you keep checking in on:

To start this phase of the Nest Egg strategy, you often need to start selling your properties. And it helps to get the ball rolling before the age you want to retire.

I often suggest that investors plan to sell their properties 5 years before they want to start drawing an income. This lets you sell your properties in stages, plan, and set up your new investment portfolio properly.

But the timing does depend on:

After all, retiring at 65 and planning for 20 years looks different to retiring at 55 and planning for 35 years.

Once you know the timeline, a good investment adviser can run the numbers to help you figure out how much spending is sustainable.

Financial adviser for 3+ years. Helped nearly 500 Kiwis buy property.

Dennis joined the Opes Group back in 2017, and he’s now one of the longest-serving team members. He’s met with thousands of Kiwis to talk about their financial goals and has helped close to 500 of them become property investors.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser