Property Investment

How to know if you can really afford an investment property top-up

Not sure if you can afford a $150–$200 weekly top-up on an investment property? Learn how to test your budget before you buy.

Property Investment

8 min read

Author: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Many people want to invest in property, but don’t know where to start.

Andrew and I were at a winery in Queenstown, and as we were leaving we bumped into a listener of the Property Academy Podcast. Whenever this happens, the listener/property investor will pull us aside and ask about their situation.

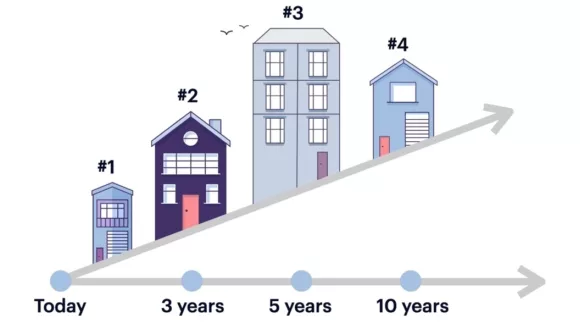

Often they don’t know where to start. That’s why we’ve created the three stages of property investment so investors can identify where they are and what they need to do next.

At the most basic the three stages are: you buy your first home; you use the equity you build from that house to grow a portfolio; then you use the portfolio to fund your retirement.

Easy-peasy, right?

All the ins and outs of what’s involved behind making these three steps a reality could fill a book. And it actually has; our book Wealth Plan – How To Invest In Property and Retire on Real Estate, is due for release in June.

So, in this article you’ll learn what each of the different stages of investing are and explore what stage you could be at and how to determine your next step.

In the book we talk about investing in property being a long-term race. An investor at the start of their journey is at the starting blocks.

A person at this stage is a keen, green investor. You either don’t own your own home, or you have your own home but don’t have the money to invest yet.

Generally speaking, people in this stage are earlier on in life and are figuring out a game plan for their financial future.

The main issue investors face at this stage is you don’t have enough deposit to go out and buy a slew of investment properties … yet. (Darn, if only things were so simple).

This is why the game plan at this stage is to build equity that can be used for your second property. And then to build a portfolio after that.

There are two things you need to do in this stage:

To tackle the first step, you have to secure your first property and be able to service (i.e. pay) the mortgage.

To do that, you’ll often use The Fast 5, which are the top 5 sources first home buyers can use to get the deposit for their first home. If you want to learn more, check our recent first home buyers’ webinar.

Once you’ve got your first home, it’s time to build equity so you can purchase your second house and build your portfolio.

You do this by choosing one of two strategies. To build equity within your first home you can either:

Once you have a minimum of $120,000 worth of useable equity, you have the ability to move onto the next stage … the Running Race.

Once you have equity to buy your next property you can blast out of the starting blocks and move into our second stage of investing, running the race.

This is the section where you start to build a portfolio and purchase multiple investment properties.

But you’re not going to buy 5 investments all at once. You’re going to do it slowly and over time.

But, let’s backtrack a bit. The whole purpose of the running the race stage is to get you into the position where you can cross the finish line and live off your property portfolio.

The idea of it being a ‘race’ is a bit of a misnomer. Because you’re not racing against anyone except yourself. All you need to do is build enough equity to fund the lifestyle you want.

To do that you need to “set the length of your race”. This is where you calculate how many assets you need to fund your lifestyle. And here at Opes we have built our own software to do this, called MyWealth Plan.

This is where you will decide something like: “I need to buy 3 properties over the next 5 years, and in 20 years’ time I’ll have a passive income of $100,000.”

This goal-setting and planning process gives a structure to follow as you’re building your portfolio.

Because each situation is personal, the length of your race will be shaped by things like: How old you are, how many kids you have, and what your goals are.

The running the race stage is where you will spend the most time. And most people who start thinking of investing in property are already at this stage.

For instance, if you’re 40 years old, you’ve owned your own home for 10 years, and you’ve been diligently paying down your mortgage, you’re probably at this stage.

This is where you need to learn:

And you actually need to buy some investment properties that you’ll hold for the long term.

You don’t need to buy 25 properties or try to get “Sir Bob Jones” rich, you just need enough to get through your race.

You’ll decide the exact number you need when you set the length of your race. Most investors we deal with need 3-5 investment properties.

So the goal here is to buy the properties you need, which you’ll then hold for the long term.

This is the fun one :). This is where it all comes together, and you use your portfolio to fund your lifestyle.

In this final stage of investment you’ll transition from growing your assets to receiving an income from those assets.

It’s your exit strategy, or your game plan for how to take the equity you’ve built and turn it into cash to live on.

So, usually in this step you’re selling the properties you’ve already purchased. But you still have a choice to make with what you want to do with that money. You can:

a) Chuck the money in your bank and live off it (the Nest-Egg strategy)

b) Buy high-yielding properties, where you live off the rent (the Golden Goose strategy)

Usually, investors will want to cross the finish line as they approach retirement.

However, age is not the only indicator, because you could just be looking to leave full-time work and have a change in lifestyle.

For instance, you might be 40 years old, have built up significant assets, and now be in the position where you can earn a passive income from your properties.

So, the time to start crossing the finish line is when:

Everyone eventually wants to cross the finish line. But you can’t do it unless you have the assets.

It’s not like you can call someone to pick you up from the starting blocks and drop you off at the finish line. Unless you inherit $1 million from a long-lost uncle.

Once you have the assets, there are 2 routes you can use in this stage. You can either:

Sell your assets to live a richer retirement

Generally this is the more affordable of the two. You don’t need as many assets to take this strategy.

Here, you sell your investment properties, put the money in the bank or a low risk fund, and you live off the principal.

That means that over time your assets will go down. But that’s OK. If you’ve set the length of your race correctly, you should have enough until you reach heaven’s pearly gates.

Hold your assets to live on a permanent passive income.

This strategy is not as common but it is arguably more desirable. That’s because under the Golden Goose strategy you can live forever and you won’t run out of money.

Instead of living off the money, this strategy sees you sell your properties, and then invest in high yielding investments with very low debt on them. The rental income then funds your lifestyle forever.

In other words, although you change the properties you invest in, you still hold on to your assets, which then produce a permanent passive income.

This article is just a basic outline of the three stages of an investor’s journey. There is a lot more to each of these steps.

The first step you need to take is determining which stage you are in. Because once you’ve figured out where you are now, you can clearly see what you need to focus on.

Once you have figured out which stage you are in, the next step is simple. You need to stay focussed on doing what’s required to get to the next stage.

If you are at the starting blocks, it’s time to get your first home. Once you’ve got your first home, focus on increasing your equity by paying off debt or renovating.

Once you’re running the race, your goal is to build wealth. So focus on buying growth properties, which tend to increase in value fastest.

Once you get to crossing the finish line, sell your properties and either invest in a low-risk fund or invest in high yield properties to build a passive income.

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Laine Moger, a seasoned Journalist and Property Educator holds a Bachelor of Communications (Honours) from Massey University and a Diploma of Journalism from the London School of Journalism. She has been an integral part of the Opes team for four years, crafting content for our website, newsletter, and external columns, as well as contributing to Informed Investor and NZ Property Investor.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser