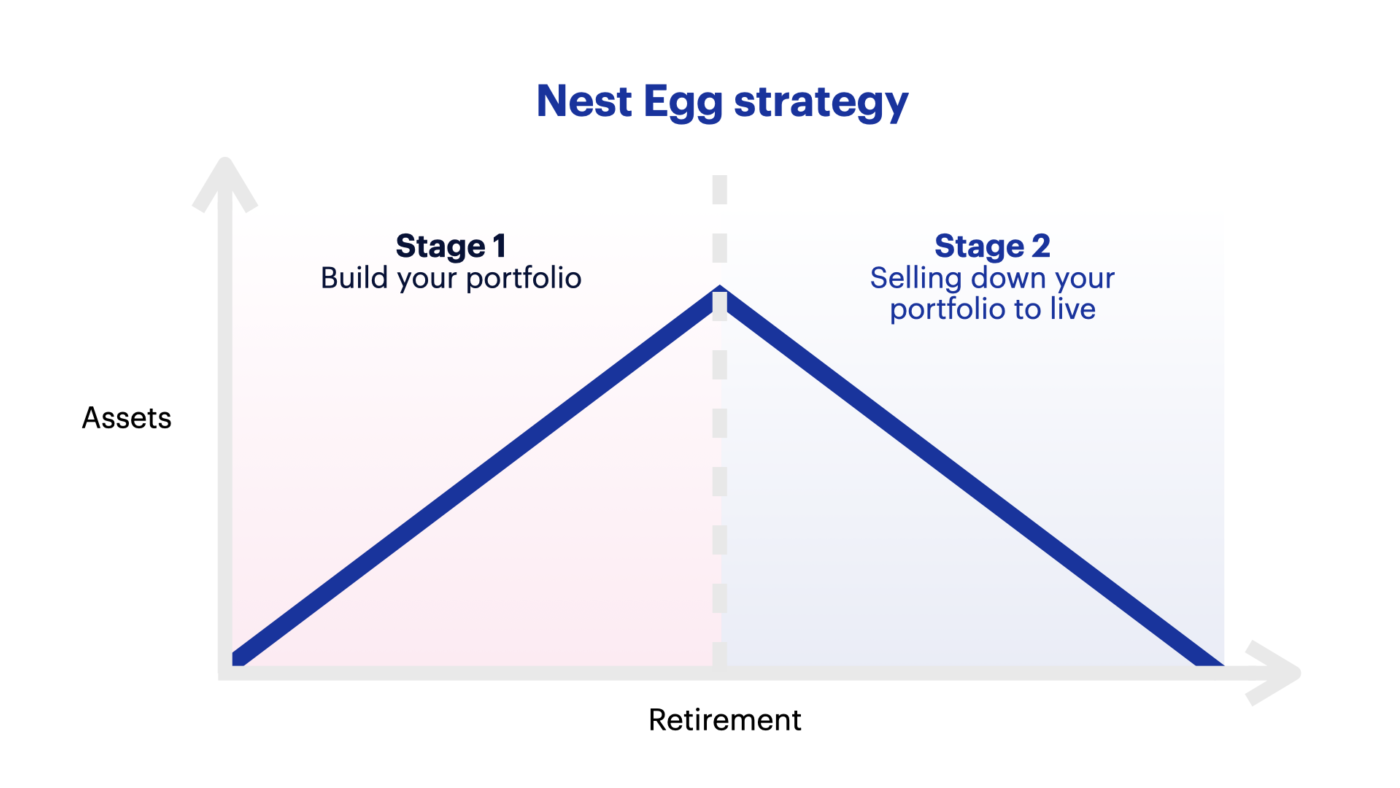

Stage 2 – Sell your assets and manage your money

The second stage is to turn your properties into cash so you can afford to live. This means selling the properties, paying off the mortgage, and then living off the left over funds.

In practice, you’re not going to put all your properties up for auction the day you turn 65, and job done.

Instead, you’ll likely only sell one property at a time, to release the money you need to live.

For instance, once you retire, you might start living off your Kiwisaver first. Once you’ve spent those funds, you might sell your first property at 67.

That could provide enough money so that you don’t have to sell your next property until you turn 75.

The benefit of this is that as you continue to hold your properties they will likely continue to increases in value.

So if you continue to hold a property from 67 to 75, you’ll likely be better off than if you sold everything up and put it in a term deposit.

Under the Nest Egg strategy, once you sell a property and release the equity, you’ll likely invest the money in a low-risk fund or term deposit.