Mortgages

LVR restrictions – Here’s everything you need to know about them

Explore the 2026 updates on Loan to Value Ratio (LVR) restrictions in NZ. Understand how LVR changes impact borrowers, investors, and the housing market.

Tax

5 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

The National government has now fully reversed Labour’s interest deductibility tax law. The last change happened on April 1, 2025.

This is a big win for many property investors. It means paying less tax and potentially making more money.

Property investors can now deduct 100% of their mortgage interest from rental income ... just like before Labour’s 2021 rule change.

In this article, you’ll learn what interest deductibility is, why it matters, and who benefits most from the new rules.

In 2021, the then-Labour government introduced new “interest deductibility” laws.

This didn’t increase tax rates for property investors, but they did change how the tax was calculated.

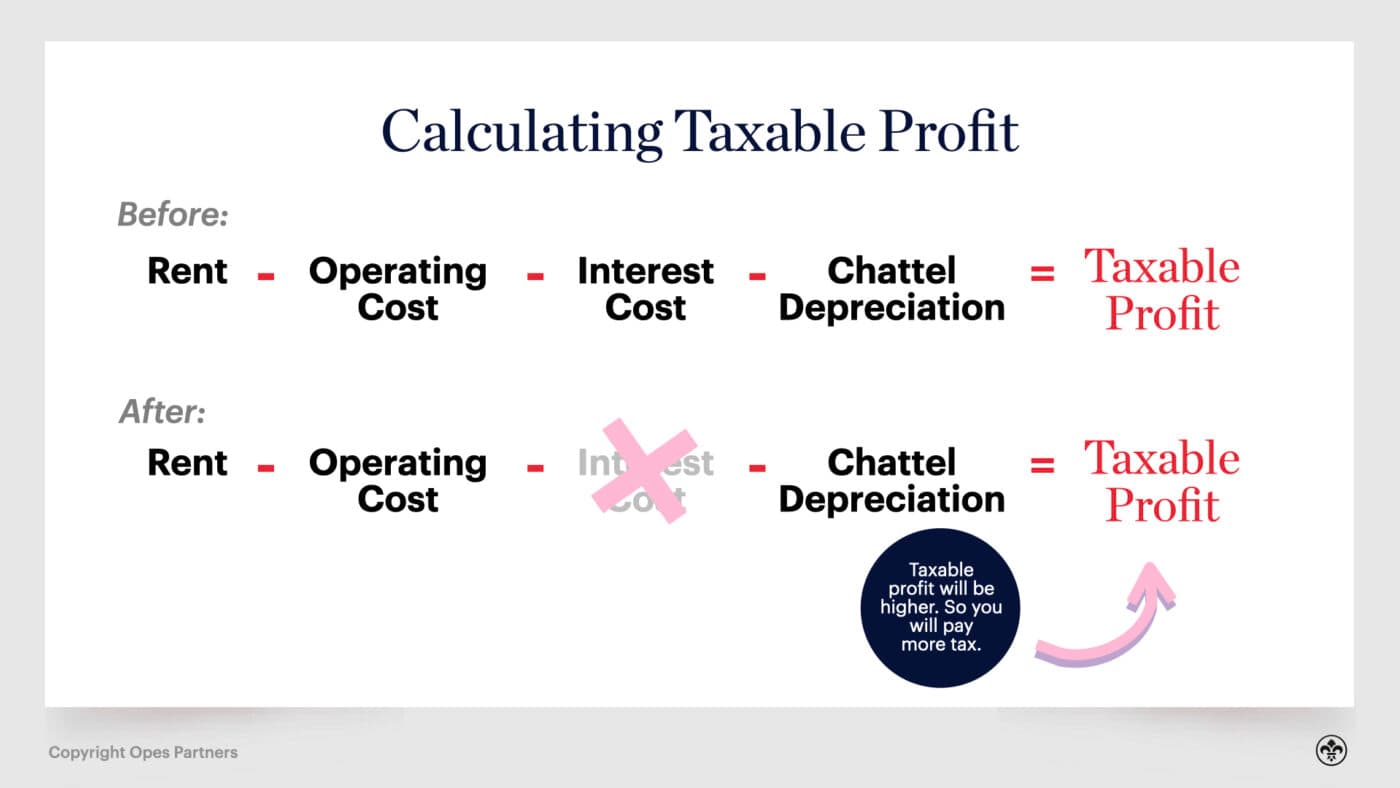

Property investors pay tax based on their taxable profit. The higher your taxable profit, the more tax you pay. And Labour changed how investors calculated their profits.

Profit is normally your income minus your expenses. And the cost of interest on your mortgage is not just an expense; often it’s an investor’s largest expense. (Imagine how much more profitable your investment would be if you didn’t have to pay a mortgage).

But when Labour introduced their rules, interest stopped coming into the profit equation. They didn’t let you use it as an expense when calculating profit.

That made it look like investors were making more money (at least to the IRD), so they paid more tax.

Effectively, you were taxed as if you didn’t have a mortgage but, of course, you still had mortgage costs to meet.

Here is an example of how an investor made their calculations under Labour’s rules.

So, you got the same amount of rent. You paid the same operating costs (e.g. insurance and maintenance). You paid the same amount to the bank, but you paid more money to the IRD.

From April 1, 2025 all property investors can once again deduct 100% of their mortgage interest. We’re going back to the old way of calculating property investment profits.

But the impact varies. Remember, under Labour the rules were messy. There were lots of exemptions:

These rules are now gone.

Here’s who benefits the most:

An investor who bought an existing 1970s house in Auckland in 2022 with an $800k mortgage would have had 0% deductibility under the old rules.

Now, that jumps to 100% in 2025, saving around $15,000 this year, and $176,000 over 15 years.

An investor who bought in 2020 had 50% deductibility at the time National changed the rules back.

That’s now back to 100%. But, since they already had some deductibility, they save $5,500 in tax this year.

An investor who purchased a New Build in 2022 already had 100% deductibility under the old rules. So, for them, National’s changes don’t have an impact.

But remember, under Labour’s rules New Builds only had that “special status” for 20 years. Under the new rules, it will continue forever.

So, there’s no longer the fear of: “What will happen to my property’s value once the 20 years are up?”

One investor had rented their property to a community housing provider just to keep full deductibility (there was a special exemption if you rented your property to a social housing provider).

If you did that you could then have 100% deductibility.

Now, this investor can rent to anyone and still claim 100% of their interest costs.

That means more flexibility. And while they may keep renting to a provider like the Salvation Army, it’s now a choice, not a tax strategy.

Let’s look at a real-world example.

Let's say an investor bought an existing three-bedroom rental in Hamilton in 2022 with a $500,000 mortgage. Rent is $540 a week.

Under Labour’s rules, none of their mortgage interest was deductible, so they paid tax on their gross income, not their profit.

Under National’s new rules they can now claim back that interest cost. Over 15 years this investor will now save over $110,000 in tax.

Yes, they’ll still have some negative cash flow (like most property investors these days). But with lower tax bills, they now have an easier time of it and are freed up to grow their portfolio faster.

There’s a General Election in 2026, and some investors are already wondering: “Could this all be undone? Could interest deductibility come back under a Labour government?”

It could but, right now, there’s no sign of that.

Labour appears more focused on a capital gains tax and wealth taxes. More so than rehashing the unpopular interest deductibility debate.

So, at the time of writing, there’s been no public discussion or policy hint that deductibility will be removed again.

New Builds gained significant advantages under Labour’s rules.

But under National’s rules, it’s an even playing field when it comes to tax.

So, many investors are now asking:“If existing properties get the same tax treatment ... is it still worth buying a New Build?”

It depends. The playing field is more level now – but New Builds still have some key advantages:

That means some investors can grow their portfolios faster if they buy New Builds rather than existing properties.

That said, not everyone should buy a New Build. Some investors are better off buying existing properties,especially if they want to renovate.

The return of interest deductibility is a game-changer for property investors. It improves cash flow, boosts long-term returns, and gives landlords more freedom.

But it's not a silver bullet ... it’s one piece of a bigger strategy.

So if you're wondering how this affects your portfolio – or whether now is the time to buy – have a chat with your financial adviser.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser