Financial Adviser

Top 10 financial advisers in NZ

Select the perfect financial adviser for your needs in 2026. Our top 10 list in NZ offers specialised guidance for investments, budgeting, and more.

Reviews

8 min read

Author: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Visually, Brooksfield developments stand out from the rest.

They build English, heritage-style properties. Often, they build New Build townhouses with a weatherboard façade, and this is unique in the Christchurch market.

So, they’re pretty … but are they a good investment?

How do their prices compare to other developers building in similar suburbs?

These are great questions, and ones we here at Opes Partners get asked all the time.

In this article you’ll learn the pros and cons of Brooksfield properties, and whether this type of property is right for your property portfolio.

Disclaimer: Here at Opes we recommend New Build investment properties to investors. Brooksfield is one developer our investors have bought from in the past. When that has happened we’ve earned a fee from Brooksfield.

This does mean there is an incentive for us to be biased.

However, we’re still going to be fair, honest, and fact-based. This way, you can decide whether they’re the right fit for you. The answer may be “yes”, but it could also be “no”.

Check out our honest reviews about other developers here:

Brooksfield has been developing residential property across Christchurch for the past 4 years. This makes them relatively new on the scene.

They build in inner-city Christchurch suburbs. For instance, they’ve built several developments in Addington, Sydenham and Edgeware.

Oliver Hickman is a director of Brooksfield. He says: “Every time I think about moving up north [to Auckland], I buy another piece of land in Christchurch.”

Generally, Brooksfield builds 2 and 3-bedroom townhouses. However, recently they have been building higher-priced properties with up to 5 bedrooms.

Typically, their developments have between 4 and 30 properties in them.

That’s fewer units in each development compared to other Christchurch developers.

One factor that makes Brooksfield properties stand out is the design.

The exterior of their properties have flair. They often take inspiration from cities like New York or London, so they look different. This is best seen in their heritage collection.

Brooksfield directors Vincent Holloway and Oliver have spent time overseas. This inspired them to bring a similar design to Christchurch. But it’s not just the outside of the property that is different.

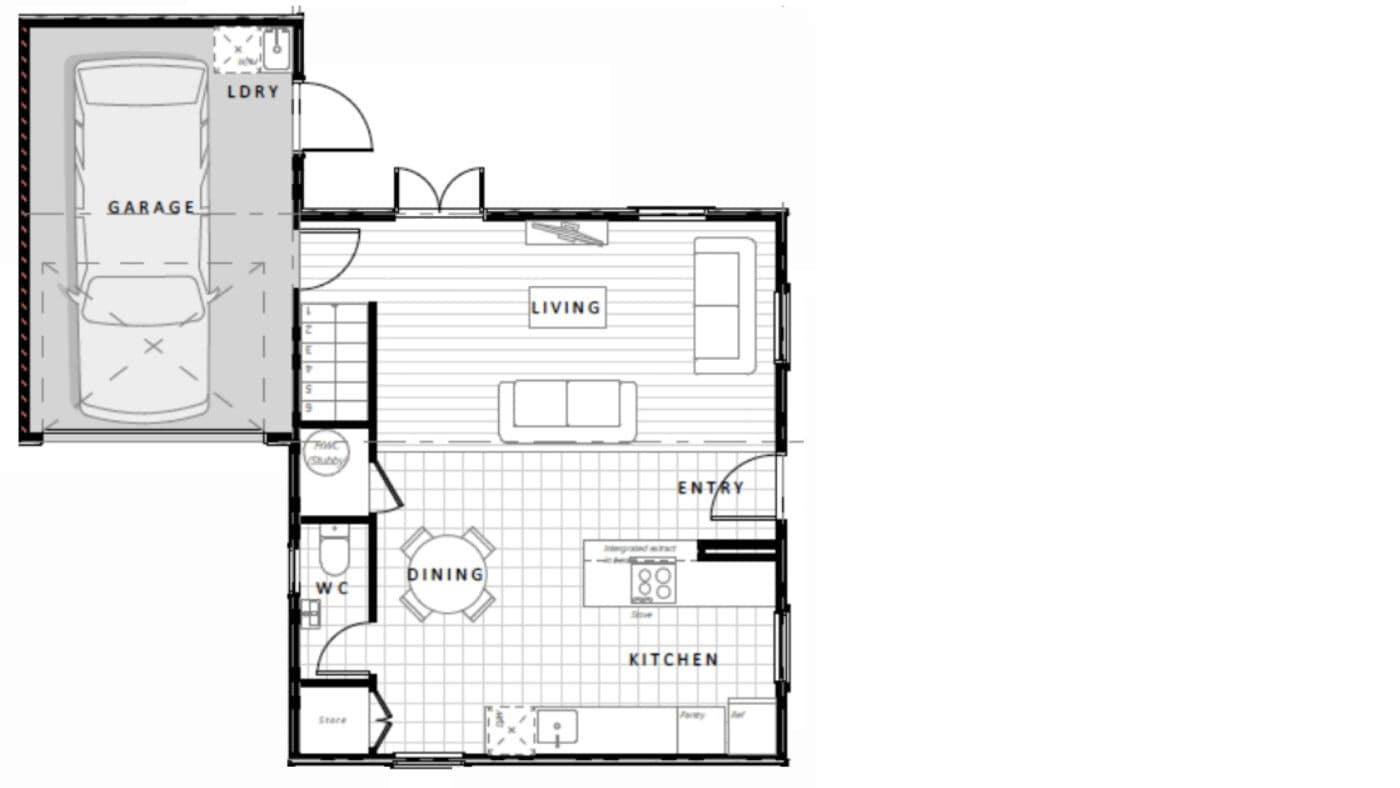

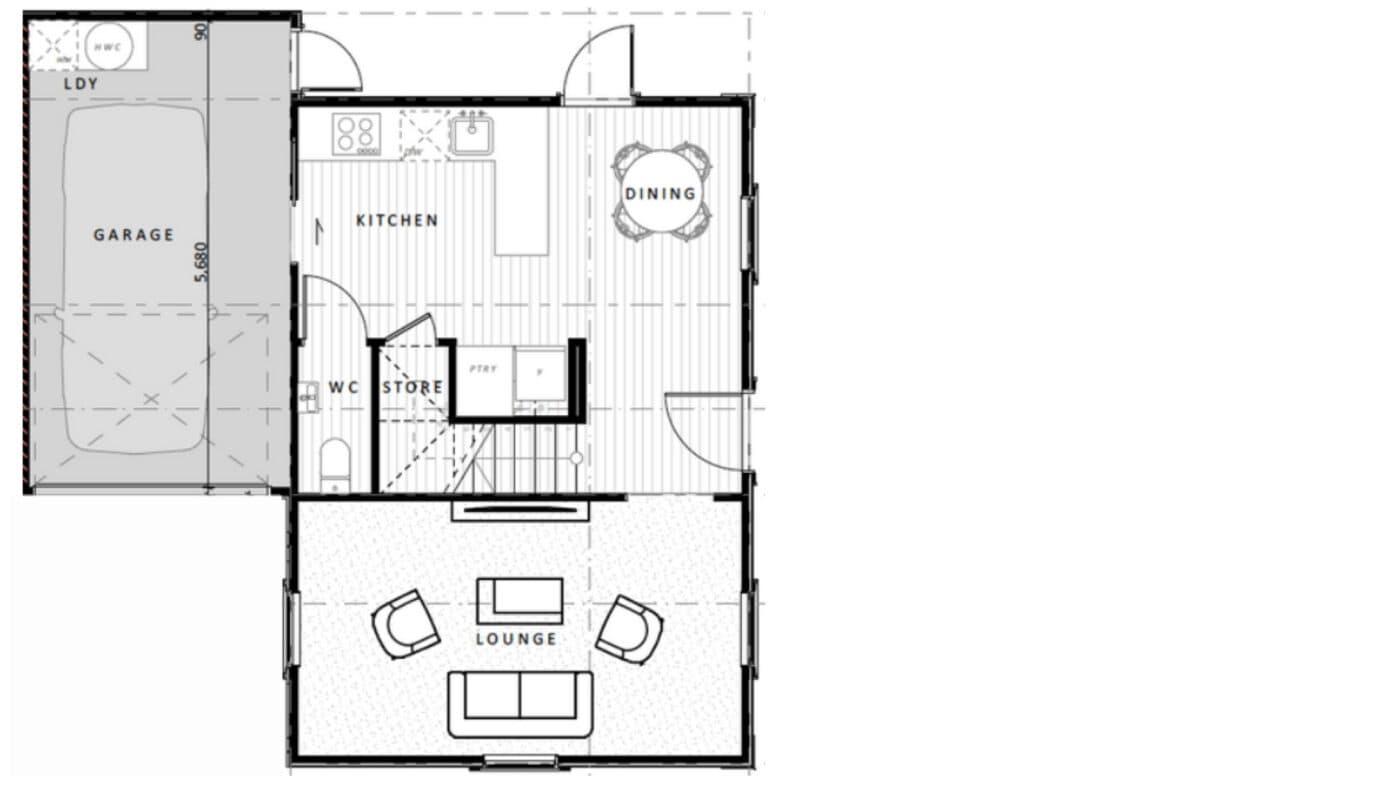

Some of their floor plans are also unique.

Most townhouses in Christchurch have an open-plan living space. The kitchen, dining and lounge space is all-in-one.

Some Brooksfield properties also have this layout, but not all of them.

In this example, there is a hallway between the lounge and the kitchen-dining area.

This gives the occupant two separate living spaces and is typical in a London home.

This isn’t the best floor plan for every tenant, but it provides a different option for buyers.

Yes, it sounds simple, but when you compare them to other New Build developments, these small details stand out.

Brooksfield also focuses on sustainability. Some properties come with a pre-installed system of solar panels. You’re also likely to reduce your power bill by 50%.

Here’s an example of a property that one of our investors purchased in March 2021. It’s in a row of 10 townhouses in Spreydon, Christchurch, and is a 2-bedroom, plus study townhouse.

This property appeared on our show, The Deal, with director Vinny Holloway pitching. This project has since sold out. You can watch this episode of The Deal here.

The price was $559,000 (in March 2021).

At the time, the properties were rented for $480 a week. That gives it a gross yield of 4.5% (based on the sale price).

The second-floor has two bedrooms, and a bathroom.

Brooksfield properties are unique, but today you pay for that difference.

Brooksfield properties are usually more expensive than other developers, but this wasn’t always the case.

When they started in 2019, Opes recommended a lot of their properties. The company was new and their pricing was sharp. This made them attractive investments.

But as developers get more established, their prices tend to increase. That happens as they build a brand name.

Here are 2 examples of Brooksfield properties in central Christchurch. Let’s compare their pricing with other developers building in a similar area.

In this development:

- The 1-bedroom property (with a car park) was $619,000

- The 2-bedroom standalone townhouse was $799,000

- The 3-bedroom townhouses are between $879k and $885k

By comparison, Opes recommended similar 2-bedroom townhouses in Central Christchurch for $650,000. This was in December 2021.

Admittedly, Brooksfield’s 2-bedroom townhouse in this example is a standalone property. But this offers a comparison of what other 2-bedrooms can cost.

Secure a comfortable retirement with 3 easy steps

Book your free sessionAround the corner, 2.6km away, was another new project in Waltham.

For this development, the 2 bed/1 bath starts at $659,000.

While the rest of the 3 bedrooms are either $789K and $795K. The one property with a garage tops $809K.

By comparison, a similar 2-bedroom townhouse in Waltham was $619,000. This was $40k lower than the Brooksfield property.

Here at Opes, we do think some of their townhouses are good investments.

But, not all their properties meet our investment criteria.

Here are a few things to consider.

As pretty as the heritage townhouses are today, will they still be on-trend in the future?

When asked this question on The Deal, director Vinny says: “This style of home has been around since the Great Fire of London. If it’s been OK for the last 300 years, it should be OK for the next 15 years.”

There is no data to suggest that a townhouse with a unique exterior will get higher capital growth, but it is fair to say the unique design will likely help with resale potential.

As shown, Brooksfield properties are often more expensive than comparable properties.

In some cases, the difference can be up to $100,000. Brooksfield properties have a few extras –

But inside, the properties are very similar to others on the market. You have to ask yourself whether you’re willing to pay a much higher price for a different exterior.

Some investors will say “yes”; others will say “no”.

While Brooksfield townhouses tend to cost more, they don’t always get more rent.

According to Opes Property Management, “Renters are practical. They care about the number of bedrooms and bathrooms, and the size of the property. They’re less concerned about the exterior of the house.

“They don’t need to fall in love with how the property looks, because they’re going to live in it for 12 months, not 20 years.”

A Brooksfield property may rent more quickly because of the exterior. But like for like, the higher sale price does not result in more rent.

This often means a Brooksfield property may have poorer cashflow than other properties.

This, of course, needs to be judged on a deal-by-deal basis. The cashflow on some Brooksfield properties will stack up. On others, it won’t.

Before Opes recommends properties, each developer goes through a detailed due diligence process.

Brooksfield passed this process because:

This can give investors confidence they have the scale to complete projects.

Some Brooksfield properties are the right fit for property investors, particularly if you are looking to invest in Christchurch townhouses, and you are willing to pay a higher price.

Brooksfield aims to develop in suburbs close to the central city.

They are also a very strong option for owner-occupiers. These are the sort of buyers who will pay a higher price to buy a unique property.

But, if you are an investor wanting to buy a New Build property outside Christchurch … then Brooksfield isn’t the right fit for you.

This is because they only develop in Christchurch. Investors who want higher capital growth might like to consider a different investment (if they can afford to do so).

If you’ve got your eyes on a Brooksfield property, you have two main options.

#1 Go directly to them. Brooksfield has an internal sales team, who can work with you.

#2 Use a property investment company, like us here at Opes.

If you work with us here at Opes Partners then you will work with a financial adviser to:

Click here to compare property investment companies vs going to a developer direct.

All things considered, Brooksfield can be a good option.

But they aren’t the right fit for every investor, and not every property they build is a good investment.

This doesn’t mean those homes are bad, it just means not every property is a good investment. That’s true for most things.

More recently, their prices have gone up.

This is why we here at Opes Partners don’t recommend them as often as we did in the past.

This is because the yield isn’t always high enough to make sense as an investment.

Ultimately, your decision hinges on the numbers. They need to stack up for the deal you’re looking at.

This is why investors who purchase New Build investment properties use Opes. We evaluate many developers and find the right properties to suit their portfolios.

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Laine Moger, a seasoned Journalist and Property Educator holds a Bachelor of Communications (Honours) from Massey University and a Diploma of Journalism from the London School of Journalism. She has been an integral part of the Opes team for four years, crafting content for our website, newsletter, and external columns, as well as contributing to Informed Investor and NZ Property Investor.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser