Mortgages

Top 6 Christchurch mortgage brokers

Here is our honest review of the top 6 mortgage brokers in Christchurch – in no particular order.

Reviews

14 min read

Author: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

For those looking to buy a New Build investment property, you’ll almost certainly have come across the name: Williams Corporation.

It’s no surprise because they’re one of the largest developers in the country, producing hundreds of homes each year.

But you might be wondering: “Are their properties good investments?”

It’s a question we, here at Opes Partners, get asked all the time. So, because we’re never ones to shy away from answering investors’ questions, here’s our honest review.

In this article you’ll learn the pros and cons of Williams Corporation, and whether this type of property is right for your property portfolio.

Do you have a question or comment about Williams Corporation? Feel free to leave your thoughts in the comment section at the end of the page.

Just before we get into it, you should know that here at Opes we recommend New Builds to investors. In the past we have recommended Williams Corporation properties to investors. However, right now we don’t recommend any Williams Corporation properties to investors.

That does mean there is an incentive for us to slag them off and say their properties are bad, and you should buy a property from another developer that we recommend.

But even though there is an incentive for us to be biased, we’re still going to be fair, honest, and fact-based. That means you can decide whether they’re the right fit for you. The answer may be ‘yes.’ Williams Corporation were also approached for comment before publishing this article.

Williams Corporation is a residential homes developer – the second busiest in New Zealand, ahead of other big names like Mike Greer Homes and Fletcher Residential, and only behind G J Gardiner.

Over the last year they’ve created plans to build another 771 properties (March 2021 – February 2022).

They primarily tend to build townhouses. According to BCI data, 90% of all their properties are townhouses.

These townhouses are spread throughout Christchurch, Wellington and Auckland (in that order).

Although the company is also looking to build houses in Nelson and Tauranga, that hasn’t shown up in the data yet.

In addition, Williams Corporation managing director Blair Chappell appeared on our show, The Deal, last year pitching their Te Atatu project on Matipo Road. This project has since sold out.

You can watch this episode of The Deal here.

Currently, Williams Corporation has projects underway or planned in Auckland, Christchurch, Wellington and Tauranga.

They are usually a mix of 1, 2, 3 and 4 bedroom townhouses, and the company builds properties at the affordable end of the market.

They can do this because when compared to the other 9 busiest homebuilders in the country, Williams Corporation properties tend to be smaller.

When you take a weighted average, their properties are half the size of the other 9 busiest developers.

That should not necessarily be seen as a negative. The reason they’re smaller is that they build different types of properties. Rather than building 4-bedroom standalone homes (like many of the other busiest builders), they build a lot of 2-bedroom townhouses.

This means they can lower the cost to build each property and bring down the price.

For example, the average weighted construction cost of a Williams Corporation property is 58% cheaper than the constructions costs of the other 9 busiest homebuilders.

But just before you get your hopes too high, that doesn’t mean you are going to be able to buy a home from 58% less than other builders. But it does mean that, when compared with others, Williams Corporation are more affordable.

However, even though Williams Corporation properties are smaller, from our experience their properties tend to use the space really well.

Another point of difference for Williams Corporation is that their homes tend to follow a standardised design and use similar materials across projects.

That means their properties get built quickly, since their builders know what to do and have built similar properties before.

However, while these points mean properties get built quickly and you can be confident in what you’re getting, it does mean all the projects look very samey.

Secure a comfortable retirement with 3 easy steps

Book your free session

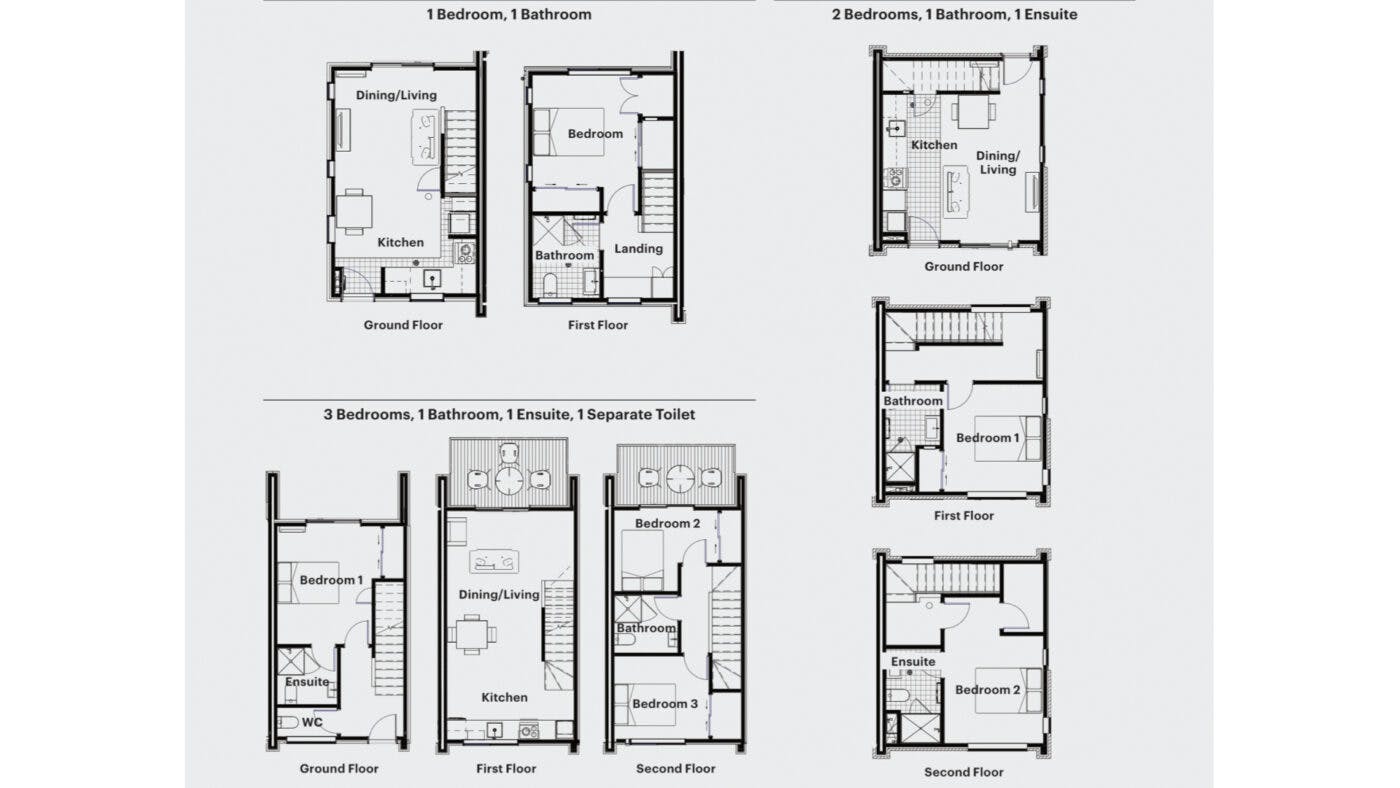

The project was a mix of 1, 2 and 3 bedroom townhouses, each with off-street car parking.

As you can see by the floor plan, unless it’s a 1 bedroom townhouse, the property has three storeys.

For the 2-beds, the ground floor hosts the open-plan living and kitchen area. The two storeys above have a bedroom each, both equipped with either an ensuite or a bathroom.

The 3-bedroom townhouses have the dining and living areas on the first floor. The ground floor has the first bedroom with an ensuite, as well as a separate toilet. The other two bedrooms share the top floor and a bathroom.

A property from Williams Corporation is likely to be on the more affordable side, which is a big drawcard.

The fact they tend to build smaller properties means they are more affordable to build. It’s designed to be that way.

As we mentioned, the average construction cost is 58% lower than the other top 9 developers.

Here is an example of some prices of recent projects advertised at the time of writing:

In Auckland there are four projects currently being advertised. The cheapest property is a 1-bedroom on Te Atatu Peninsula, advertised for $745,000.

The property has 1 bedroom, 1 bathroom and 0 car parks.

The most expensive property currently being advertised in Auckland is a 2-bedroom townhouse in Mt Albert. This property is advertised for $1,290,000.

For comparison the median sale price in the Auckland region at the time of writing is $1,189,000, according to CoreLogic (January 2022).

Here’s a breakdown of the properties currently available (at the time of writing) in Auckland on the Williams Corporation website.

It includes all projects that currently have at least one property available. This is to give you a sense of the prices that are currently being advertised. These will naturally change day-to-day.

Similarly, we can look at the price of properties that are currently available in Christchurch:

The cheapest property is a 1-bedroom townhouse in Papanui, which is currently being advertised for $529,000. This property has 1 bedroom, 1 bathroom and 0 car parks.

The most expensive property is a 3-bedroom townhouse in Upper Riccarton, which is being advertised for $1,230,000. This property has 3 bedrooms, an office, 2.5 bathrooms and a double garage.

For comparison the median sale price in Christchurch at the time of writing is $657,000, according to CoreLogic (January 2022).

Some Williams Corporation properties do tend to be affordable compared to the rest of the market. This is because they are building smaller, higher density properties compared to the rest of the market.

However, if we compare the price of Williams Corporation properties with similar properties built by other developers, their properties do tend to be relatively expensive.

For example, take the 1-bedroom Williams Corporation townhouse in Addington with a car park, which is being advertised at $639,000.

In the same neighbourhood, 1.7km away, Platform Residential – another developer – is selling a 2 bed/1 bath/1 car park townhouse for $629,000.

In this instance, the Platform Residential property is $10,000 cheaper and has an extra bedroom.

To take another example, Williams Corporation’s cheapest 2-bedroom townhouse in Auckland is a Henderson property which is 2 bed/1 bath/0 car park, advertised for $850,000.

However, there is another 2-bedroom townhouse in Glen Eden (another West Auckland suburb) which one of our investors has just purchased for $769,000 from Aedifice. This was 2-bed/1.5 bath/1-car park.

In this example, the Aedifice property is $81,000 cheaper, has an extra toilet and a car park.

A fair criticism of this comparison could be: “You’re choosing only the most expensive ones to use as examples in this article,” or “it’s apples and oranges, maybe they are more expensive because they are higher specced and nicer properties.”

In this instance we have used the cheapest Williams Corporation properties available. But it is true their price differences will be based on lots of factors, including the specification of the house and location.

But this comparison is based on our observation as a company that reviews New Build developments every day, and from the data available. Ultimately, you can look at the different options available to see if you agree with our assessment or not.

For a ball park on how much you should be spending on an investment property, check out our in-depth article.

All investors need to run the numbers when making an investment decision. On top of this you want to make sure that your property is going to remain attractive to future purchasers so you can achieve a good resale value when it’s time to exit the property.

Here are the two most common considerations for Williams Corporation properties.

The first consideration is Cashflow. Let’s look at how a Williams Corporation property stacks up against another option.

If we take the same 1-bedroom example from Addington, and run it through our cashflow model, the numbers show you’d have to drop $94K in cash to top up that property over 15 years.

That means after you take all the positive cashflow the property would make and take away all the negative cashflow, the property is negatively geared by about $94k.

Now, having a negatively geared property in today’s market is not unusual.

But let’s compare it to a similarly priced property in the same area. Let’s again use the 2-bedroom townhouse from Platform Residential mentioned above.

If you run this property through the same cashflow model, you’d only have to top up $52,000 to hold the property (again looking at net cashflow).

So, this means you’d have to spend 80% more topping up to the 1-bedroom Williams Corporation property compared to an equivalently priced townhouse in a similar area.

To be fair, not every Williams Corporation property is going to have bad cashflow. And this is just one example.

In fact, when Williams Corporation featured on our show The Deal, they presented another property based in Te Atatu. In that case the cashflow worked for our investors, so we approved the deal and recommended it to investors.

It is also important to be fair and say that Williams Corporation aren’t necessarily out there marketing all these properties as great cashflow opportunities for investors.

They’re a building company rather than an investment company. But if you are evaluating this as an investor, these are the sort of questions you want to ask yourself.

The second consideration is whether Williams Corporation properties will increase in value as quickly as similar properties.

This is a question that property investors often ask us. This comes down to two factors.

Firstly, if Williams Corporation build townhouses that all share a very similar design, investors may worry that they won't be able to attract a premium price when it comes to selling the property in 15-20 years’ time.

This is because if there are many similar properties all being sold at the same time, there is more competition for you when it comes to selling the property.

Also, a lot of Williams Corporation homes come without a car park. Some investors worry that this lack car parking will affect capital growth in the future.

This is because as more townhouses are built in central city suburbs, on-street parking will become more competitive. i.e. there are more people all trying to park on the street. On top of this, some councils are removing on-street parking.

So properties with dedicated car parking may become more desirable in the future.

On top of this, one investor commented on our You Tube video asking about electric cars. If more Kiwis transition to owning electric cars, how will they charge them if there isn’t a dedicated car park?

It’s a fair question and this could impact the future value of these properties, although it should be mentioned that for many Williams Corporation properties that do have car parks, they often come with an electric charger built in.

Our colleagues at Opes Property Management – a property management company – tell us because on-street parking is becoming scarce, a property without a car park is harder to rent, has more vacancy, and means slightly lower rent.

But this doesn’t mean buying a property without a car park is always a bad investment. But these are important considerations to think about.

A strong pro for a company as well established as Williams Corporation is they‘ve got some grunt behind them.

By this we mean they’ve got a team, they’ve got standardised processes – these factors lower the risk that the property isn’t going to be complete.

Before Opes recommends properties to our investors there is a detailed due diligence process each developer goes through.

This is where we scrutinise a developer and categorise them by risk.

For instance, to be in the “lower risk” side of things, the company has to have:

They also must have a sizeable team of support staff and good project supply chain agreements. This is to minimise the risk of build delays due to supply shortages.

With their sheer size, and the team they have behind them, Williams Corporation would fall into these criteria.

In other words, they can deliver in a good time and stick to the stuff they know.

During the post-pandemic property price boom some developers either cancelled contracts or increased the price of their builds. Williams Corporation didn’t. They honoured all fixed-price contracts.

Williams Corporation managing director Matthew Horncastle says this is because they have the scale to, and do, build a lot of houses.

Williams Corporation understands what a build costs and they factor in cost increases. So, when building materials increase in price, they don’t pass that increase on to purchasers like some other developers may. They have a fixed-priced contract, and that’s the price. They don’t increase it.

For an owner-occupier looking to break into the housing market, a Williams Corporation home can be a great option.

For instance, there are lots of 1-bedroom townhouses that are naturally going to be cheaper than a 4-bedroom standalone house.

This is a great thing for a single person or a young couple looking to get their foot on the property ladder.

On the other hand, while there are great positives to Williams Corporation: affordable, great use of space, a lot of grunt behind the company – in our eyes many of their properties are not the right fit for investors.

This is because of the purchase price compared with other properties available; the cashflow of the properties; and the questions around future value appreciation.

This will be deal specific. That’s the reason we have recommended some Williams Corporation properties to investors in the past (mostly 3+ years ago). However, based on today’s numbers, we don’t.

All things considered, Williams Corporation can be a great option for an owner-occupier or a first-time buyer looking to crack the housing market.

But for investors, in our view, they may not be the right fit right now.

This doesn’t mean those homes are bad. It just means that not every property is a good investment. And this is true of most things.

So, whether or not one of William’s Corporation properties is the right investment for you will hinge on the figures standing up and the deal you are evaluating.

That’s why many investors who purchase New Build investment properties use our service at Opes to evaluate developers and find the right properties to suit their portfolios.

Check out our honest reviews about other developers here: Wolfbrook, Aedifice, Brooksfield and Golden Homes

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Laine Moger, a seasoned Journalist and Property Educator holds a Bachelor of Communications (Honours) from Massey University and a Diploma of Journalism from the London School of Journalism. She has been an integral part of the Opes team for four years, crafting content for our website, newsletter, and external columns, as well as contributing to Informed Investor and NZ Property Investor.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser