New Builds

New builds - The ultimate guide for every property investor

Explore the essentials of investing in new builds. Our guide covers key strategies, benefits, and tips to navigate the market and maximise your investment.

New Builds

7 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

What’s the better investment, New Builds or existing properties?

The rules are constantly changing, so which is better in 2024? In this article, you’ll get an honest comparison of the pros and cons of both types of properties.

Just remember, here at Opes Partners we help people invest in New Build properties.

So, there is an incentive to tell you New Builds are the best thing ever. I’m not going to do that. This is going to be an honest review and comparison.

Because the truth is that New Builds aren’t the right fit for everyone.

Existing properties tend to be bigger and have more land.

For the same price, a New Build will be more compact. It’ll be smaller and have less land.

Existing properties tend to have more bedrooms. But, New Builds often have more bathrooms.

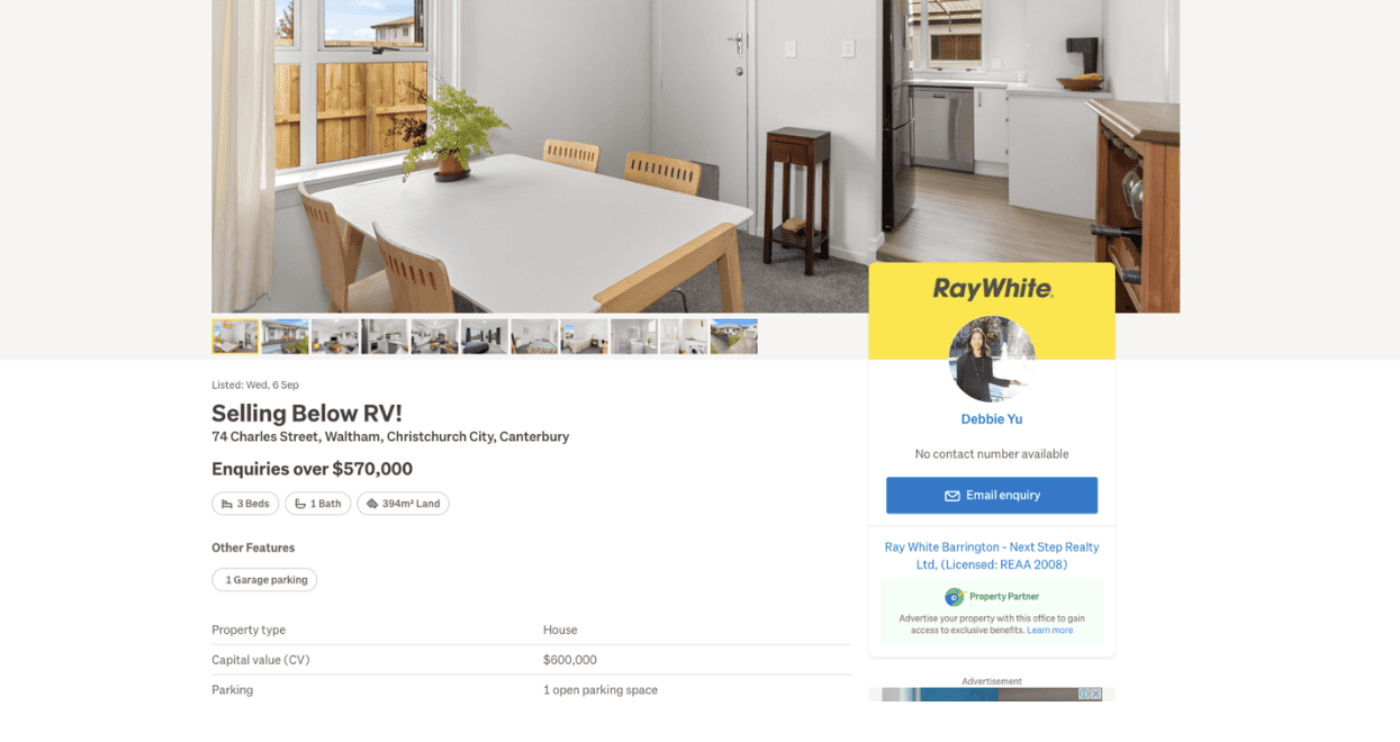

Here’s an example of two recent properties you could have bought.

You can get a 1920s 3-bedroom house in Waltham, with 400sqm of land, for $570k.

Or you could have bought a 2-bed New Build townhouse in the same area for $550k. This property had 85sqm of land.

Even though this New Build was a lower price, New Builds tend to be more expensive because you get less house for a similar amount of money.

If you were to buy a 3-bed New Build house on 400sqm it would cost a lot more than the $570k the existing property cost.

You need less money to invest in a New Build.

New Builds are exempt from the LVR restrictions, so you only need a 20% deposit to buy one.

You need a bigger deposit to buy an existing investment property. At the time of writing, you need a 30%.

On top of this, investors who buy existing properties often renovate. So you need to have money for the renovations too.

This means you need less money to buy a New Build.

A $550,000 New Build needs a $110,000 deposit.

But for a $550k existing property, you’d need $165,000 and another $50,000+ for the renovations. That’s $215,000 in total.

New Builds usually give a higher return on investment. This is because all properties tend to go up in value, but they require different deposits.

Let’s say you have two properties. One new, one existing.

They're both worth $600k. They both double in value over the next 15 years, so they both made $600,000.

But the New Build required you to put less money upfront. You only had to put in $120,000 to buy the New Build property (20% deposit).

But you had to put in $180,000 to buy the existing property (30% deposit).

That means you made a 500% return on the New Build, but the existing property delivered only a 333% return.

The return was the same, but the investment was different.

That’s why New Builds usually give a way higher return on investment … because you put in less money at the start.

Just remember, in this example we’ve just looked at capital growth.

In practice, you need to also look at cashflow and the money you make through renovations.

Even after accounting for these differences, New Builds tend to get a higher return on investment.

Existing properties tend to get higher gross yields than New Builds.

For instance, the tenant in that $570k Waltham property we mentioned before pays $570 a week. That means the investor gets a gross yield of 5.2%.

The New Build is going to rent for $500 a week. The gross yield is 4.7%.

There are some differences in maintenance costs.

But generally an existing property will have a better yield and cashflow than a New Build property.

The National government repealed the interest deductibility tax law in 2024.

This means that New Builds no longer have a significant tax advantage over existing properties.

On April 1, property investors could claim 80% of their interest expenses. This increases to 100% on April 1, 2025

Sure, there will temporarily be a difference in deductibility between New Builds and existing ones.

But in practice, this makes very little difference. Unless you have a very large cash deposit, you won’t notice.

On top of that, the bright line test was reduced to 2 years.

This means New Builds and existing properties are on a more even playing field.

However, debt-to-income ratios (DTIs) have since been introduced.

DTIs cap the amount you can lend, by how much income you earn.

The Reserve Bank has set DTIs as:

6x your income – for an owner-occupier

7x your income – for a property investor

This means if you and your partner earn $100k a year combined, the maximum you can borrow is:

$600k if you are an owner-occupier

$700k as an investor

New Builds are exempt from DTIs. So, some investors will find it easier to grow their portfolios if they invest in New Builds.

New Builds are new. Existing properties can be up to 100+ years old.

That’s why existing properties tend to have more maintenance issues as things wear out.

You might need to replace the hot water cylinder or the roof.

Those costs can be surprising and expensive.

Whereas New Builds have fewer of these issues. Everything is new, and you have a 10-year guarantee on the building work, so there will be fewer of these surprises.

New Builds are also built to today’s building codes.

Building regulations tend to get tougher over time. So it’s fair to say that New Builds are often built to a higher standard than existing properties.

Of course, the New Build will get wear and tear over time. But, you will likely find that you spend less on maintenance.

The biggest benefit for existing properties is you can renovate them to add value.

This means you can create an immediate increase in the value of your property.

For example, you buy a property for $550k, and spend $50k renovating it. Now it’s worth $650k.

You’ve got more equity, and your rent has gone up.

So, if you are a hands-on investor, this can be a really good way of growing your wealth.

But some investors don’t want to be hands-on and don’t care about renovating properties. If that’s you a New Build is likely a better fit.

The Reserve Bank has introduced debt-to-income ratios this year.

This has made it harder for investors to grow a portfolio.

But these new rules only apply to existing properties. New Builds are exempt.

This will make it harder to get money to buy more and more existing investment properties.

Some investors will find it easier to grow their portfolios if they invest in New Builds.

Over time, you’ll always expect there to be more incentives for New Builds.

The government wants more New Builds. So does the Reserve Bank. That’s why they make it easier to build a portfolio of New Builds.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser