Property Investment

How to think like a pro property investor

Unlock the mindset of successful property investing. Learn how to think like a pro property investor and elevate your investment strategies.

Property Investment

3 min read

Author: Lance Jensen

15 years’ experience in the industry. Active property investor with $6 million+ portfolio. Financial adviser at Opes Partners.

Reviewed by: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Postcode prejudice is a mindset some property investors fall into. It’s when you only want to buy properties in prestigious, high-end suburbs.

In Christchurch, think Fendalton. In Auckland, it’s Remuera or Herne Bay.

After all, these are “nice” suburbs, filled with “nice” houses and “nice” people.

But does investing in these areas make sense? Or could it cost you when it comes to investment returns?

In this article, we’ll explore postcode prejudice. That includes where the mindset comes from and the pros and cons. That way you can make the right investment decision for you.

There are 3 main reasons some investors want to buy in higher-end suburbs:

Many investors want to buy in areas they live (or want to live). If you currently own a house in Fendalton, you might think, “Why not buy a rental up the street?”

The logic often goes – “I like the area. It should attract good-quality tenants, and my house has gone up in value. So it must be a good place to invest.”

If you’re a high-income earner, buying a house down the road can feel comfortable.

Higher-end suburbs tend to have higher-end schools. These schools are often in high demand. So, first-time investors often want to buy in a good school zone.

Again, the idea is: “Good school zone = good tenants.”

I recently spoke to someone who bought a Herne Bay property for $4 million in 2007.

Today, it’s worth $8 million – it’s doubled in value.

So they’ve made $4 million. That’s a lot of money.

When an expensive house doubles in value … that delivers a lot of return from a single property!

But you need to be aware of the downsides of postcode prejudice too.

More from Opes Partners:

It can sound like investing in higher-end suburbs has a lot of benefits, but there are downsides you need to consider.

If you live in a higher-end suburb, you’ll know that many of the “quality tenants” already own their own homes. So, you may not capture the rental market you expect.

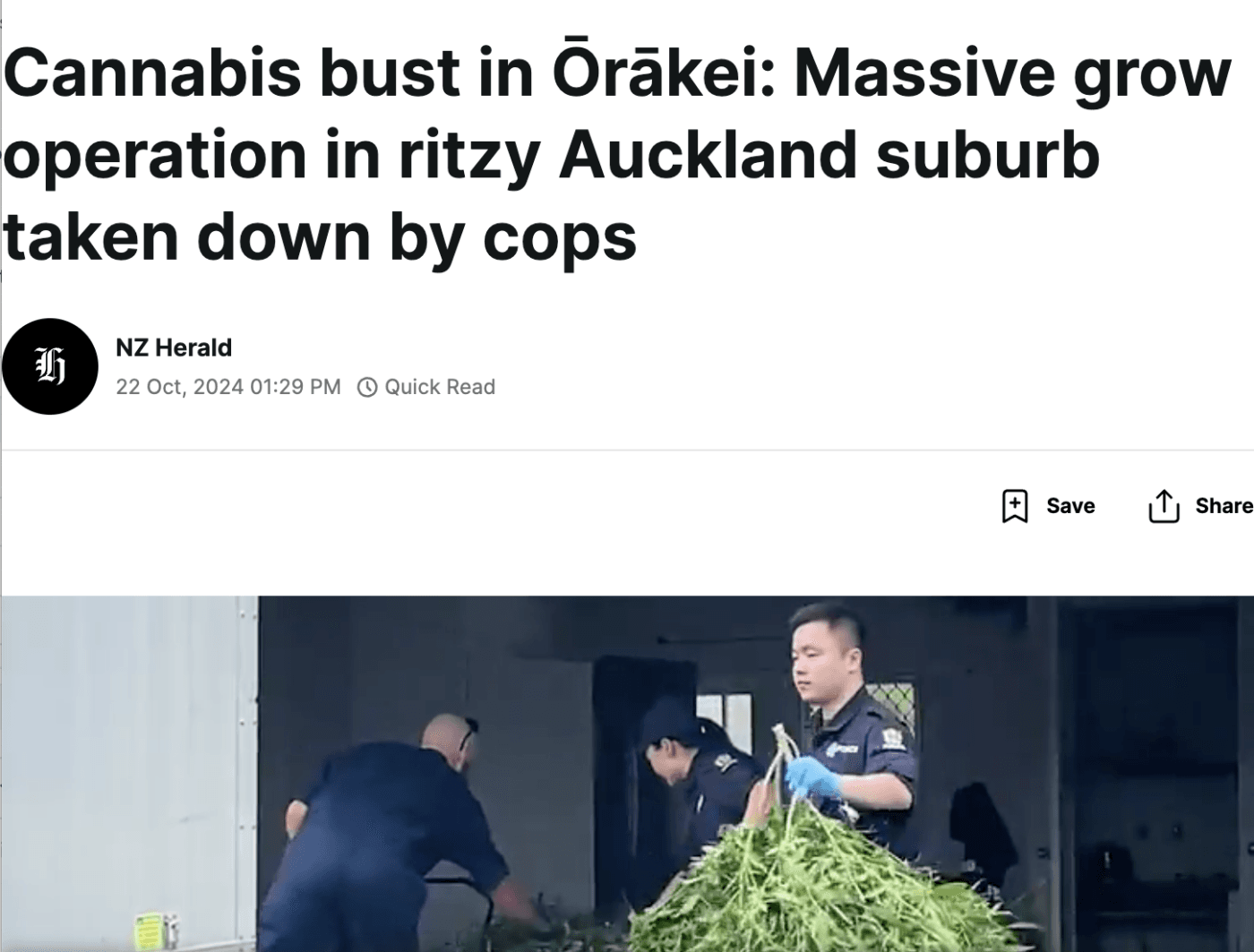

One landlord recently discovered their rental was at the centre of a large drug bust.

The house wasn’t in Otara or Otahuhu (two south Auckland suburbs) the property was actually in Orakei, a more affluent, high-income suburb.

That’s not to say all tenants in higher-end suburbs are degenerates … and not all tenants in lower-income suburbs are darlings. It’s just that there are good and bad tenants everywhere.

Prestigious suburbs often come with a hefty price tag. So, you have higher upfront costs.

In premium suburbs like Remuera, property prices can be 10-30% higher than in nearby areas like Royal Oak.

What do you get for that extra $300k? Maybe an extra $60 a week in rent. That’s a 1% return on that extra spend.

Think about that person who made $4 million from a single property in Herne Bay, Auckland.

Now, a $4 million gain sounds incredible (and it is).

But what if the investor bought 4x $1 million properties, rather than a single $4 million property?

Those 4 properties could have each more than doubled in value and at the same time that investor would have got the benefit of diversification.

Some investors are lucky; they have a choice. They can buy 1 property in a higher-end suburb … or 2 in cheaper suburbs.

If you buy 1 higher-end house, all your investment eggs are in one basket.

Here in New Zealand, each region’s property market tends to operate independently. Property prices in Auckland can be skyrocketing while Wellington is flat. In other times, Wellington will be booming while Auckland prices are going backwards.

Diversification spreads the risk. It gives you a better shot at your net worth increasing in a given year.

Similarly, just having different properties in the same city can spread risk. If you’ve got one property and it’s vacant, you've got a 100% vacancy. If you own 2 properties, and only one is vacant, you’ve only got 50% vacancy.

Just because a property is in a “bougie” suburb doesn’t automatically make it a great investment.

Premium suburbs can feel like the “safer” choice, but the strengths don’t always outweigh the challenges. Things like higher costs and lower returns.

This is where investors need to move from a home-owner mindset to an investor mindset.

You should base your investment decision on data, not just assumptions or personal preferences.

15 years’ experience in the industry. Active property investor with $6 million+ portfolio. Financial adviser at Opes Partners.

Lance has over 15 years’ experience in the property industry. He became a property investor at 22, and has since built a personal portfolio worth over $6 million.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser