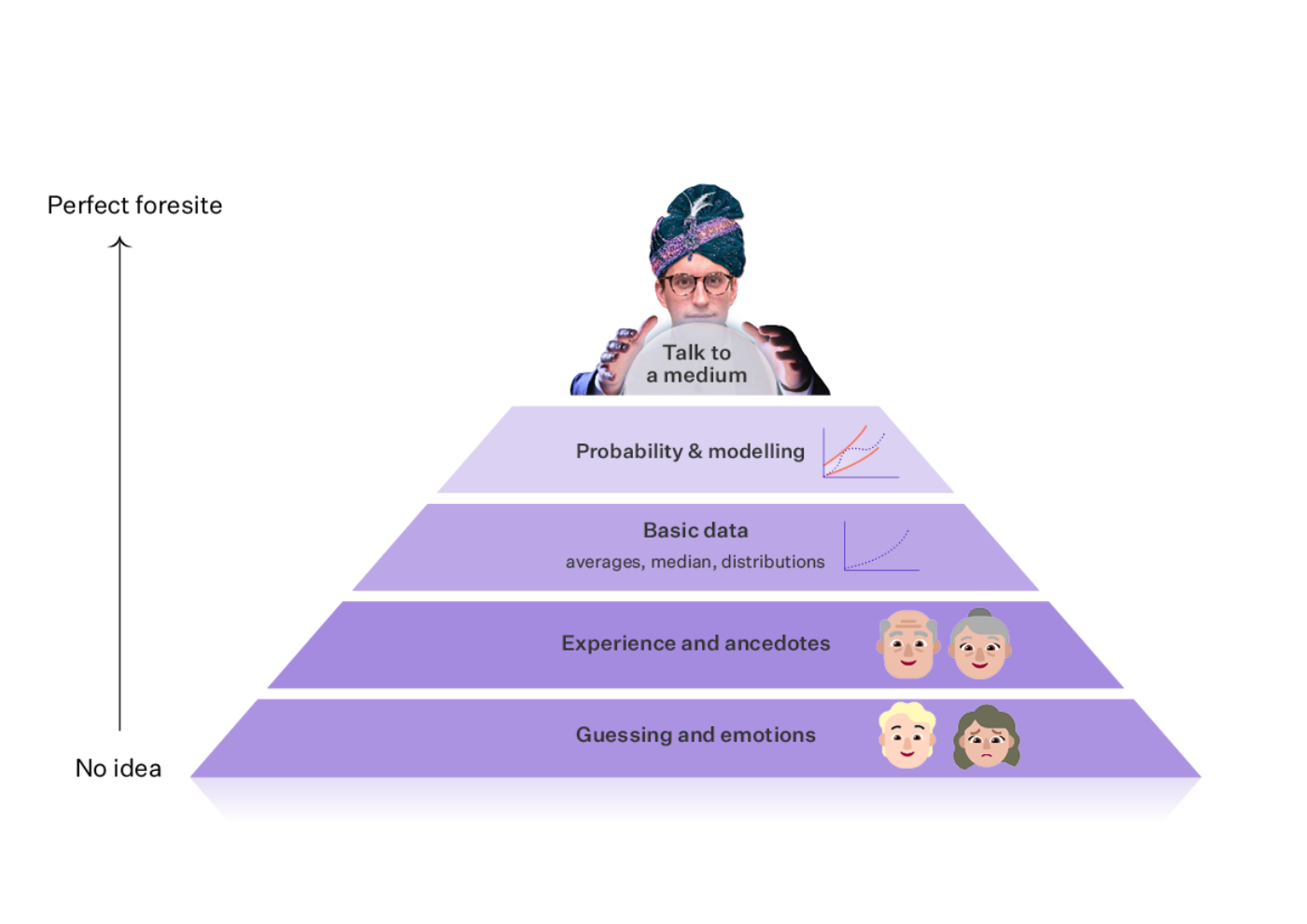

Level #2 – Experience and anecdotes

This type of thinking says things like: “Sometimes the market is hot, sometimes it’s cold. Be in the market for the long term.”

A level up from emotions, this information based on someone else’s experience.

And you can learn a lot from another person’s wisdom; people who have seen the ups and downs of the market.

This is where many investors say things like, “It’s time in the market, not timing of the market that counts.”

But remember this: one person’s experience doesn’t often represent what happens to everyone.

Your neighbour Steve might have had a bad run of tenants and say, “Don’t invest. Tenants don’t treat your property with respect.”

That might have been Steve’s experience, but that’s not what happens with most investors.

The thing to remember here is that while we can get some good wisdom out of others, it is just one person’s experience.

We shouldn’t make decisions based on what happened to one other person, but we can listen to 20 people’s experience to build a better picture.

This brings us to the next level.