New Builds

What is a turnkey property? Turnkey pros and cons explained

In this article, you’ll learn what a turnkey property is and hear both sides of the argument, so you can decide whether a turnkey property is right for you.

Tax

7 min read

Author: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Want to pay less tax?

Over time things in your house are going to wear out – the carpets will fray, your driveway may sprout cracks, and your washing machine will decrease in value.

This all comes as a cost to you … the property investor.

And that decrease in value is called depreciation. When claimed correctly, this will save you thousands in tax.

That’s why property investors need to get a Chattel Valuation. It’s a small upfront cost, with a big, long-term pay-off.

So, why are some people hesitant about getting one?

In this article, you’ll learn what a Chattel Valuation is and how it can help you minimise the amount of tax you pay.

And if you have a question, write your questions or thoughts in the comments section below.

If it’s not directly a part of the building, or it’s not bolted down – it’s a chattel.

So think about things like washing machines, dryers, letterboxes, carpets, curtains, light fittings, appliances, and even driveways and fences.

Once upon a time you could claim depreciation on the building structure itself. But since the law changed on April 1, 2011, this is no longer the case.

But, for anything else you can still claim depreciation (some accountants miss this).

Put simply, anything that isn’t physically fixed or integral to the structure of the property can be depreciated.

But the scope for what constitutes a chattel is a lot broader than it may be assumed.

As a standard, a New Build unfurnished townhouse might have $45,000 worth of chattels.

This is why Steve Tucker, a professional valuer at Valuit, says the title “chattel valuation” isn’t really the best name because there are so many things you can depreciate that sit outside the realm of what people assume is just washing machines, dryers and dishwashers.

Steve says he likes to use the term depreciation apportionment, or purchase price allocation.

But the term Chattel Valuation has well and truly stuck … and it's not likely to go anywhere.

In its simplest term, a Chattel Valuation is an allowance for wear and tear, which is given to you from Inland Revenue (IRD). It’s a recognition that things go down in value over time.

In order to claim back the depreciation of all chattels in your house, you’ve got to understand what your chattels are worth.

This is so your accountant knows how much depreciation to actually claim.

A Chattel Valuation is an itemised list of every single chattel within your property, what it’s worth, and how much it depreciates over time, according to the Inland Revenue.

This depreciation is then claimed as an expense, which means you can use it to pay less tax.

It may surprise you to learn the process of working out your Chattel Valuation is a bit more convoluted than just pointing to chattels and writing down What’s this X chattel worth?

An expert will split the purchase price of your investment property into the various depreciation categories set by the IRD, thereby increasing your depreciation claim.

This will decrease your taxable profit … then you will have less tax to pay.

The final report will include:

You then hand this to your accountant, who takes care of the depreciation.

A Chattel Valuation is a money-saving exercise, because it can help you pay less tax.

Chattel Valuations have become more of an essential item in the world of property investors since the government’s new tax deductibility laws were introduced.

This is because you can no longer include your interest in tax deductibility, which greatly severs cashflow.

So … expenses are high, and all investors are looking at ways they can minimise tax. A Chattel Valuation is one of the main ways you can do this.

Read our other article for a list of other ways to minimise tax.

And for New Build investors the rewards can be even higher.

This is because depreciation is higher in early ownership. The higher the depreciation, the less tax you pay.

For instance, a brand new property can depreciate carpet by $15,000, compared with $5000 for an existing property.

Let’s say you buy an $800,000 property. It’s possible you might have $50,000 worth of chattels (when you add them all together) in that property.

If you get your chattels depreciated correctly you could potentially save as much as $16,500 in tax (over time), if on a 33% tax rate.

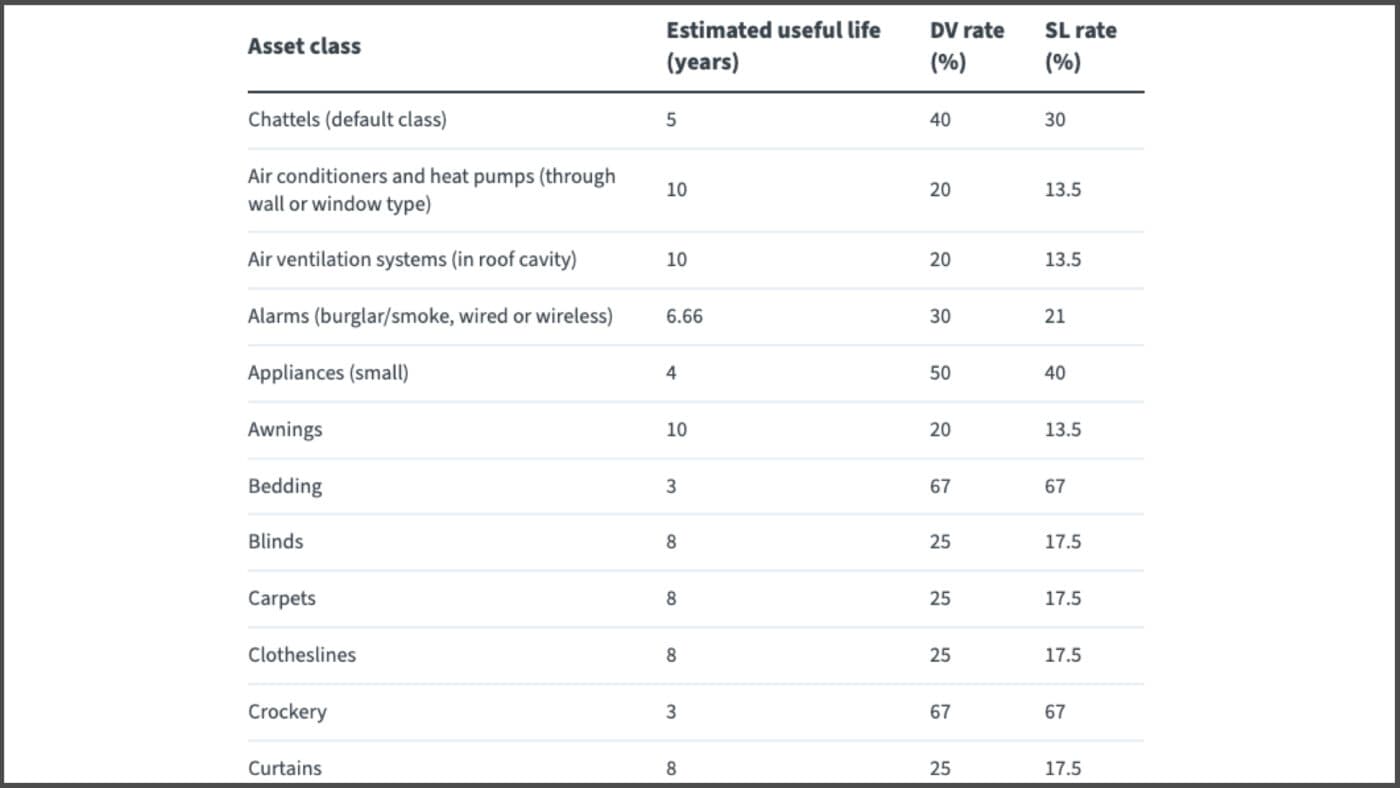

However, this varies from property to property because every chattel depreciates at a different rate.

For example, the IRD reckons your dryer, washing machine and dishwasher are good for 6.66 years. But your lawnmower and your microwave are only good for 4 years. You can check out the IRD list here.

This is why it’s important to use a company like valuit.co.nz to make sure you get a proper Chattel Valuation and depreciation schedule, which you can give to your accountant.

Let’s run through a case study for one of our investors in Papamoa.

The purchase price was $669,000 for a 3-bedroom house.

The land value was $317,000 (47.4%), the building value $311,000 (46.5%) and the chattels $40,600 (6.1%).

The total expenses are potentially $40,600 – because they are going to wear out over time.

At today’s highest tax bracket (33%) that’s a potential tax savings of $13,400 compared to if you didn’t get the depreciation schedule.

The cost of the Chattel Valuation is only about $450.

It’s important to note the chattel amount here is actually only about half what you can claim, because the definition of what a chattel is in the IRD’s eyes is so much wider.

For instance, the No.1 for this Chattel Valuation in Papamoa was driveways and paths – something you might not immediately know was classed as a chattel.

A tax saving of $13,400 is pretty significant for this investor, especially as the tax bill is about to jump by up to $4,000 a year (with the interest deductibility changes).

In practice, you might find your chattel depreciation is offsetting a lot of that newly-acquired tax liability.

The key message is get your depreciation schedule done early so you are getting those benefits right up front. Not getting it done early enough is a common mistake by novice investors.

Essentially, you will pay more tax than you need to.

Some investors will say, “But on my property valuation [from a registered valuer], it has an allowance for chattels. Why can’t I use this?”

You’re right. When a registered valuer puts a valuation on your house they will give an estimate of what the chattels are worth, e.g. $10,000.

However, this figure is typically much lower than the figure a chattel valuer will give you.That’s because, as discussed, a valuer takes a wider view of what is considered a chattel for tax purposes.

For this reason we argue the price of a Chattel Valuation will always outweigh its cost, especially when you are potentially saving $16,500 in tax (over time).

Similarly, when you buy a New Build property you can, of course, ask the developer how much the chattels cost and use this as the basis for your chattel depreciation.

Same issue as above. Yes, your developer can tell you how much they spent on heat pumps, but they have no idea how much the driveway cost to put in, or the value of the paving stones.

Often the price developers pay for chattels comes with a heavy bulk discount and the value of the chattels they give you is likely be understated.

So, if you want to maximise your tax savings you need to spend the money to get it done right.

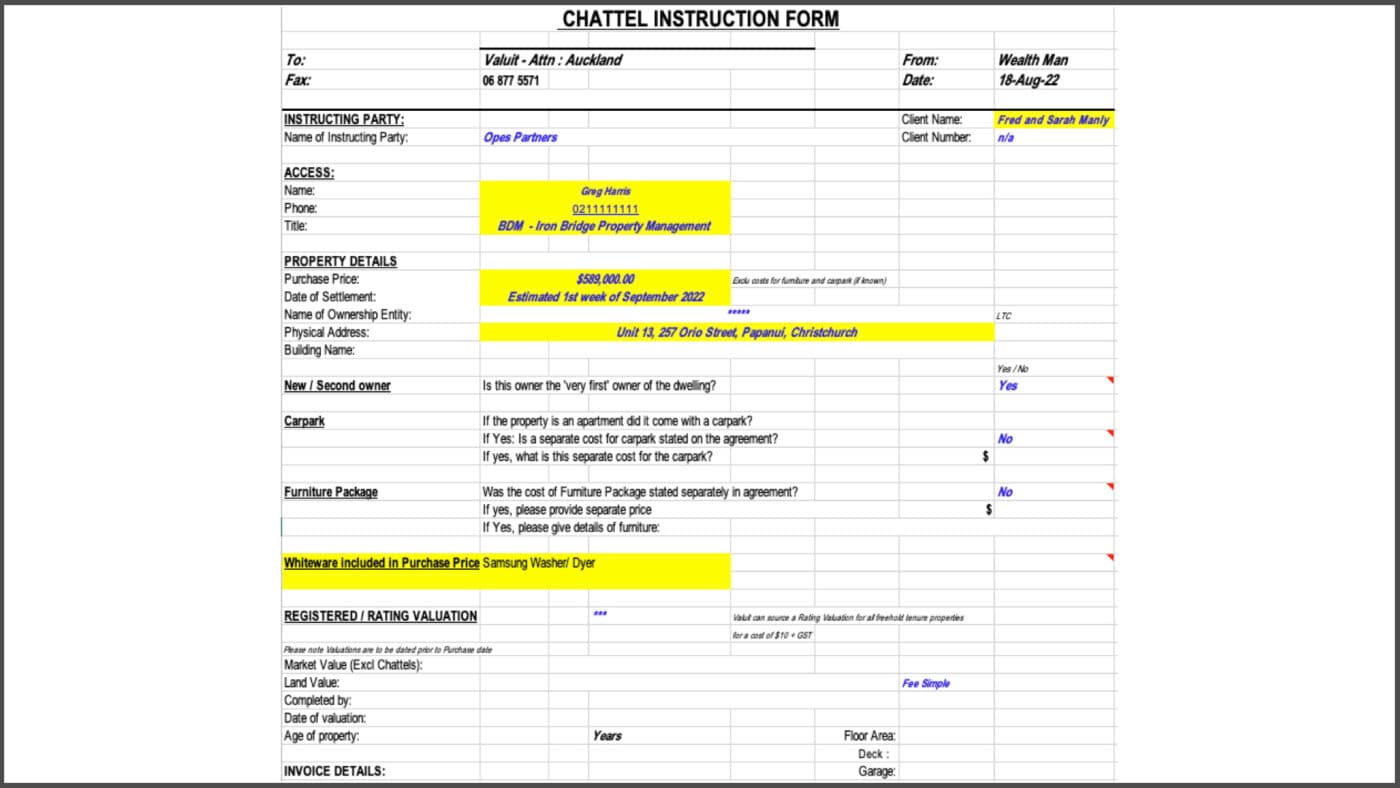

It’s best practice to use a professional chattel valuer to complete your Chattels Valuation. Here at Opes we recommend Valuit.

You can either get in touch with them yourself or, if you’re an Opes client, your CRM will organise this on your behalf following confirmation of settlement.

If you choose to go it alone, the Valuit team will get in touch with you or your property manager to arrange access. They will complete their valuation of your chattels and finish the report.

However, it’s important to note the report can take a few months to come through as the Valuit team rely on some Councils to complete aspects of the report.

Valuit charges different fees based on a per person and per property basis.

For Opes clients the cost of this is discounted through Opes to a one-off fee of $431.25.

Yes.

Sometimes, when an investor is setting up an investment property, they view the Chattel Valuation as “just another cost”.

However, you’re paying about $500 upfront to save up to $15,000 over the next 15 years.

If you’re buying a New Build, surely that’s worth the small cash cost today?

Write your questions or thoughts in the comments section below.

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Laine Moger, a seasoned Journalist and Property Educator holds a Bachelor of Communications (Honours) from Massey University and a Diploma of Journalism from the London School of Journalism. She has been an integral part of the Opes team for four years, crafting content for our website, newsletter, and external columns, as well as contributing to Informed Investor and NZ Property Investor.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser