Property Market

What's happening with NZ house prices right now?

Get the latest insights on New Zealand’s property markets, including trends, growth areas, and investment opportunities across regions.

Property Market

7 min read

Author: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Let’s face it, 2022 was a downer for property investors – literally. New Zealand house prices fell 15.1% from the peak (November ‘21 – December ‘22).

But at the same time interest rates went up, causing mortgage costs to rise and property investors’ cashflow to worsen.

So, the question on many property investors’ lips is: “What will 2023 have in store for us?”

In this article you’ll learn the 8 trends to watch for in 2023. And, of course, because we are data nerds here at Opes Partners … all the trends are supported by data and numbers.

And once you’ve read the trends, let us know which ones you think are most likely in the comments section at the end of this article.

Many banks predict house prices will bottom out in mid to late 2023. This includes Kiwibank, ANZ and the Treasury.

Kiwibank, independent economist Tony Alexander, and Opes Partners (that’s us) predict the market will bottom out between June and September.

Treasury and ANZ reckon we’ll see the market’s bottom between October and December.

The Reserve Bank and Westpac are more pessimistic; the Reserve Bank thinks the bottom will hit in a year; Westpac says we’ll have to wait until April – June 2024.

So, we are likely to see the housing market bottom out this year.

But, depending on who you ask, we could see the bottom of the market as soon as June this year, or as late as June ‘24.

This 12-month period is quite a large window – which means that even informed investors have different opinions.

If you are considering an investment just remember it’s impossible to put a pin on the exact bottom, but you can invest within “cooey”.

6 months either-side of the bottom is a good window to aim for. The key is to get a good deal.

After the market bottoms out it will start to recover. Take a look at this consensus forecast, comparing different predictions from the industry.

Treasury’s predictions are the most interesting. Their forecasts show house prices back above their peak levels by 2027.

In fact, they think house prices will increase 10% in the 12 months between Sept ‘24 to ‘25.

If this prediction is correct (it probably won’t be) house prices will have taken 5.5 years to go from the peak through the downturn to full recovery.

This is similar to the 2008 housing market downturn.

In 2021, inflation skyrocketed out of the normal 1-3% band. It peaked at 7.3% in 2022.

And this is going to stick around for a while in 2023. At the end of the year inflation will still be 4%, when you take the average of all the banks’ forecasts.

In fact, inflation won’t come back within the target band until mid-2024, according to that measure.

Here’s the data:

So, inflation will hang around longer than what some may think.

The Reserve Bank has been trying to wrangle the rising cost of living back down for the best part of the year, raising the Official Cash Rate (OCR) not once, but 8 consecutive times … and it’s still not budging.

That brings us to the next trend.

Mortgage interest rates are expected to peak around April 2023 … and will likely start to (slowly) fall away soon after.

Over the previous 2 years, the Reserve Bank has lifted the OCR from 0.25% to 4.25% – a level not seen since before the GFC, in 2008.

And they currently plan to lift it even further to 5.5% by April.

This means mortgage interests will increase further, but perhaps not as much as some property investors think.

The 1-year interest rate will probably hit 7% or slightly over.

This is because while some of the Reserve Bank’s increases to the OCR will flow through to mortgage interest rates … most of the coming increase has already been priced in.

As the Reserve Bank starts to win the battle against inflation near the end of the year, expect interest rates to start trending down slowly.

The buyers market will continue for the whole year.

Why? Property sales are still decreasing. Fewer properties are being sold.

To be clear, we haven’t seen a big rush of new listings come onto the market. But, because fewer properties are selling, the number of listings available online has increased.

That means there is more choice for people who want to buy. They can also take more time, find a property that better suits their needs and can negotiate more.

This is all really good news for buyers – at least those who are in a position to buy, of course.

This is why we are seeing some types of investors coming back to the market, which leads into our next trend.

Over the last year first home buyers and property investors buying with cash have been buying a larger share of properties, according to CoreLogic data.

People who are moving house (selling their home to buy another) are sitting on their hands. And the proportion of investors buying with a mortgage has also decreased.

This will likely continue in 2023.

The retreat of property investors buying with mortgages is primarily driven by:

But property investors who have the cash to purchase are doing so and are coming back with a vengeance to nab all the bargains.

But it’s not a good time to sell, so people moving house are waiting for a better time to move.

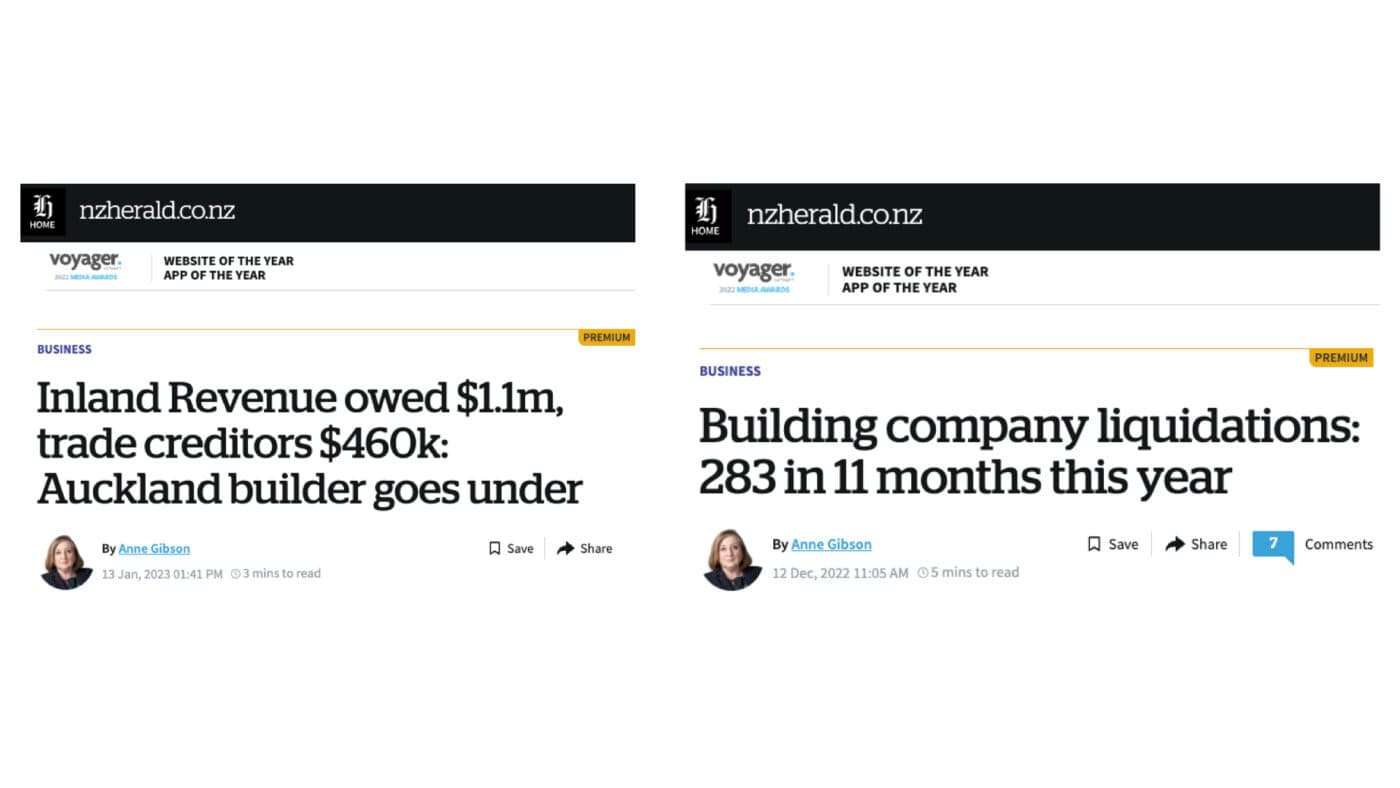

There have been several news reports of developers and building companies going bust, or going into liquidation.

It’s likely this will keep happening.

Specifically, it appears smaller building companies are struggling with cash flow.

This is driven by:

This means if you are going to build a home, or purchase one off the plans through a progressive payments contract, you should have some sort of guarantee, like a MasterBuild or a builder’s guarantee.

It’s also up to you to make sure you do your due diligence on any developer you choose to work with.

To learn more, read this article about how to tell whether a developer is good or not.

Every three years (like clockwork) property investors stop buying properties right before the election.

They hear policies from some parties they will like; and policies from other parties that scare them.

You know which ones I’m talking about.

And that is going to cause uncertainty. They’ll think “Well if X party gets in, that’s good … but, if another party gets in … that’s going to cost me.”

Because of this many property investors will sit on their hands, waiting to see what sort of housing market policies they might face in the coming 3 years.

However, there will be some property investors who spot this trend and think: “I’m going to buy before the election”.

Here’s the logic:

Seeing that’s the case, if National looks likely to get in some property investors will buy in advance of the election, expecting the housing market policies to change.

Finally, for the first half of the year, it’s likely people’s attitude will be largely negative.

For some the upcoming OCR rises will catch them by surprise (they shouldn’t).

Rising interest rates and further falling house prices will create a depressed mood in the market.

But, the second half of the year will be more hopeful.

As the tide turns and we see evidence of the market turning, Kiwis’ attitudes towards the housing market will likely change.

And this is when we will start to see some of those property investors buying with a mortgage start to ramp up their property purchases.

Which trends do you think are most likely to happen? Let us know in the comments section below.

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Laine Moger, a seasoned Journalist and Property Educator holds a Bachelor of Communications (Honours) from Massey University and a Diploma of Journalism from the London School of Journalism. She has been an integral part of the Opes team for four years, crafting content for our website, newsletter, and external columns, as well as contributing to Informed Investor and NZ Property Investor.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser