Mortgages

Top 10 mortgage brokers in New Zealand

Find your best mortgage broker in NZ for 2026. Our top 10 list offers insights and options to help you secure the best loan for your home.

Mortgages

41 min read

Author: Peter Norris

Mortgage broker for over 10 years, property investor and Managing Director at Opes Mortgages

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Mortgages are complicated. Not only are they the most significant financial purchase of your life – very little seems black and white.

There are few hard and fast rules, and when you do learn of one, there's always another it turns out you didn't know about.

Don't worry, we've got you.

This 10,000-word guide contains everything you need to know to get a basic understanding of home loans ... how to get one, and then how to pay it off faster.

Here's a quick video from Ed, one of the co-authors of the guides, introducing what you'll learn here:

Over the next 30 minutes or so, this guide will show you:

By the end of this guide, you'll feel confident knowing your next steps to get your mortgage application approved.

There are three most common types of mortgages used in New Zealand. Each has its own structure, benefits and drawbacks.

Although we'll introduce them as different types of loans, it's common for all three to be used by the same borrower on the same property at different times.

We should also mention that there is a whole range of mortgage structures. Still, we'll just cover the main ones that you'd actually use and a few variations later in the article.

The three main mortgage types are:

The most common home loan type in New Zealand is the 'Table Mortgage'.

A Table Mortgage is a home loan where the borrower pays the lender back both the principal and the interest of the loan at the same time.

This is why a Table Mortgage is often also referred to as both 'Principal and Interest' or 'Equal Payment' home loans. In the latter case, that's because the repayment you make each week, fortnight or month is exactly the same for the life of the home loan (as long as the interest rate doesn't change).

For instance, a $500,000 mortgage on a 30-year term with a 4% interest would attract weekly repayments of $500.50.

As long as the interest rate stays at 4%, the borrower will pay $500.50 every week for the entire length of the loan (30 years).

This is great for borrowers because they know what their repayments will be.

This makes it the perfect loan type for borrowers who have regular jobs and a steady income.

The person taking out the loan also choose whether their mortgage payments will be made weekly, fortnightly or monthly (and which day the payments will start).

This gives borrowers the flexibility to work mortgage repayments in with their pay schedule.

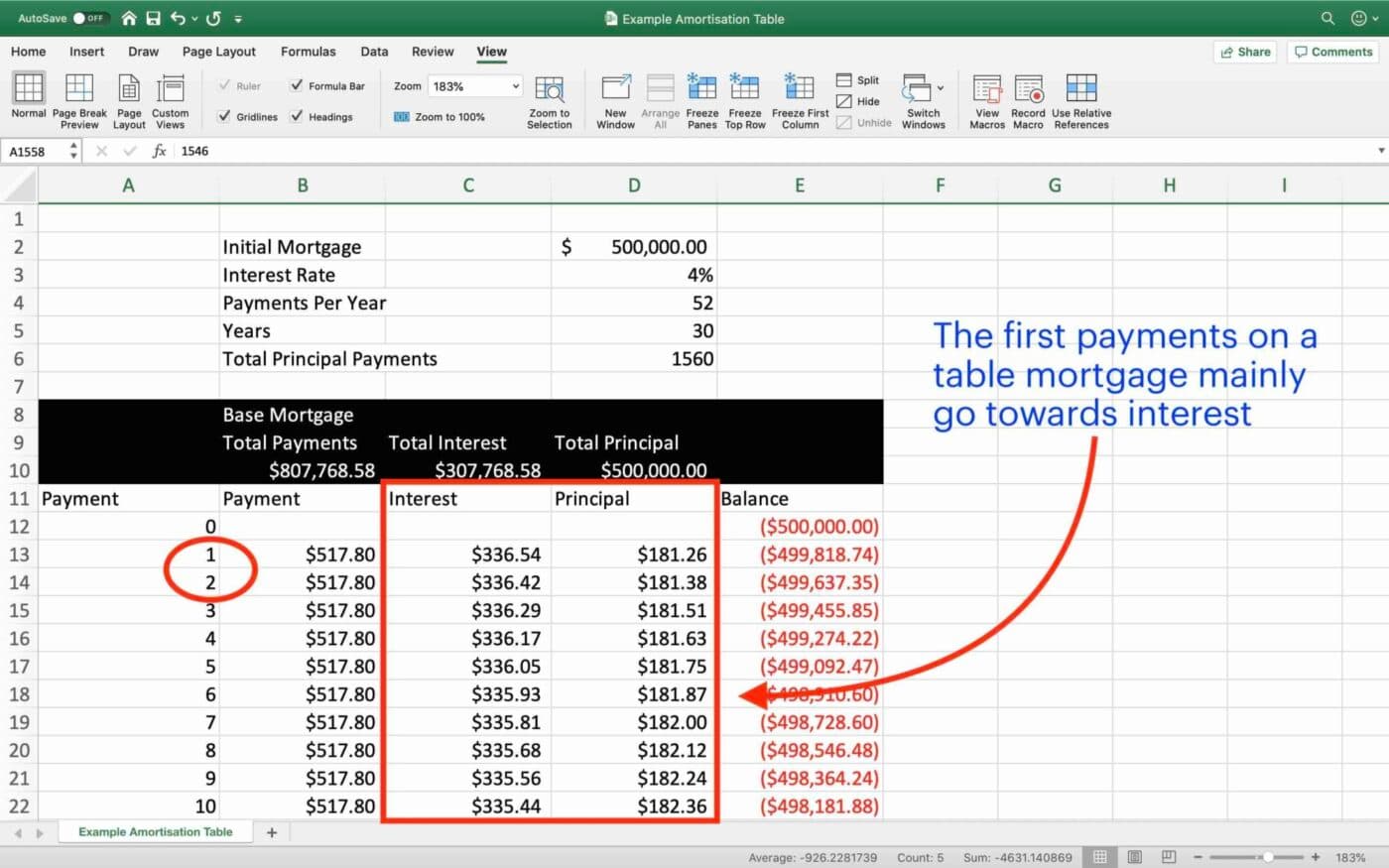

Early in the mortgage term, most of each repayment goes towards interest.

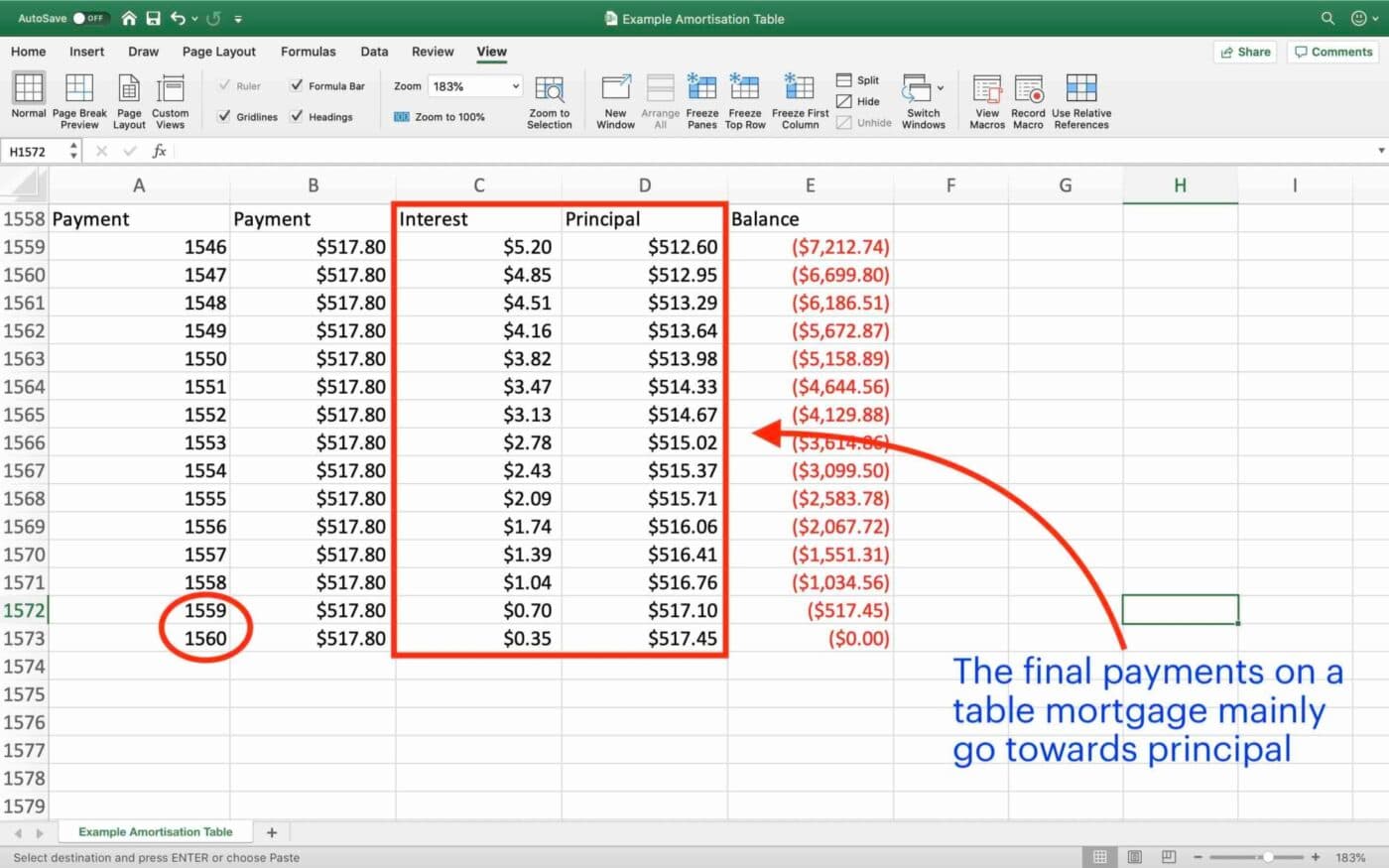

But, as the mortgage is paid off over time, the amount of interest decreases and each repayment pays off more of the principal.

This is because the loan is 'amortised,' i.e. paid off over time.

Each loan comes with an amortisation table. This shows how much of each repayment goes towards interest and how much goes towards paying down the principal.

This amortisation table is how 'table' home loans get their names

In New Zealand, Interest-Only Mortgages aren't true interest-only mortgages like they were in the early 1900s, where the whole loan is paid off at the end of the loan term.

Instead, interest-only mortgages are really temporary 5-year interest-only periods that lead into a Table Mortgage.

When you obtain an interest-only mortgage from a lender, you really get a 5-year interest-only period, followed by a 25-year Table Mortgage.

At the end of the 5-year interest-only period, the loan reverts to a Table Mortgage. This includes both principal and interest payments unless a new 5-year interest-only period is agreed to by the lender.

Interest-only mortgages are most useful to borrowers who want to decrease the payments they make towards their loans temporarily.

Property investors, for instance, often use interest-only home loans when purchasing new properties. This makes these properties more profitable during the early years of property ownership.

To learn more about interest-only mortgages, you can find out more on our interest-only mortgage calculator page and guide.

Revolving Credits are home loans that are on a flexible floating interest rate and are treated like overdrafts.

Some lenders will call Revolving Credits by different names and give them various features, but most Revolving Credits:

Revolving Credits are often used as part of an overall structuring of a home loan, as opposed to having the whole amount of a mortgage under a Revolving Credit.

Revolving Credits are typically set up so your salary or wages are paid into your revolving credit account. This pays down the balance of the loan.

You then pay your regular expenses from that same account, which gradually increases the balance of the Revolving Credit. This is then paid down again when you are next paid. Because interest is calculated daily but charged monthly, you're able to save on interest payments using this strategy.

They are most useful when the borrower doesn't spend all that they earn each month. This means that any extra amount left in the account acts as an additional mortgage payment, helping to pay down the mortgage more quickly.

In this section, we'll compare what each of the mortgage types looks like.

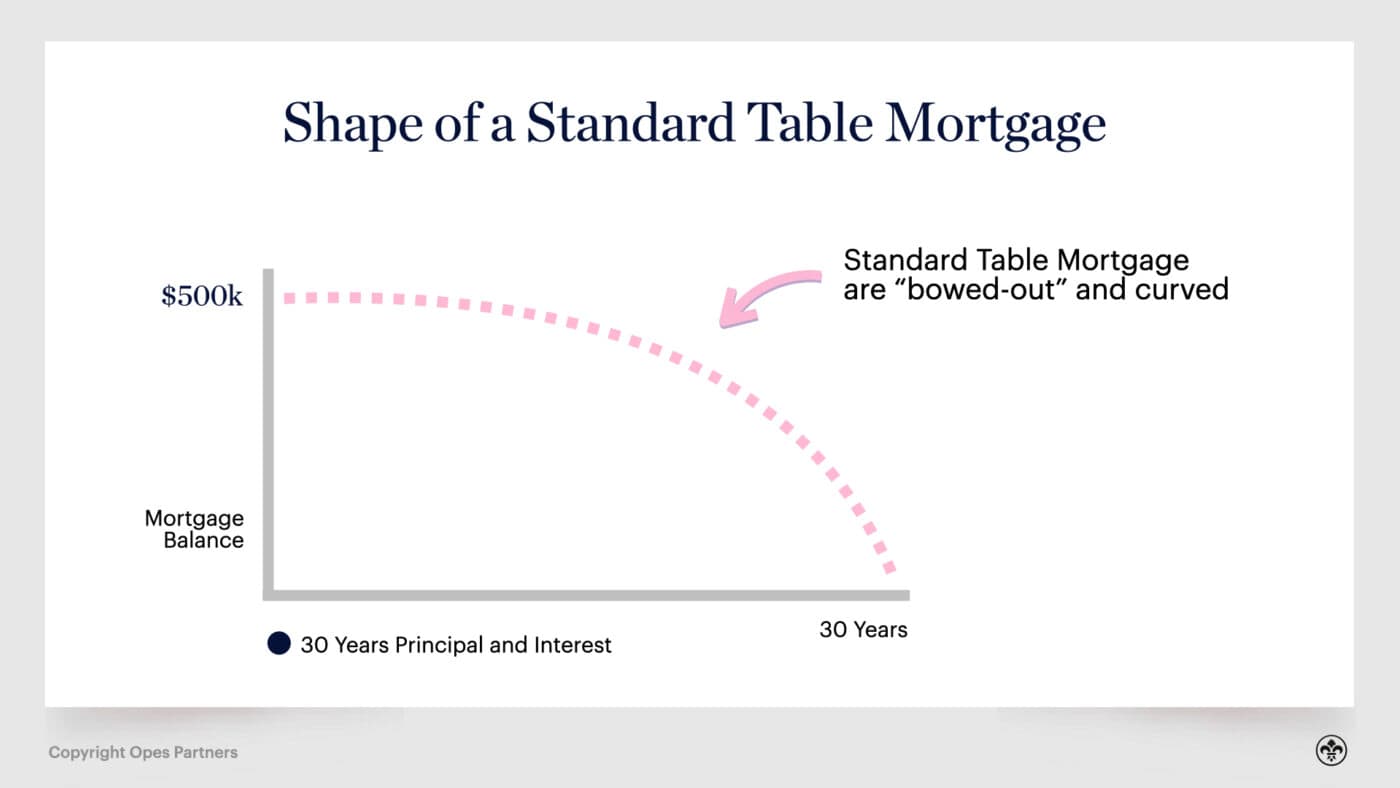

The table mortgage is curved, bowed out, like this:

Initially, the first repayments you make to the bank primarily go towards interest and don't pay down a lot of the principal. Here's how the first few payments for a standard table mortgage are divided.

This is for a $500,000 mortgage at 3.5% over a 30-year term where payments are made weekly.

Of the first $518.80 payment, $336.54 (64.9%) would go towards interest, and $181.26 (35.1%) would be used to pay down the mortgage.

As the principal is gradually paid down, the bank charges less interest. This means that each additional repayment pays off more of the principal.

30 years later, the final $518.80 payment would be split: $0.35 (0.07%) would go towards interest, and $517.45 (99.03%) would be used to pay down the mortgage.

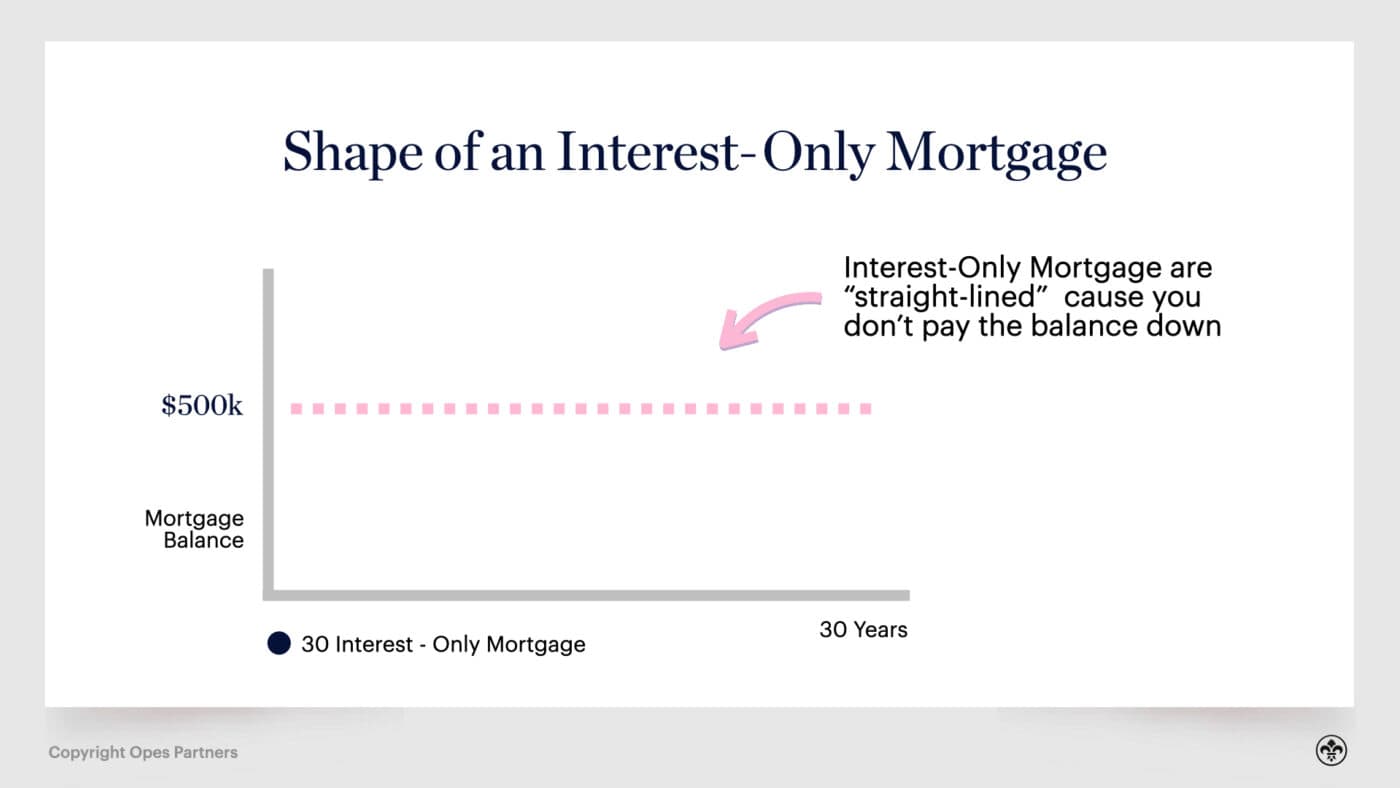

Interest-Only Mortgages, on the other hand, are a straight line. Because you only ever pay interest on the mortgage and never pay it off, which means the principal of the loan never decreases.

Revolving Credits are harder to graph because they are flexible in nature. However, the way they typically work is like a table loan that is spikey.

This is because as your income is paid into your revolving credit account, the balance is paid down. Then as you pay for your regular expenses, the balance gradually increases before being paid down again.

The deposit you need to get a mortgage is not always the same.

Some Kiwis can now get mortgages with just a 5% deposit. Others will need 30% or higher.

This section is going to go through the exact rules and best practices for deposits in New Zealand.

The Loan to Value Ratio restrictions were introduced by the Reserve Bank (the bank that sets the rules for NZ banks) in 2013. These are temporary measures that regulate how much banks can lend against a property.

For owner-occupiers, 80% of each bank's lending needs to be within the LVR restrictions. But, for investors, 95% of each bank's lending needs to be within these restrictions.

For an owner-occupier mortgage to be within the LVR restrictions, the borrower needs to have a 20% deposit.

That means that if you were to buy a property for you and your family to live in and that property cost $500,000, you would need a $100,000 deposit.

For an investment mortgage to be within the LVR Restrictions, the investor needs to have a 30% deposit.

Say you bought that same $500,000 property as an investment, you would then need a $150,000 deposit.

If you can pull together this level of deposit, you will find it much easier to pass your lender's borrowing criteria.

There are, however, multiple ways borrowers can still get their mortgage approved with a deposit than what we've discussed so far.

1. Get Lending within the non-LVR Compliant Portion of a Bank's Lending Capacity

We mentioned before that 80% of a bank's owner-occupier lending needs to be with a 20% deposit or higher.

That still leaves 20% of bank lending that can use a smaller deposit.

That means that about 1 in 5 people will be able to borrow with less than a 20% deposit for their own personal home or holiday home.

It is not uncommon that first home buyers, for instance, will be able to purchase their first home with a 10% deposit using this workaround.

2. Use a first home loan

There are several exemptions to the LVR restrictions.

These exemptions allow banks is to write loans that don't count towards their LVR calculations at all.

This allows banks to lend with lower deposits and not be penalised by the Reserve Bank.

One exemption is for First Home Loans.

First Home Loans (formerly called Welcome Home Loans) are semi government-backed loans. Under this loan type, the central government will pay for your mortgages and lenders mortgage insurance on your home loan (we'll discuss this more below).

The minimum deposit required for a First Home Loan is 5%.

You will, however, need to meet specific criteria and still pass your lender's lending criteria.

Welcome Home Loans are for people who:

You can apply for a First Home Loan here.

3. Buy a new property

Another exemption is for owner-occupiers or investors who purchase brand new properties.

Under the LVR rules, there are no restrictions on how much a bank is allowed to lend on a newly built property or a property that is currently under construction.

This means that a bank could theoretically lend 100% of the value for new properties.

Now, we don't ever see that level of lending. Still, investors can expect to secure a new property with a 20% deposit easily. This is much easier than pulling together a 30% deposit.

It is also not unheard of for investors or owner-occupiers to secure a loan with a 10% deposit for brand new properties.

4. Use a second-tier lender

Banks aren't the only companies you can get a mortgage from.

You can also use '2nd tier lenders', which are private finance companies who offer loans and mortgages.

Because they are not banks, they are not regulated by the LVR restrictions. This means they can offer loans above the 20% cap for owner-occupiers and 30% cap for investors.

Because 2nd tier lenders are often used by borrowers who can't get finance through a traditional bank, they charge higher interest rates. This is to take account of that increased risk.

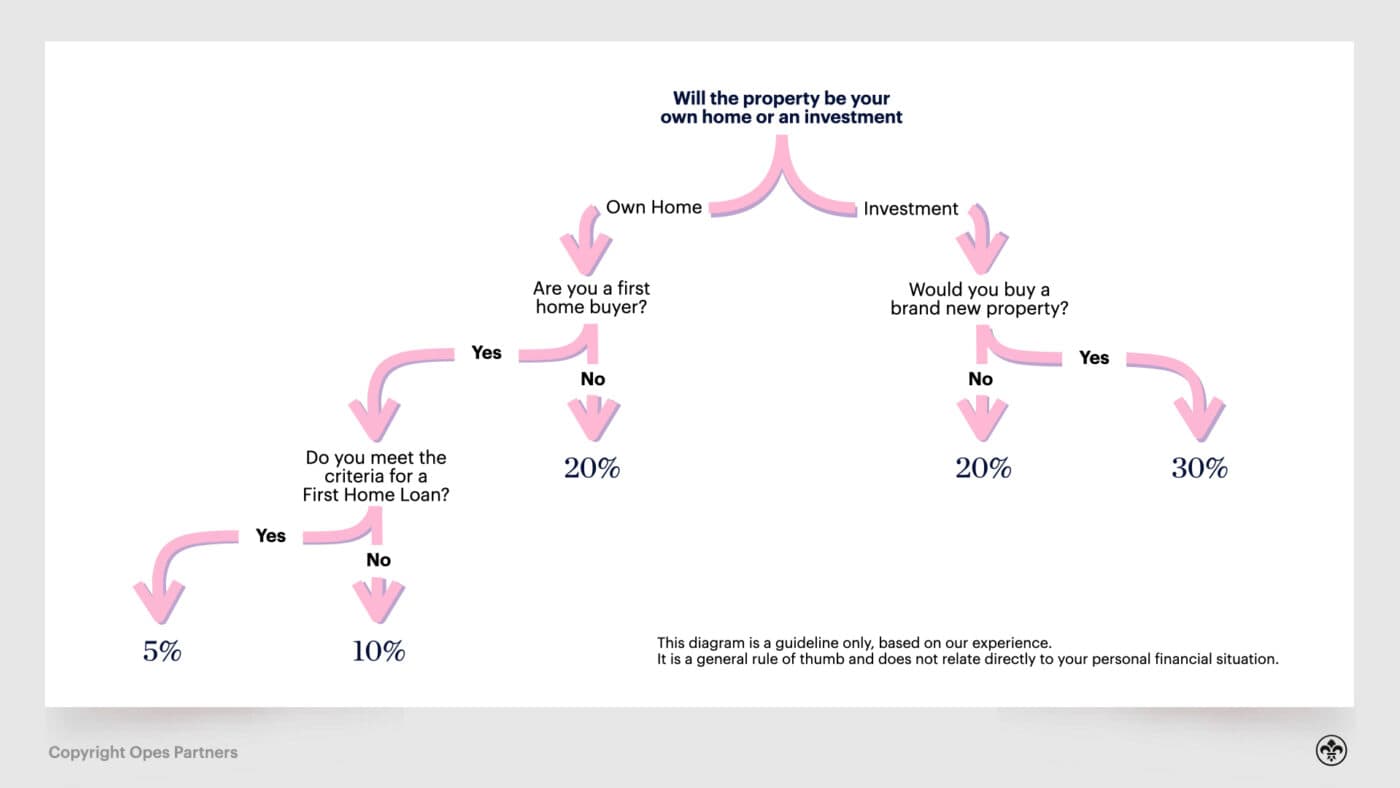

Lots of numbers have been thrown around in this section. To sum it up, take a look at the following diagram. It shows the general rule of thumb about how much of a deposit you need based on what you're buying for.

Please note, this diagram does not mean that you will be able to secure a mortgage at these deposit levels. This is just a general guide to get you started.

You should also note that if you use less than a 20% deposit, you will face higher interest rates and may need to pay low equity fees or low equity margins.

Interest is arguably the most significant factor when taking out a mortgage.

If your interest rate is 5.32% or higher for the life of a 30-year home loan, then you will pay more in interest than you will in principal payments.

To put that into context, let's say you take out a $500,000 mortgage for 30 years at 5.32% interest rate and make weekly repayments. In 30 years, you would have paid $501,093 in interest and $500,000 in principal payments.

This is why discussing interest rates and how they are structured is so essential.

Your interest rate is the price you pay to borrow money from your lender.

The amount of your interest you pay is calculated by multiplying the interest rate by the amount you have borrowed.

If you borrow $1,000,000 for a year at an interest rate of 3% (and the loan isn't paid down over that year), then you will pay $30,000 in interest.

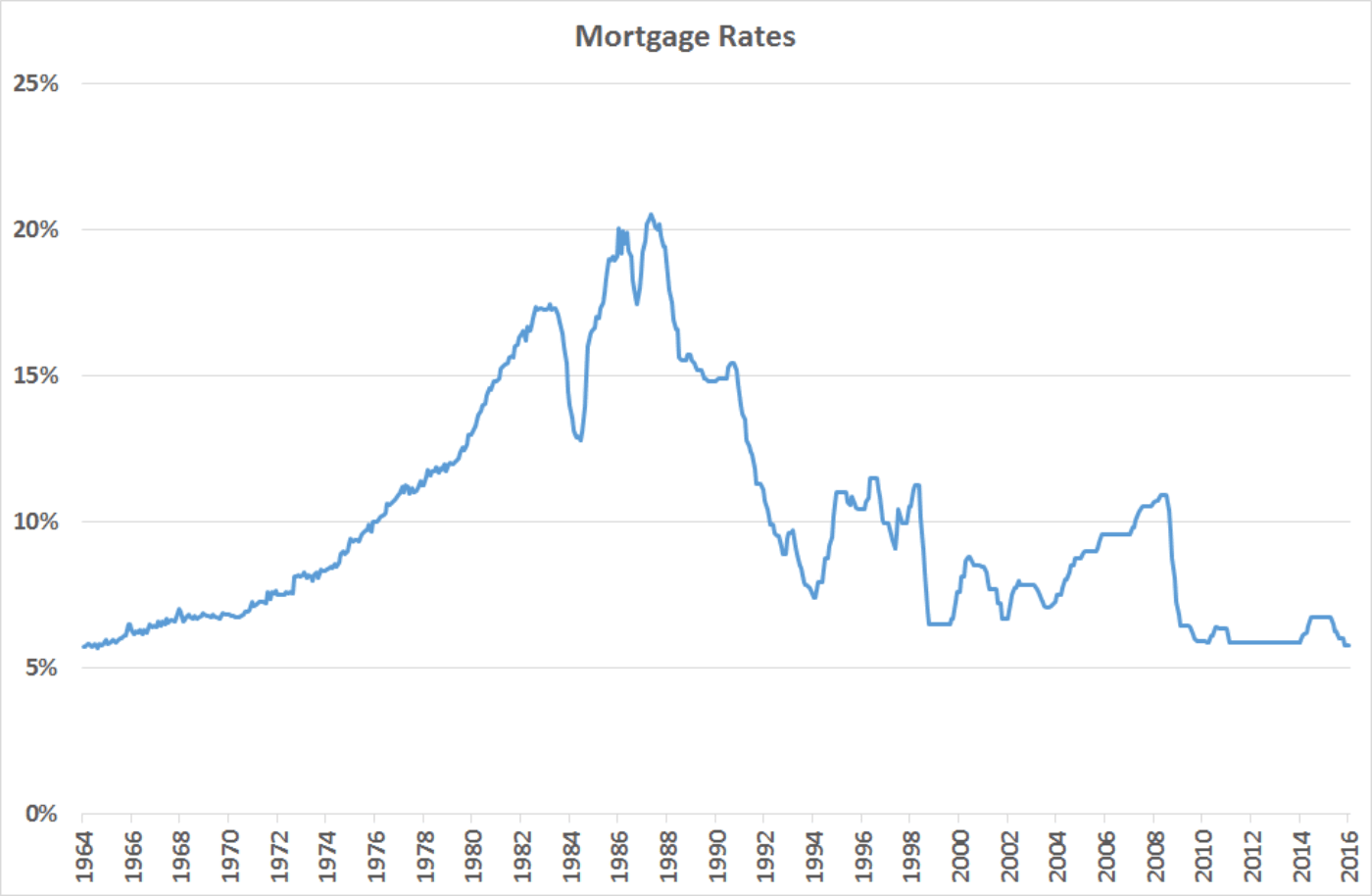

In the 1987 mortgage rates peaked in New Zealand at over 20%. Now, interest rates have fallen to their lowest ever levels, sitting at below 3.5%.

In New Zealand, Britain and Australia, most mortgages are Adjustable-Rate Mortgages (ARM), which means that the interest rates can vary over the term of the home loan.

You can either choose to 'fix' your interest rate so that it stays the same for the agreed timeframe. For instance, most banks will allow you to 'fix' your interest rate for 6 months, 12 months, 2 years, 3 years or 5 years. More periods may be offered by different lenders.

'Fixing' your mortgage rate allows you to do two things:

The drawback is that if interest rates fall, you'll either need to:

If you choose not to 'fix' your interest rate, you can go on the 'floating' interest rate.

The floating interest rate can change day to day based on whatever is happening in the lending market or the broader economy.

As the floating interest rate changes the repayments you make to the lender will also change.

Floating interest rates are usually higher than fixed rates, so you might wonder why someone would opt for the floating rate.

Some borrowers opt for the floating rate if they believe that interest rates will fall, leading to lower borrowing costs. Others decide to float if they intend to make additional unarranged payments towards their home loans.

When applying for your mortgage, you can choose the sort of interest structure that will work best for you.

References

Mortgage Rates from 1964 – Kiwiblog

Standard table mortgage repayments are calculated, so you pay the exact same amount over the life of the mortgage (or the period you have fixed for). You can work this out for yourself using a mortgage calculator.

For example, if you take out a home loan of $500,000 at 4% interest over a 30-year term, your first weekly repayment would be $550.50. Then, every week over the next 30 years, your weekly repayments would remain at $550.50.

This assumes that your interest rate wouldn't change over the life of your loan. If your interest rate was to go up, then your repayments would increase. If your interest rate falls, your repayments will subsequently decrease.

The banks will calculate the level of repayment that will fully pay off the principal of the loan, and cover the interest, over the agreed term.

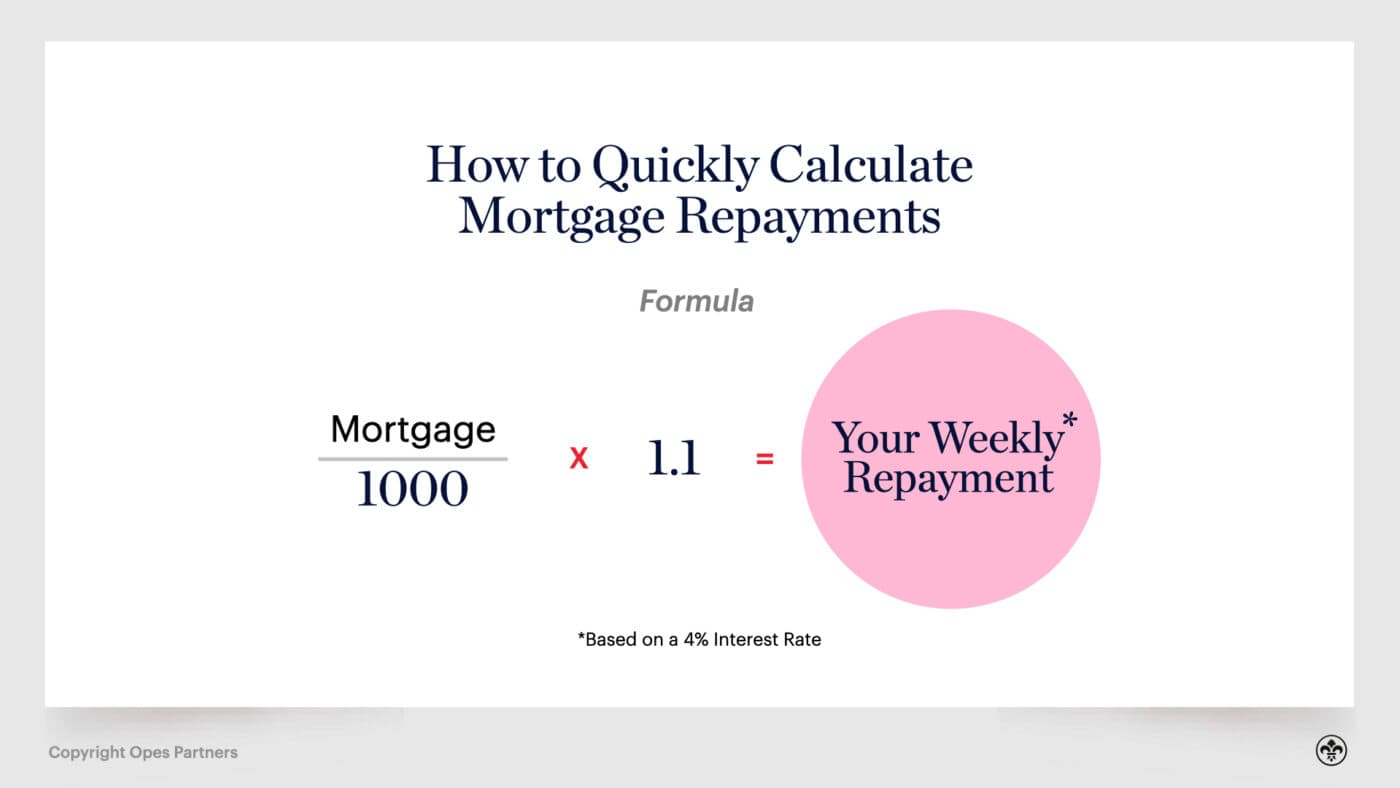

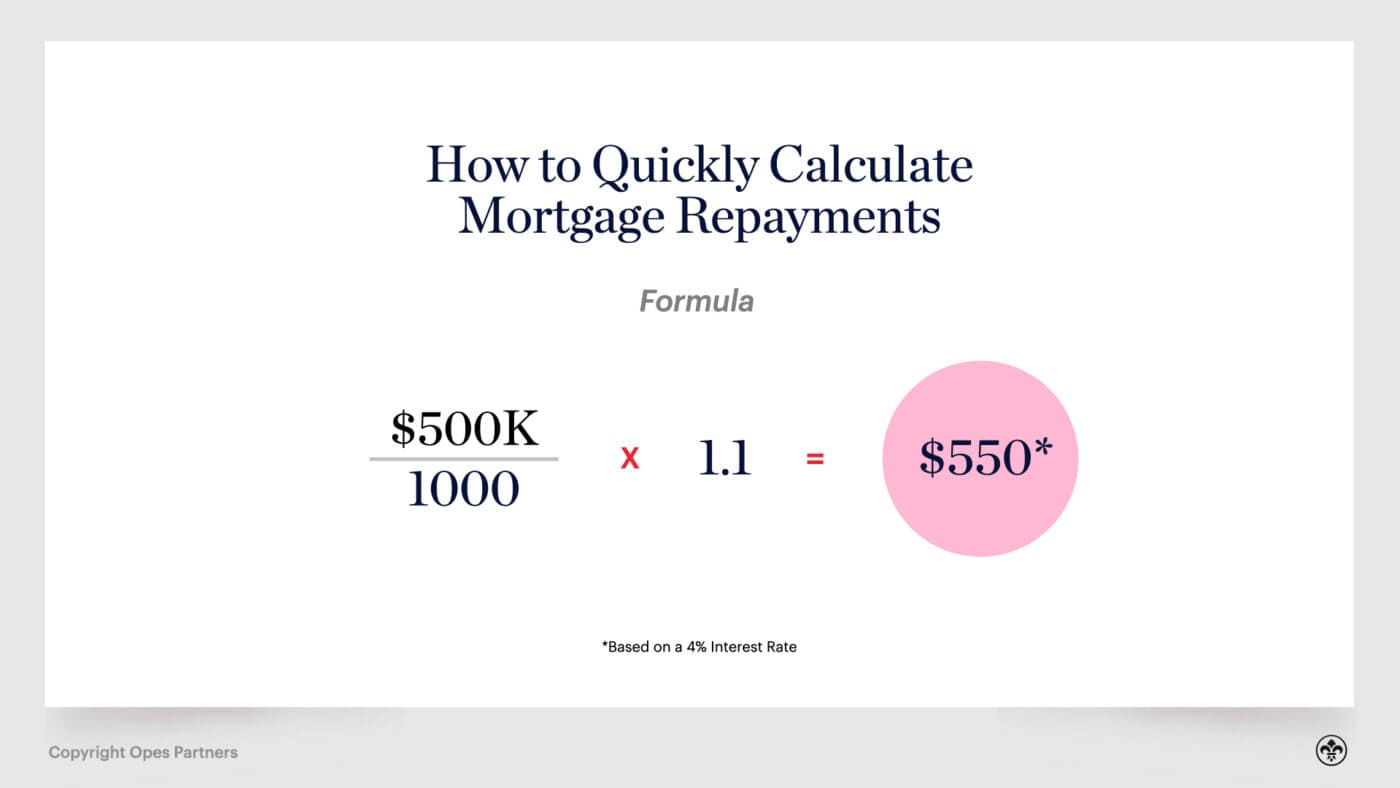

While you can use a mortgage calculator to work out your exact repayments. You can also use this simple formula to calculate what your weekly repayments would be at a 4% interest rate:

Say you take the $500,000 mortgage we mentioned above and divided it by 1,000, that would give $500. Multiplying it by 1.1 gives us $550 as a weekly repayment.

Although the exact repayment is $550.50, this simple formula gives us a 99.9% accurate ballpark when we don't have a mortgage calculator in front of us.

Interest-Only Mortgages are cheaper in the short term than table mortgages. That's because you aren't paying down any of the principal.

Like a table mortgage, the repayment borrowers make to lenders each week, fortnight or month is exactly the same as long as the interest rate doesn't change. You can use an interest only mortgage calculator to work out these repayments, or it is also quite simple to work out by hand.

First, take the size of your mortgage and multiplying it by the interest rate. This will give you the amount of interest you need to pay for the year.

You can then divide that by 12 for monthly repayments, 26 for fortnightly repayments or 52 for weekly repayments.

Interest-Only Mortgage Weekly Repayment = Mortgage x (interest rate / 100) / 52

For a $500,000 mortgage on a 4% interest rate, the annual repayments would be:

$500,000 x (4 / 100) which is really: $500,000 x 0.04 = $20,000.

This is the annual interest paid on the mortgage. Dividing that by 52 gives a weekly repayment of $384.62.

This means that in this instance, at a 4% interest rate, an interest-only mortgage would be $165.88 cheaper each week than a standard table mortgage.

If you borrow more than 80% of the money to buy your property, you may be subject to additional fees. These typically take three forms: low equity fees, low equity margins, or lenders and mortgages insurance.

These are additional charges your lender will require you to make because they face higher risk and higher costs when they offer low equity loans.

In this section we'll cover each of these three charges, when they apply and roughly what they cost.

But, first, let's go over how to calculate if you fit into this 'high LVR category'.

Your home loan will be classified as a 'high LVR' loan if you have less than 20% of 'equity' within your property.

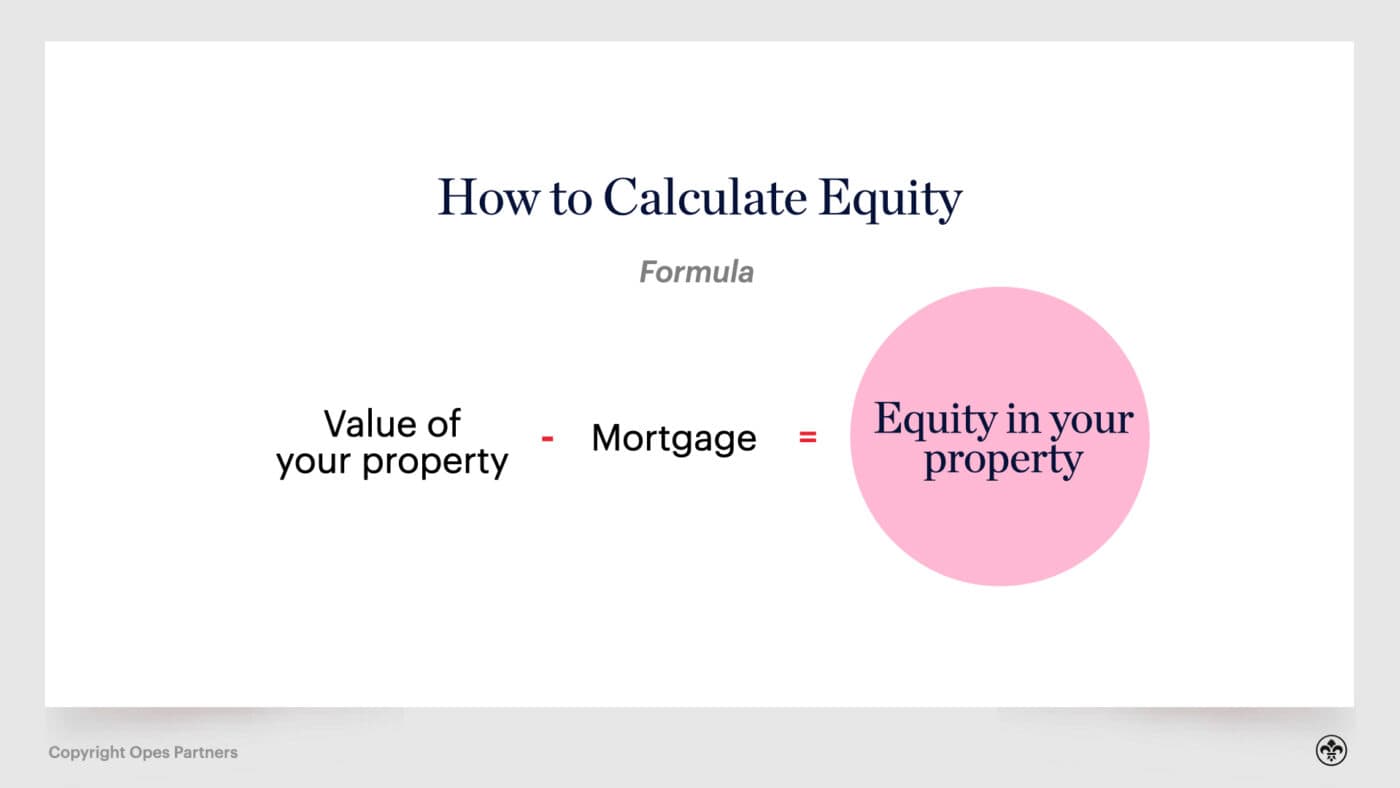

Remember, equity is:

For instance, if you own a property worth $500,000 and your mortgage is $300,000, then you have $200,000 worth of equity within your property i.e. $500,000 - $300,000 = $200,000.

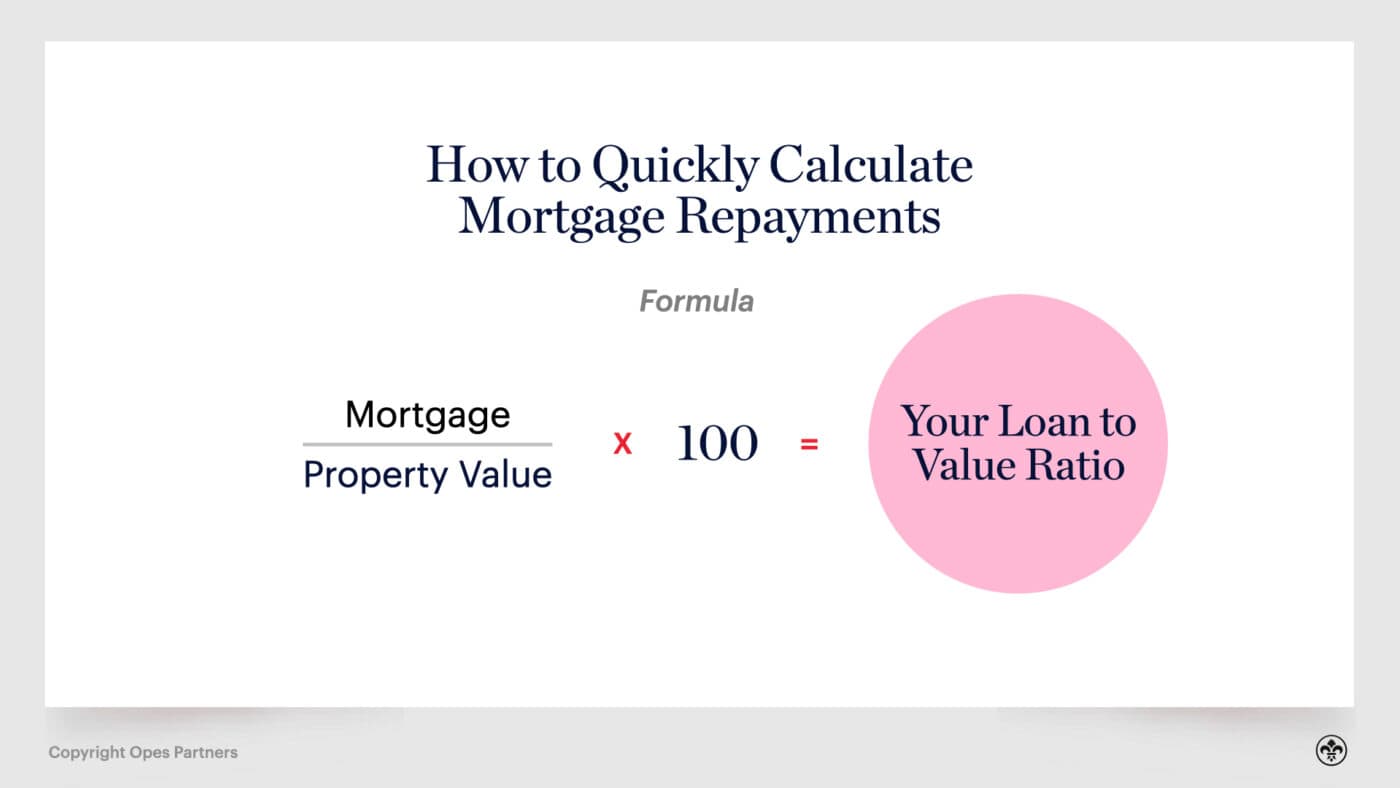

When you calculate your LVR, you want to calculate the amount of debt you have as a percentage of the property's value.

Using the same example, ($300,000 / $500,000) x 100 = 60%.

This means this property's LVR is 60%. It is made up of 60% debt and 40% equity.

The mortgage secured against this property would not be considered a low equity home loan because the LVR is less than 80%.

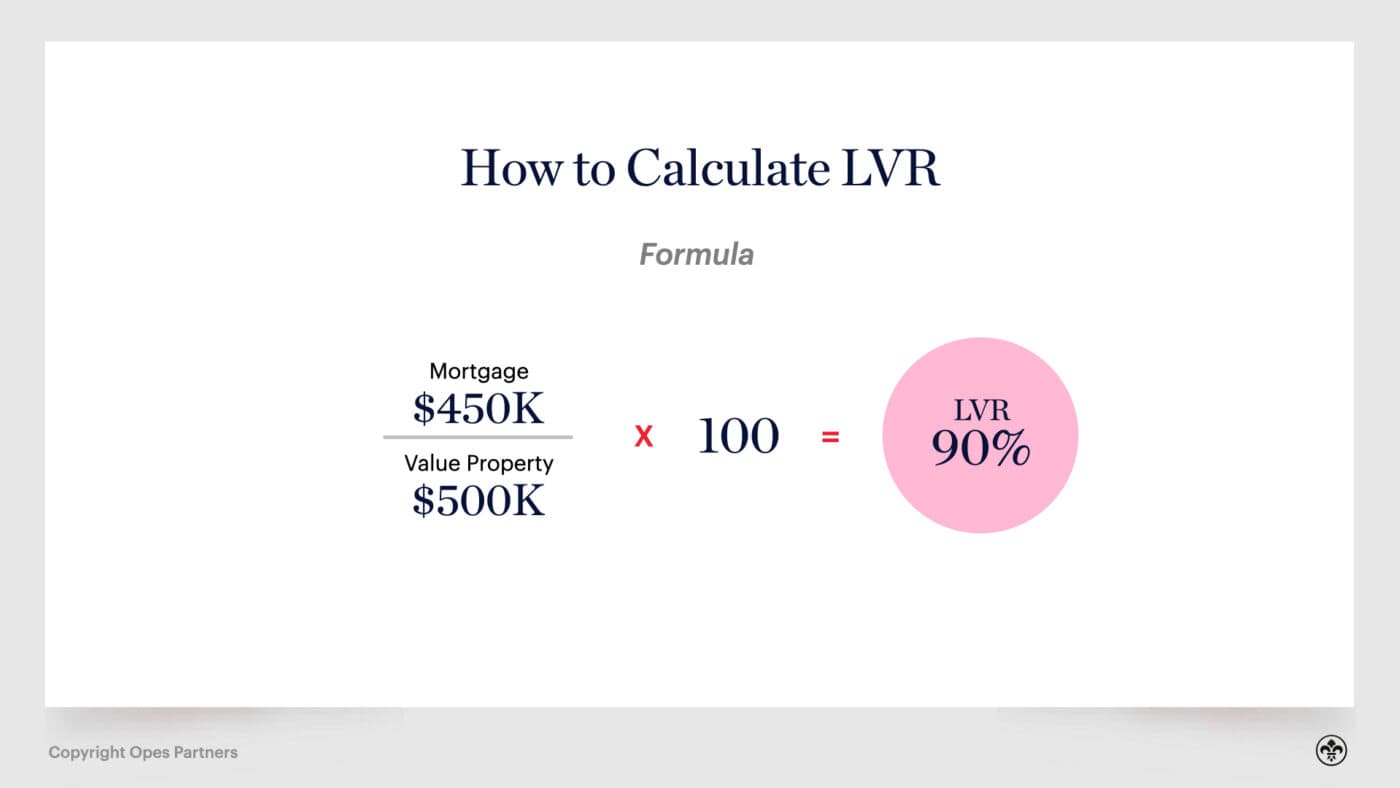

If the same $500,000 property had a mortgage secured against it of $450,000, then the LVR would be 90%.

i.e. ($450,000 / $500,000) x 100 = 90%.

This loan would be considered a high LVR loan and therefore may be subject to additional fees and interest charges.

While three different charges can apply to low equity home loans, most banks will use either a low equity fee or a low equity margin.

If you need a low equity loan, it's best to check with your mortgage broker, or the banks you are negotiating with, which of these additional charges they will apply.

Let's now get into the detail of these three different types of charges.

A low equity fee is a fixed one-off charge that is typically added to your mortgage. It is calculated as a proportion of the loan you've taken out.

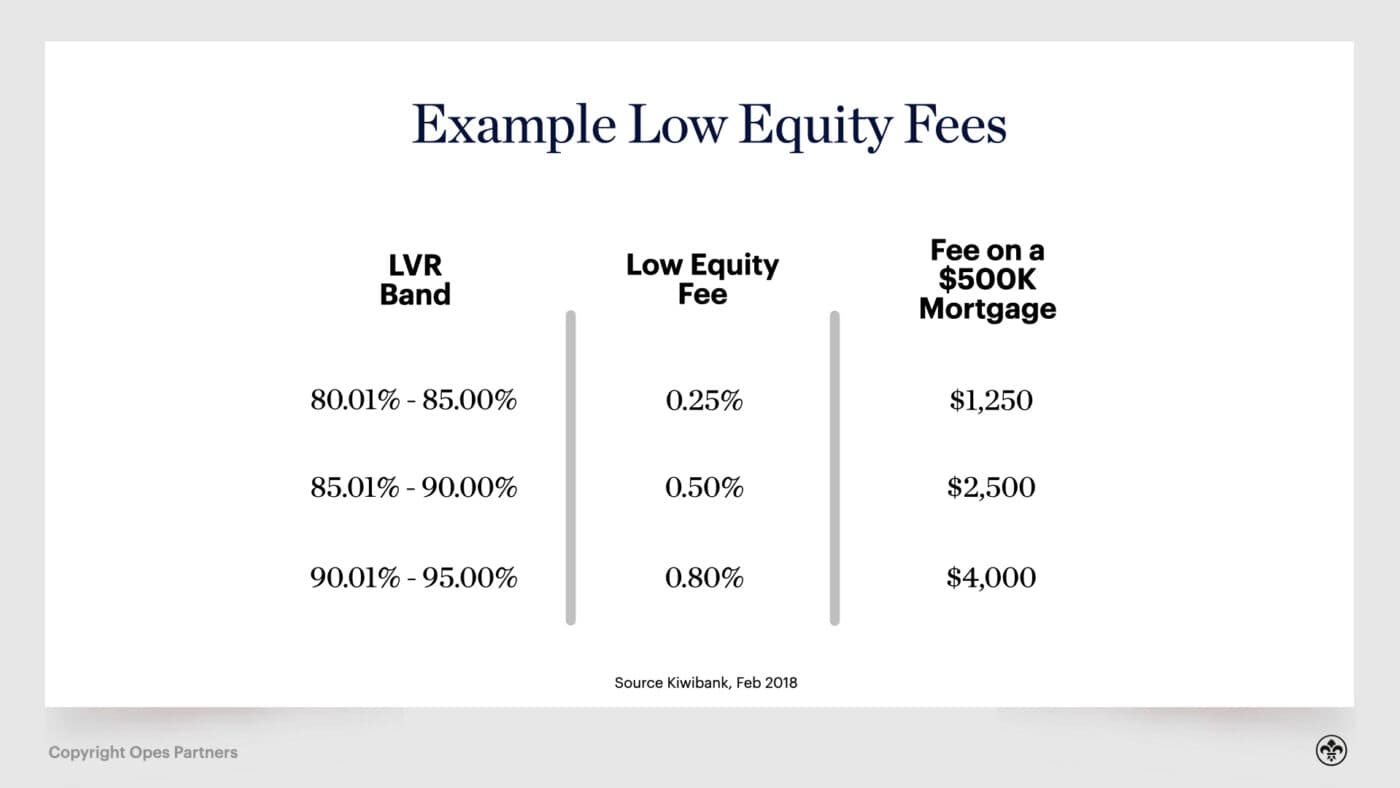

For instance, as of 2018, KiwiBank's low equity fees have been:

Because this fee is usually added on to the mortgage, you'll pay interest on the additional charge.

Recently, some larger banks have stopped charging low equity fees and have begun to charge low equity margins instead.

Low Equity Margins are an extra bit of interest your bank charges when you get a loan with less than a 20% deposit. That additional interest is called a low equity margin.

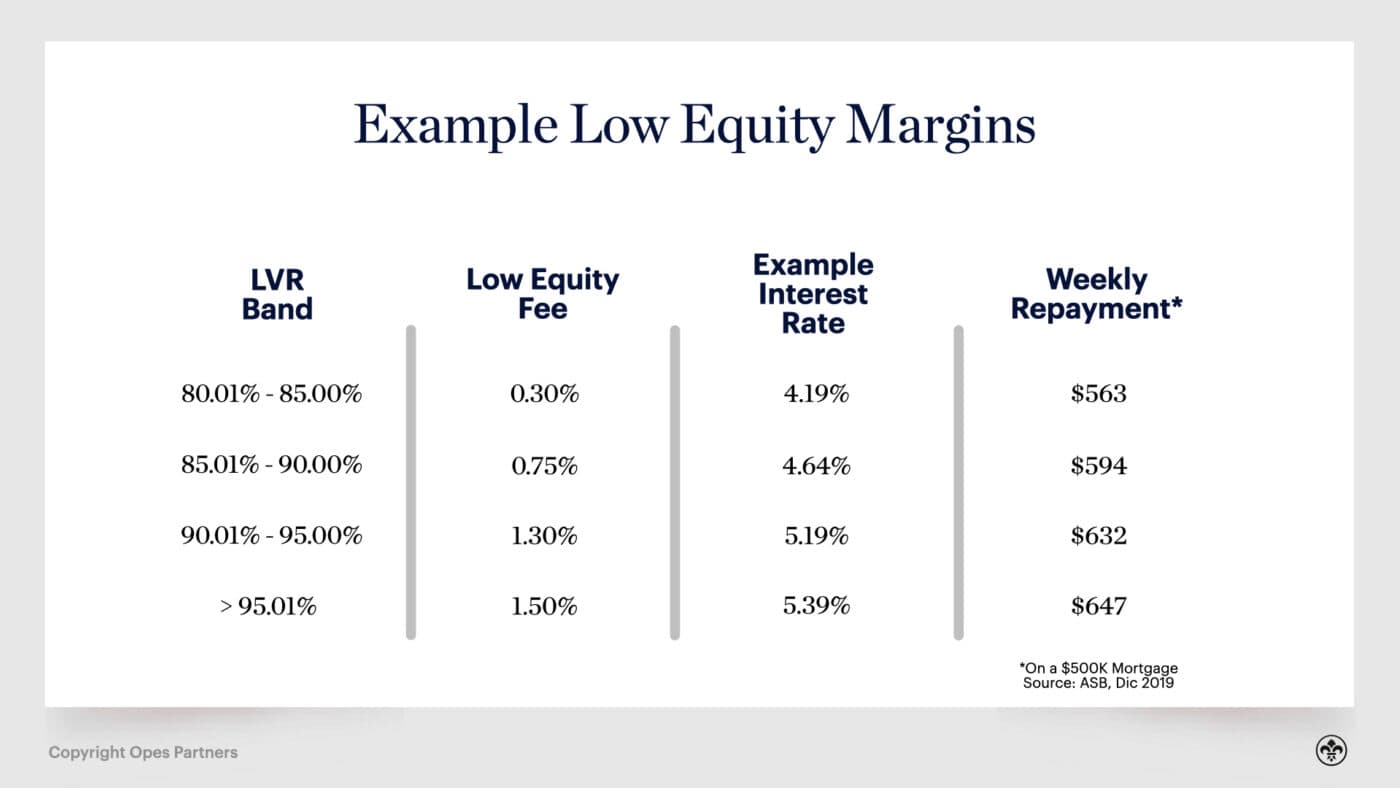

These margins typically range from 0.25% up to 1.5% depending on how small your deposit is. As a general rule of thumb, the lower your deposit, the higher your interest rate will be.

It's important to know that these margins aren't added to the rates you see banks advertise as you drive around town. You know, the ones you see at bus stops, on billboards or TV ads. These are called 'special rates'.

These special rates are only for borrowers with an LVR of 80% or lower, i.e. a borrower with a deposit of 20% or more.

Borrowers with less than 20% deposit use the 'standard rate', which are 0.5% higher at the time of writing (for ASB).

Your low equity margin is then added on top of the standard rate.

For instance, here are ASB's current low equity margins:

These example interest rates and weekly repayments are calculated using the standard rate of 3.89% as at 27th December 2019, and a $500,000 mortgage.

Because the less deposit you have, the higher the interest rate will be, your repayments will also be higher.

How to remove your low equity margin

The low equity margin only applies while you are within each LVR band.

You can remove the LVR margin after 6 months, or as soon as you move bands, whichever is later. This helps to decrease your mortgage repayments as you build more equity within your property.

There are two ways you will likely build equity within your property:

If you are relying on your property increasing in value to remove the low equity margin, you will need to provide the bank with an updated registered valuation. This will prove that you are in a new LVR band.

Lenders may also require borrowers to pay for Lenders and Mortgages Insurance (LMI). This is an insurance policy the bank takes out to protect themselves if the loan isn't repaid or something goes wrong.

This cost is passed on to the borrower to pay as a one-off upfront fee (like a low equity fee).

In this case, when the bank offers you finance, it will be conditional on you paying for the bank's Lenders and Mortgages Insurance.

There typically hasn't been a lot of transparency about the actual cost of Lenders and Mortgages Insurances. However, in 2016 Canstar did a study and showed that on a $350,000 mortgage the average LMI fee was $2,223 – 0.64% of the loan amount.

Because this fee is typically added on to the loan amount, you will also pay interest on this fee.

Under the government's First Home Loan scheme, the government pays this fee for each borrower who meets the First Home Loan criteria (discussed above). This is one way to avoid paying lenders and mortgages insurance.

In essence, there are two core criteria you need to satisfy to have your mortgage approved:

This second point is called 'servicing'.

The bank needs to see you have enough money to afford your mortgage repayments.

The last thing the bank wants is to approve a mortgage only to find that you can't pay it back.

As part of your mortgage application, you'll submit three months of bank statements. Your prospective lender will use these to check both your income and expenses, making sure you can make your repayments.

A bank employee will literally go through your bank statements line by line to check what you are spending and where you are spending it.

Let's give an example. If you currently pay $300 a week in rent and your new mortgage repayment will be $500 a week, the bank will want to see that you have more than an extra $200 a week that can go towards the mortgage.

This is where a mortgage broker can be immensely helpful when trying to get finance. If they anticipate your lender will ask questions about your finances, a broker will help you get your finances in order before you make an application.

But, just being comfortable with the repayment a mortgage calculator gives you may not be enough ...

You might use the mortgage calculator, above, see the repayments you would need to make in today's low-interest environment and think 'I can afford that'.

The bank might not agree with you, and your mortgage might not be approved.

You might think: "But if I can afford the repayments, why wouldn't a bank lend me the money?"There are two reasons:

This is why the bank will do two things to your mortgage application:

Let's walk through both scenarios:

When you apply for a mortgage, your lender will use a 'servicing test rate'. This assesses whether you could afford your mortgage at a higher interest rate while making principal and interest payments.

For instance, you might apply for an interest-only mortgage intending to receive a 3.5% interest rate.

Even though the bank might approve this borrowing, they will check to see whether you could afford a 7% interest while still making principal and interest repayments.

These repayments required in these two scenarios vary widely.

A $500,000 interest-only mortgage at 3.5% requires weekly repayments of $337. But, a $500,000 mortgage with principal and interest repayments at 7% interest over 30 years requires repayments of $767 per week (128% more).

Even though you wouldn't pay that $767 over the 5-year interest-only term, banks need to see that you could afford that right now.

You might include some form of income (other than your wages or salary) in your mortgage application, which you'll use to help pay the mortgage.

For property investors, that's the rent you charge the tenant to live in the property. For owner-occupiers, it's more likely to be flatmate income or renting out a minor dwelling on the property.

When the banks assess your application, they will scale this income down so that you can't count it all towards your repayments.

Say you plan to buy your first home and have a flatmate help pay the mortgage. You plan to charge this flatmate $200 a week.

On the mortgage application, your bank will ask you to scale this down to only 50%. That means that only $100 a week of flatmate income would count towards the bank's affordability calculations.

This is to protect both you and the lender. It means that if you didn't have a flatmate for 6 months of the year, you'd still be able to afford the mortgage.

For property investors, rent is scaled at 75%, which means that if you charge your tenant $500 a week, only $375 of that counts towards the servicing of the mortgage.

The bank needs to see that you have enough income to cover the shortfall if required.

This will become a lot clearer when we start to look at an actual mortgage application in a moment.

There are two primary places you can get a mortgage from. You can either use the core banks or use second-tier lenders.

There are also two ways to get lending from these businesses. You can either negotiate directly or use a mortgage broker.

Let's look at the two options:

Banks are financial institutions that are regulated by the Reserve Bank of New Zealand. There are five big lenders in NZ:

But, we also have several other smaller banks:

Secondary lenders are not banks and therefore are not regulated by the Reserve Bank. These lenders include:

Secondary lenders are usually used if you can't get a mortgage from a bank. They are used to looking at mortgage applications that fall outside the square and therefore charge higher interest rates than a bank lender. They may also charge an upfront fee when you take out the loan.

Instead of going to a bank or non-bank lender and negotiating finance yourself, many New Zealanders will instead use a mortgage broker.

A mortgage broker will do two main jobs:

Because mortgage brokers stay up to date with each bank's lending policies, they will determine which lender is most likely to give you a loan. They will then approach these specific banks first.

They will also look to present your finances in a way which is most likely to get you approved. Or, if they believe that you're unlikely to get approved yet, they will work with you to get your finances in shape until you're ready to go.

A good mortgage broker will also help you create a plan to pay off your mortgage more quickly.

Mortgage brokers won't generally charge you a fee for this service. This is because when they successfully broker your lending, they receive a commission from the bank.

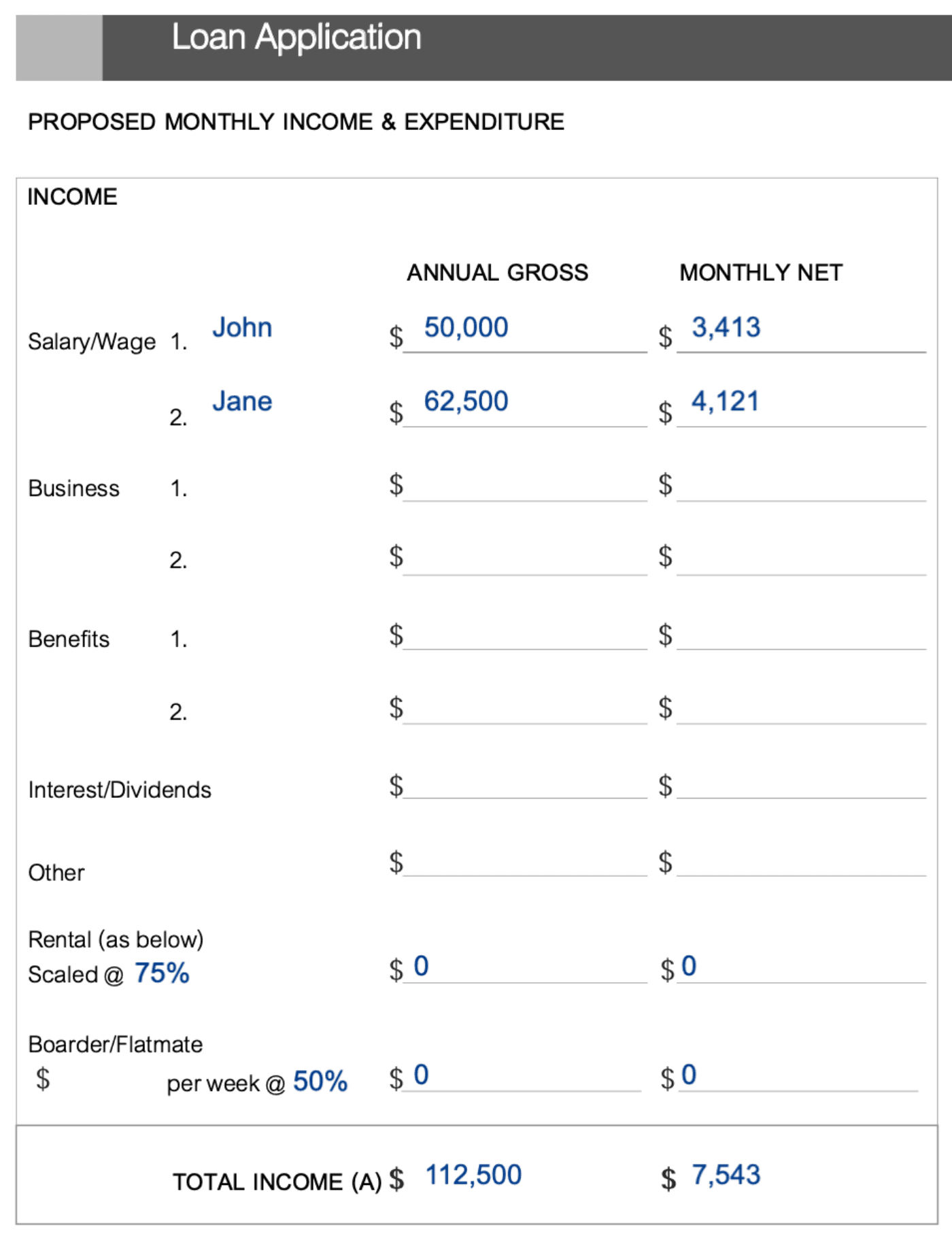

Now that we know the basics of getting a mortgage, let's dig into what an actual mortgage application might look like.

This will clarify the principles we've already discussed so far.

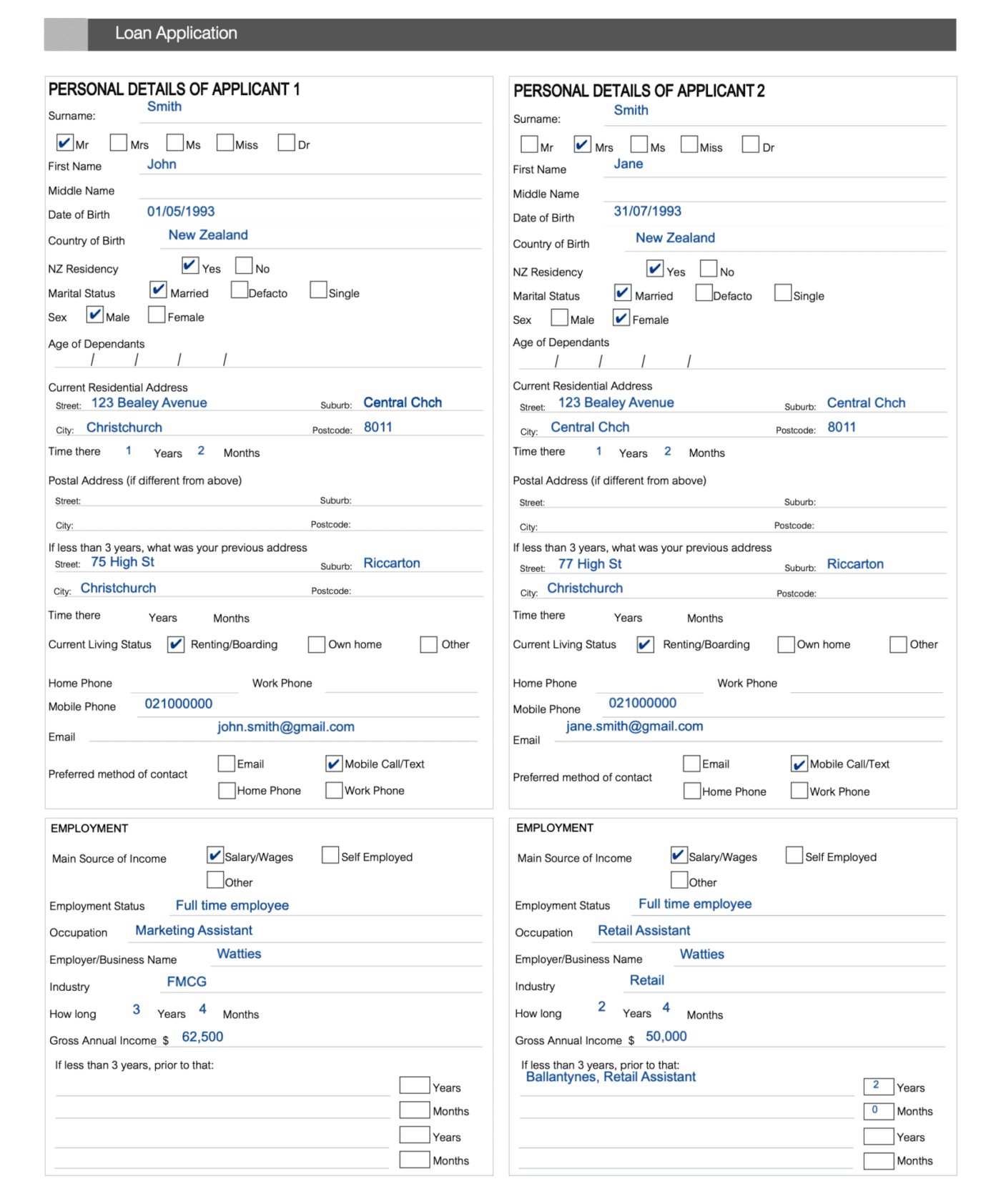

To do this, we're going to take the example of a typical mortgage application for a couple in Canterbury – John and Jane Smith.

John and Jane are a couple who want to purchase a section of land and build their own home.

All up they estimate costs of $550,000 and will use a 20% deposit. Here is what their mortgage application might look like:

The first section contains the standard personal details of the couple.

They are married, both born in 1993, so they are about 26 years old. All pretty simple stuff.

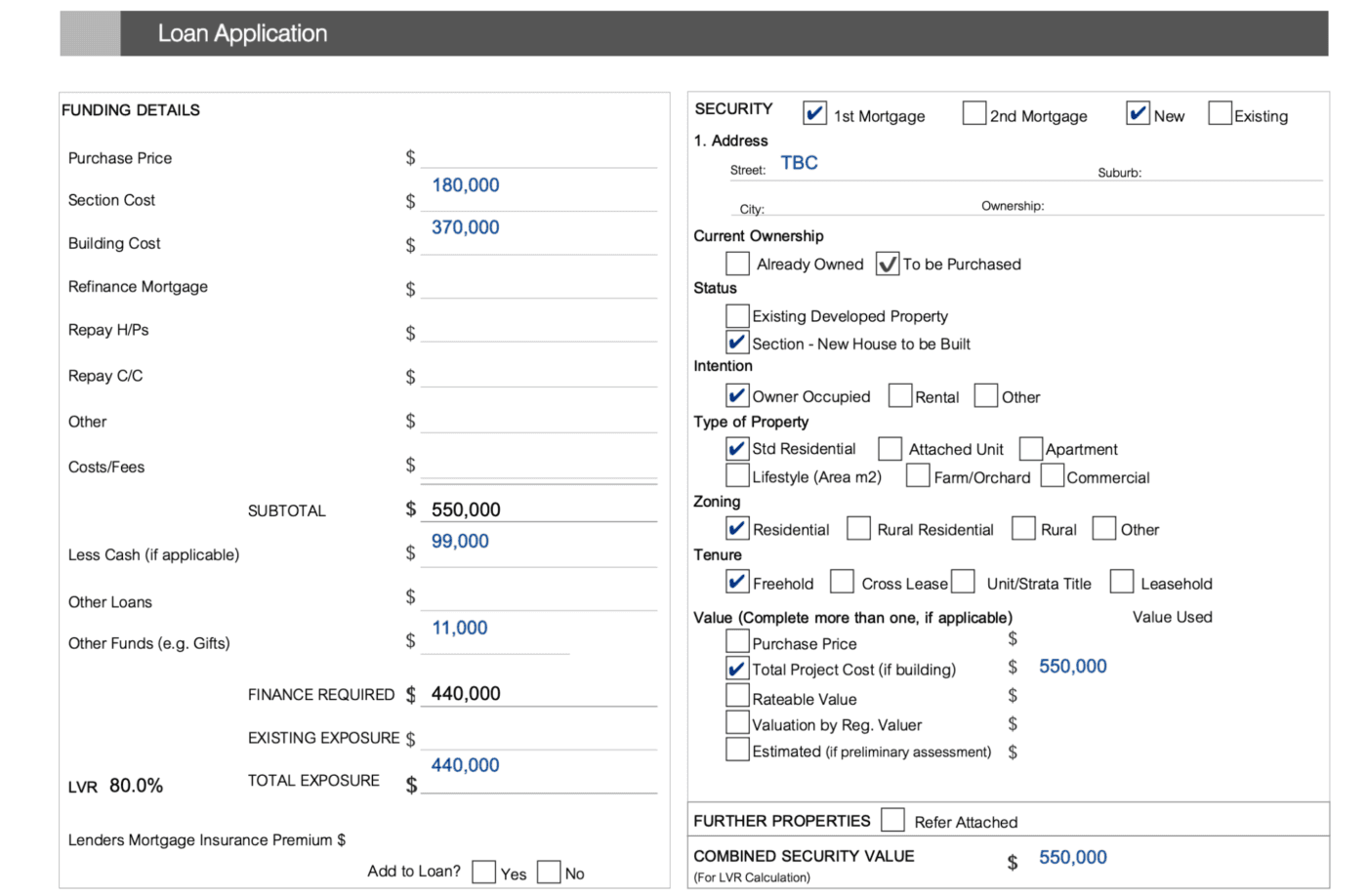

The next section contains details about the property they want to purchase.

They anticipate the section will cost $180,000 and building their new home will cost $370,000. This adds up to the $550,000 we mentioned earlier.

They've already saved a deposit of $79,000. The Smith's also expect to receive $20,000 as part of the First Home Grants, as well as receiving an $11,000 gift from the Bank of Mum and Dad. This gives John and Jane a total deposit of $110,000, so they are applying for a $440,000 home loan.

Because they have $110,000 they can use as their deposit, their LVR will be 80%, which means they can access the bank's special advertised rates, rather than the higher standard rates.

Once completed, the property will be a standard residential property on freehold land, and the mortgage will be secured against the property.

Next, John and Jane note down their income. John earns $62,500 before tax and Jane makes $50,000 pre-tax. This gives a combined monthly income of $7,543 after tax.

If the Smiths were building this property as a rental, see how the application asks John and Jane to scale the rental income down to 75%.

If they were to use border/flatmate income, they would need to scale this income down by 50%.

Although John and Jane would have this income week to week, not all of it counts towards the income part of the mortgage application due to the bank's cautious approach.

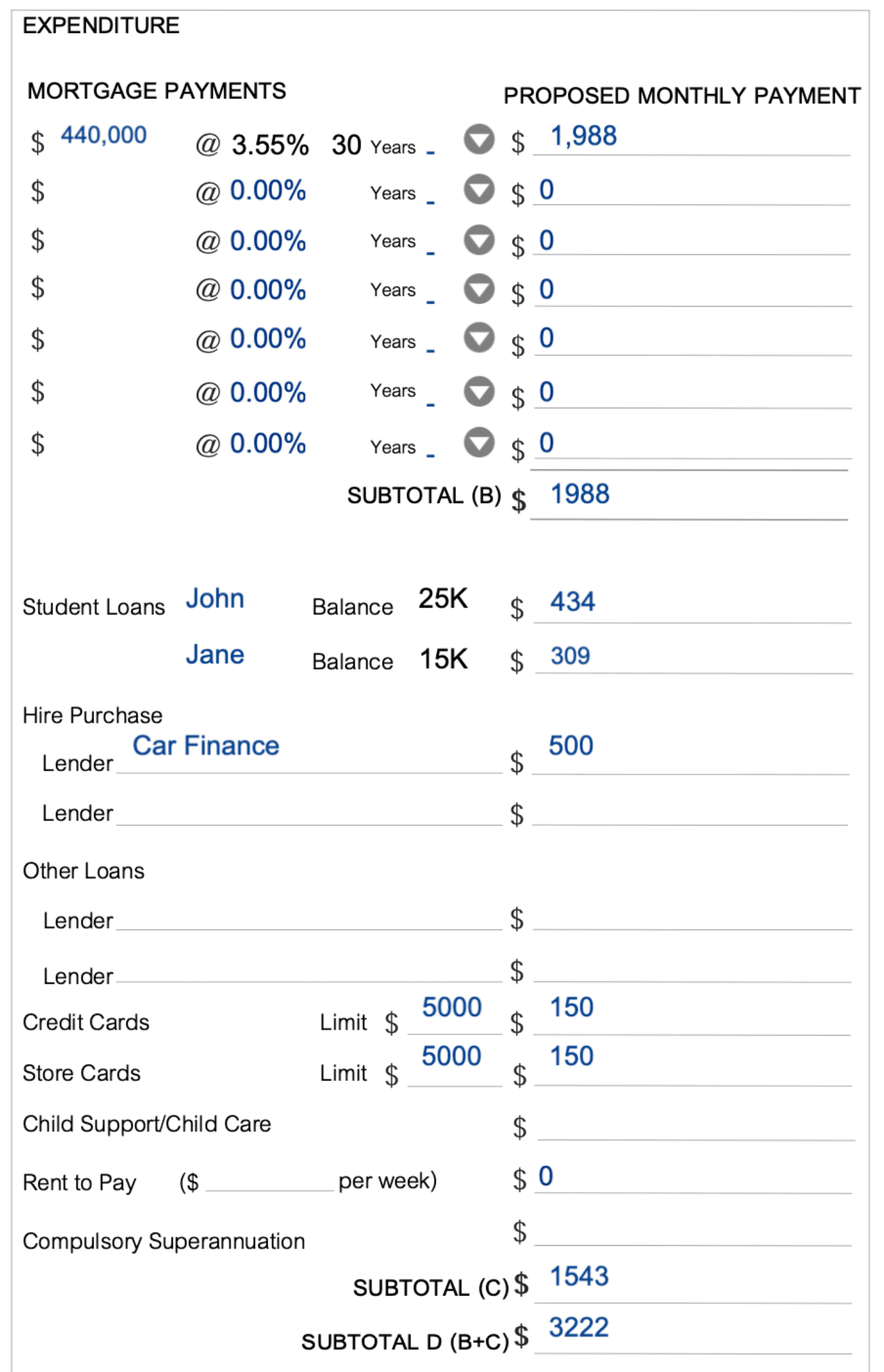

Next up, John and Jane need to estimate their expenses to make sure they can afford the mortgage.

First, they note down their anticipated mortgage payments.

John and Jane plan to take out a 30-year mortgage at a 3.55% interest rate, which means they'll pay $1,988 a month.

They also note down the existing debts they are already committed to.

John has a $25,000 student loan and Jane a $15,000 one. Together they pay $743 a month towards these debts.

They also have a $500 a month car payment and set $300 aside for credit card payments.

Even if John and Jane haven't used any of their credit card limits, they still account for the payment they'd need to make if their credit cards were maxed out.

In this example, as we'll see, John and Jane have only used $7,750 of their credit card limit, but the bank will require them to have enough income to service the whole limit.

That's because after the mortgage is approved, there is nothing stopping John and Jane spending on their credit cards and taking on more debt.

This ensures that if John and Jane did use their whole credit card limit that they'd still be able to afford that debt.

Adding it all up, in this scenario, John and Jane have $3,222 per month allocated towards paying debt.

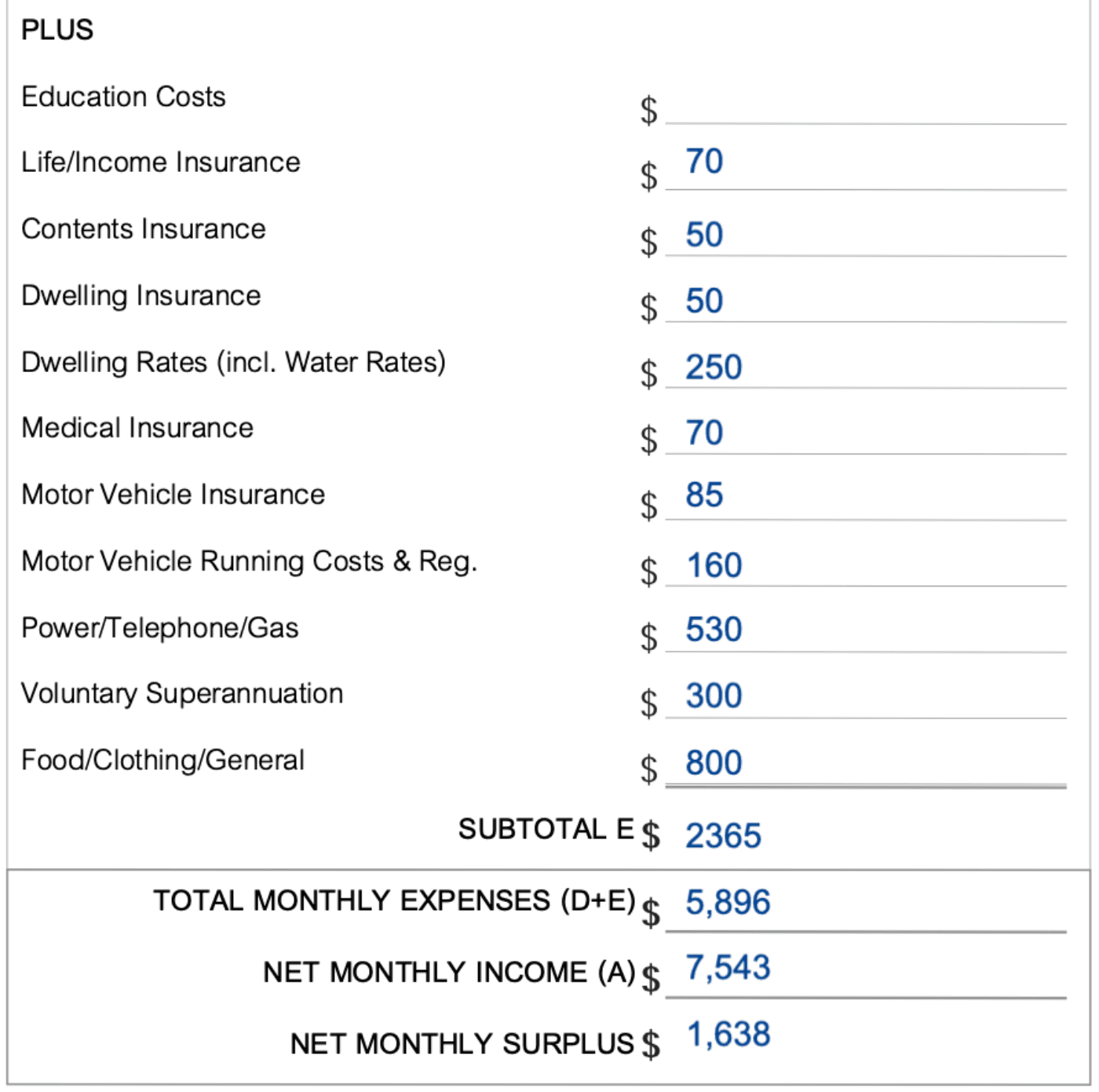

They then estimate their general monthly expenses, from insurance to motor vehicle costs, and food, clothing and general. This adds to $2,365.

This means that once John and Jane have their mortgage approved, they will have $5,896 of expenses and $7,543 of income. This gives a monthly surplus of $1,638.

This means they have plenty of additional income they can use to pay the mortgage if interest rates increase. So, they are likely to pass the bank's servicing tests.

As a general rule of thumb, banks like to see at least a $500 monthly surplus in these calculations.

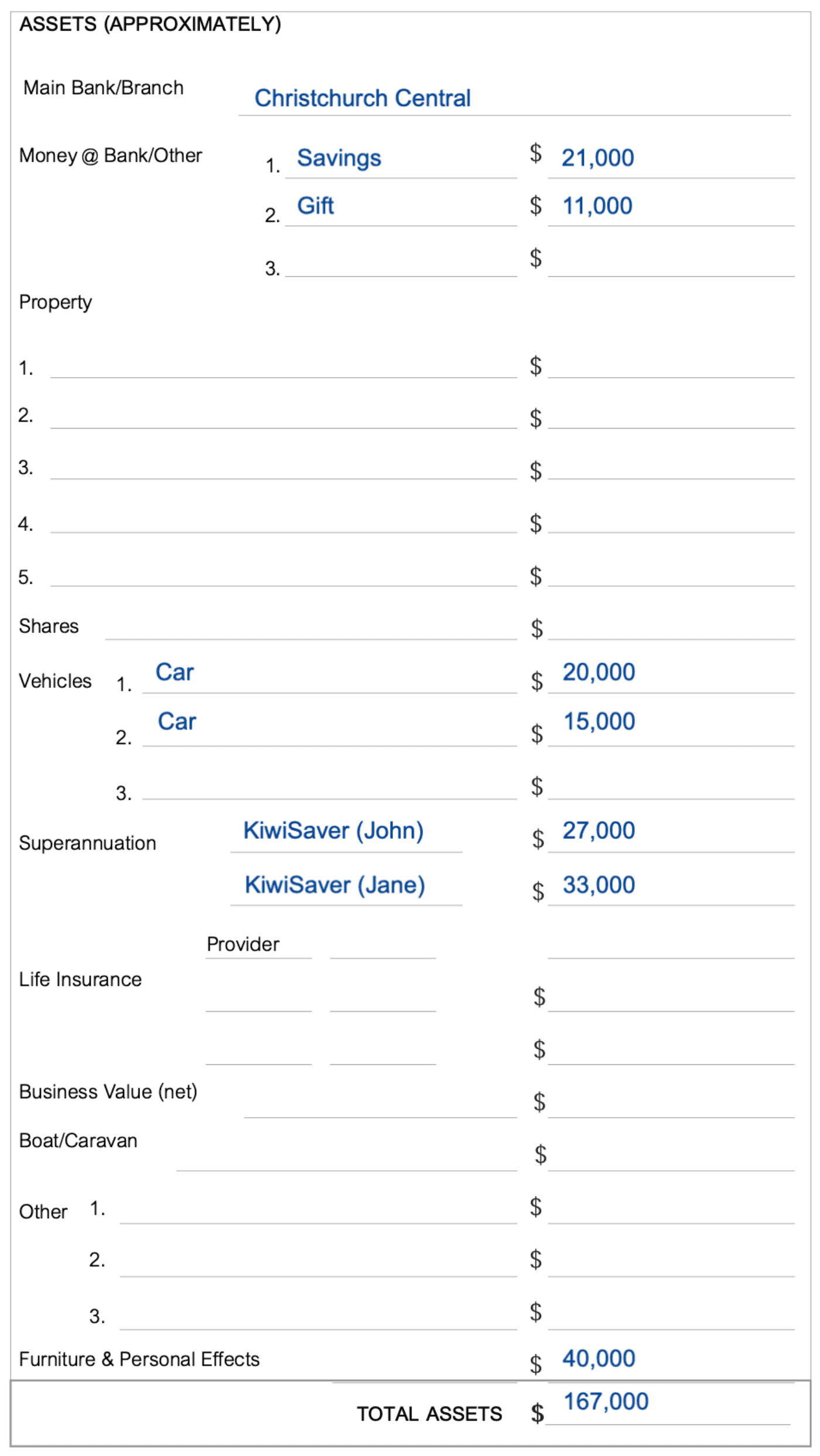

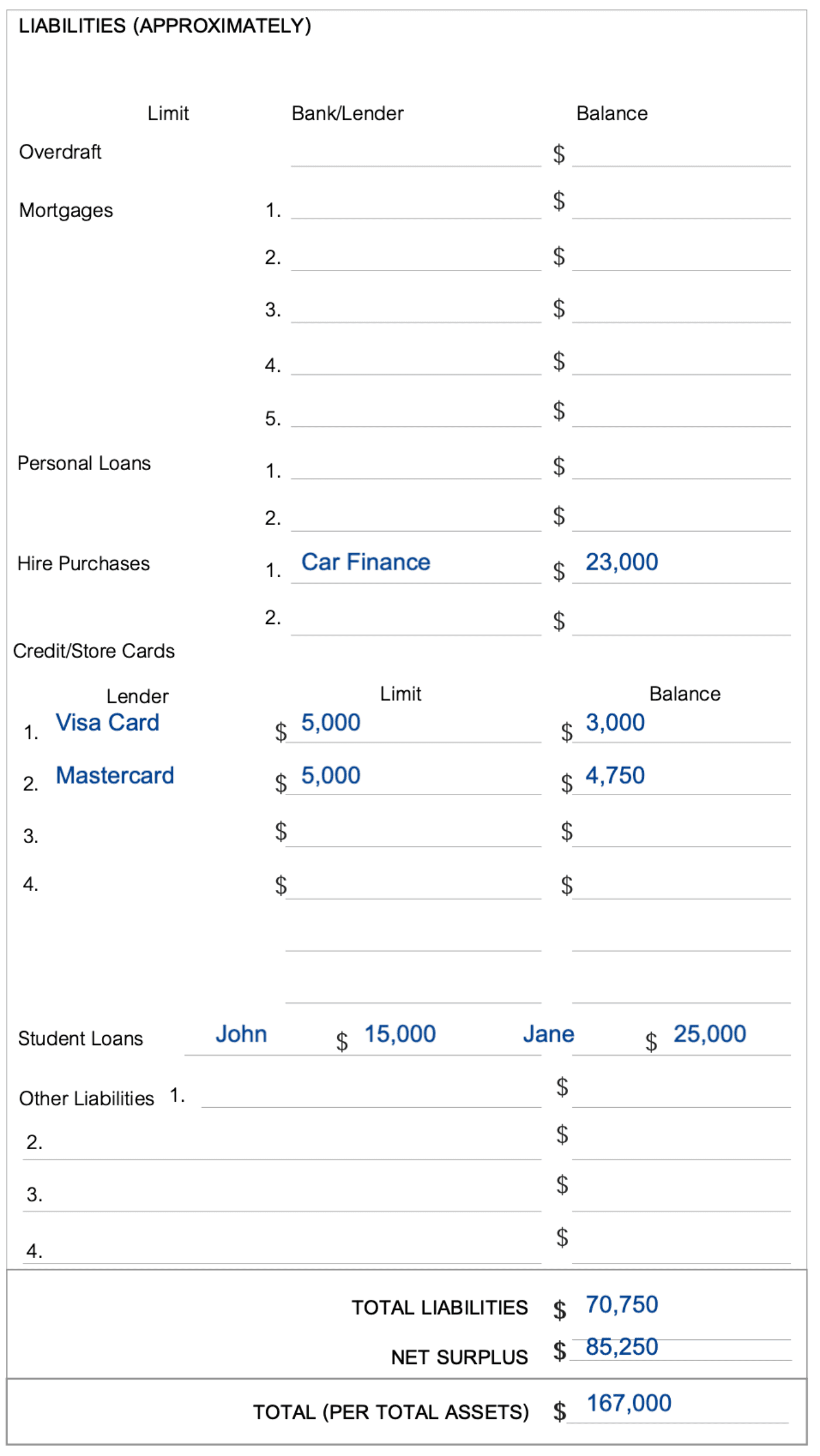

The last two sections concern John and Jane's assets and liabilities.

Collectively they have $21,000 of savings and an $11,000 gift from the Bank of Mum and Dad. They also have cars worth $35,000, and $33,000 and $27,000 respectively in their KiwiSaver.

They also estimate that their personal possessions are worth $40,000.

This gives the couple total assets of $167,000.

Finally, John and Jane calculate their liabilities.

They have $23,000 of debt secured against their car, as well as $7,750 of debt across two credit cards. As mentioned, they also have $40,000 of student loans.

This gives total liabilities of $70,750. Once we take this off their $167,000 worth of assets, the Smiths have $85,250 of net assets.

If approached right, John and Jane's mortgage is very likely to get approved. They have enough income to pass the bank's servicing tests and a good deposit built from multiple sources.

However, there are other reasons why a mortgage application that appears at first glance to be stable might be declined ...

There are four key reasons why your mortgage might be declined by a bank. Two of these we've already spent a lot of time addressing:

But, even if you meet these first two criteria, there are two more reasons your mortgage might be declined.

When a bank lends you money, they want to make sure that they're going to get it back. That's why they may not approve your mortgage if you show signs of poor account conduct, i.e. 'not being a good payer'.

We earlier mentioned that when you apply for a mortgage, the bank will go through 3 months worth of your bank statements.

As well as looking at what you have spent and where you're spending it, they're also looking for instances where:

These indicate that you may miss mortgage payments in the future, which can make the banks nervous about lending large sums of money to you.

If this does sound like you, and your application is declined due to poor account conduct, it's not a 'no' forever. It usually takes 6 months of 'good behaviour' before the bank will reconsider and approve your mortgage application.

Your best course of action, in this case, is not to apply for a mortgage. Instead, work with a mortgage broker to get your finances in order, consolidate any debts and create a record of being a 'good payer'. This will ensure your mortgage is approved when you do apply.

If you apply directly first and get declined, the result of that application will stay on your credit record, which can make it harder to get finance in the future.

Working with a mortgage broker will help you get in financial shape before you go and see the bank, so you can get approved more quickly.

Banks will also look at your credit history, looking for instances where debt collection agencies have chased you to pay outstanding debts.

If you have notes on your credit history that could work against you, then it's not an automatic 'no'. But, it is best to front foot it.

Request your credit report early and work with a mortgage broker to explain these to your bank.

Once you've got a mortgage, most people will want to pay it off as quickly as possible.

Remember, mortgages are expensive for two reasons:

If you buy a property for $500,000, the actual cost could be in the vicinity of $750,000 by the time you factor in interest.

But, there are strategies to pay off your mortgage more quickly and decrease the interest you pay.

Here are five strategies you can use to pay off your home mortgage faster:

The key to financial success is making your money work for you in its most efficient way.

You may have money squirrelled away into different accounts. You might have $2,000 in an emergency fund or $5,000 saved for a holiday.

Even if you don't pay this money against your mortgage, you can still use it to help reduce the interest you pay using an offset account.

Say you have a $300,000 mortgage in one account (i.e. $300,000 worth of debt), and $20,000 of savings in an offset account.

Instead of charging you interest on the $300,000, you would only pay interest on $280,000.

Using a 3.5% interest rate, you would save $700 worth of interest per year ($20,000 x 3.5%).

This means you can pay down the principal of your mortgage more quickly because that $700 can be used to pay down the debt, rather than go to the bank's bottom line.

Instead of using an offset account, you could also use a revolving credit.

This is where a portion of your mortgage, say $50,000, would be set up as a transactional account – like a $50,000 overdraft.

Your wages or salary would be paid into this account, and you would pay your daily expenses from this account.

The benefit of this is two-fold:

You could also make additional payments towards your mortgage. You don't just have to make the minimum payment.

Say you have a $400,000 mortgage at 4% interest on a 30-year term.

Your minimum payment is $440 per week. Over the life of the loan you will pay $287,023 in interest.

If you increase your repayments to $500 per week (an extra $60), you cut down your mortgage by 6 years, paying it off in 24 instead of 30. You'll also only pay $221,321 in interest, saving $65,702 in interest.

An alternative strategy is to increase your payments gradually each year.

For example, BNZ's Tailored Home Loan product, or TSB's Step Up programme allows you to increase the repayments you make each year by a small manageable amount.

Say you've got a $300,000 mortgage on a 20-year term at 3.5%. Your current repayments are $400 per week. If you increase that by 3% each year with the rate of inflation, next year's weekly payment will be $412. Using this structure will cut 5 years off your mortgage and save $95,000 in interest.

If you're like most Kiwis, you probably have a few credit cards with a little more than you'd like left on them, a store card, and a bit of debt here or there.

You're probably paying 10-15% interest on this debt and making regular repayments against them.

An alternate strategy is to consolidate this debt into your home loan. You'll increase the size of your mortgage and use those funds to pay off your credit cards and other consumer debt.

It may sound counterintuitive to increase the size of your mortgage to pay it off faster.

However, consolidating your debts will mean that you will lower your interest costs. Instead of paying 10-15% interest on your consumer debt, you'll only pay 3.5% (or whatever the interest rate on your mortgage is). This will decrease your minimum repayments.

If you then pay the same amount you were paying before against your consolidated mortgage, you'll pay your debts off faster.

For example, let's say you have a $300,000 mortgage that is 3.5% and you are paying $1400 a month. That means you'll take 28 years to pay off your mortgage.

Let's also say that you have three consumer debts:

All of these loans have different interest rates, terms and payment dates, which can make it hard to manage.

Consolidating this $23,000 of consumer debt into the mortgage would increase that mortgage to $323,000.

But, your total financial position is the same – you still have the same amount of debt.

If you add up all the repayments, that gives you $2,250 that you can put towards the new mortgage. But, the minimum payment on that new mortgage is $1,508.

If you continue to pay that $2,250 towards your mortgage, you'll make significantly more payments than you need to.

Under this scenario, you'll be debt-free in 15 years and 6 months (12.5 years early) and save around $83,000 in interest repayments.

The last strategy is to buy an investment property.

Now you may be thinking: Shouldn't I pay off my mortgage before I start investing in property?

In short, you do not need to pay off your mortgage before you get started in property investment.

You might really want to pay off your mortgage fast and be making extra repayments beyond the minimum required amounts.

This additional money may be better put to use in investment property.

Let’s say you have a $300,000 mortgage that you’ve just refinanced onto a 30-year term.

If you’re paying 3.5% interest, your minimum payments will be $311 a week. Over 30 years you'll pay $184,611 in interest.

We've already discussed that you could decrease this amount by increasing your repayments, say by $50 a week.

Now, let's say your alternative is to invest in a $500,000 property, which would also require a $50 a week investor contribution (because the property is negatively geared).

Let’s compare the two options:

In this scenario, your repayment will be $361 rather than $311 per week. This shortens the mortgage term to 24 years, saving 6 years and $45,000 in interest.

Now, let's say you carry on paying $311 and use that $50 to go and buy a rental property worth $500,000.

If you had 5% capital growth on that property, eventually there would be enough equity in that property to sell the property and pay off your mortgage.

In this situation, you can sell the property in year 8, and pay off your entire mortgage.

This allows you to pay off your mortgage 22 years early rather than 6, and you would save $82,000 worth of interest, rather than $45,000.

Typically yes, because the interest on your mortgage is calculated daily, the more frequent payments you make, the less interest you will pay over the term of your mortgage.

The general rule of thumb for an owner occupier is 20% of your home's value. For investors intending to purchase existing properties the deposit requirement is 30%, or 20% if intending to purchase a brand new property.

These are general rules of thumb and depend of the Reserve Bank's LVR restrictions as well as each individual bank's lending policies.

In New Zealand, it is generally 20%, but depends on the Reserve Bank's LVR restrictions as well as each individual bank's lending policies.

Mortgage broker for over 10 years, property investor and Managing Director at Opes Mortgages

Peter Norris, a certified mortgage adviser with 10+ years of experience, serves as the Managing Director at Opes Mortgages. Having facilitated over $1.2 billion in lending for 2000+ clients, Peter is a respected authority in property financing. He's a frequent writer for Informed Investor Magazine and Property Investor Magazine, while also being recognized as BNZ Mortgage Adviser of the Year in 2018 and listed among NZ Adviser's top advisers in 2022, showcasing his expertise.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser