Property Investment

How to know if you can really afford an investment property top-up

Not sure if you can afford a $200-$350 weekly top-up on an investment property? Learn how to test your budget before you buy.

Property Investment

12 min read

Author: Lance Jensen

15 years’ experience in the industry. Active property investor with $6 million+ portfolio. Financial adviser at Opes Partners.

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

If you’re a long-term property investor, at some point something will go wrong.

That’s not to scare you off, or to say you shouldn’t invest in property. After all, here at Opes Partners we are a property investment company.

But you need to be aware of the most common things that do go wrong ... that way you can avoid them.

That’s why in this article you’ll learn the top 8 problems investors often face when buying and holding property.

You’ll also learn how to manage these risks. So when your old mate, John, says: “Property is risky … what if X happens?” you’ve already got a game plan for how to tackle the issue.

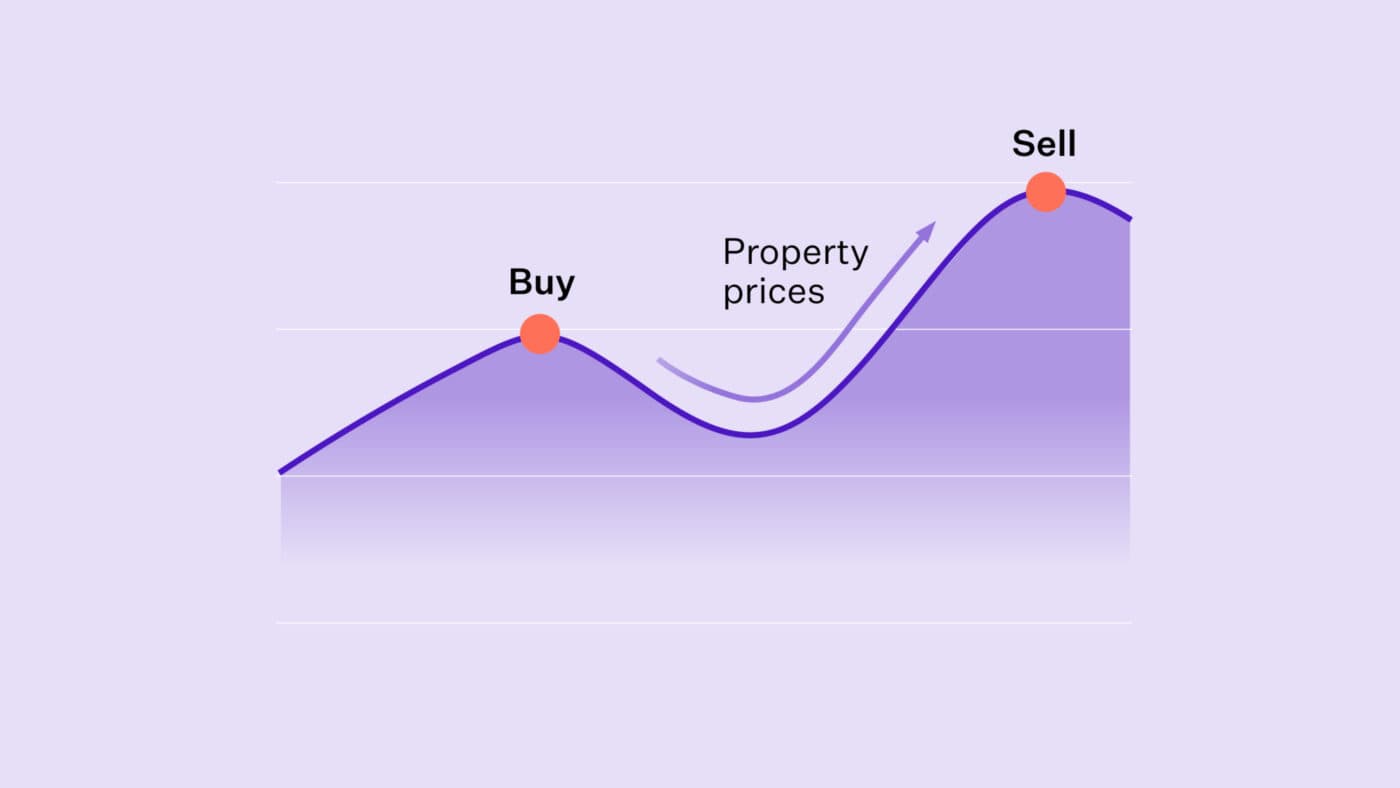

One of the biggest worries property investors have is what happens if the market falls?

Spoiler alert: house prices do go up and down. They don’t increase every single year forever.

So, if you are a long-term investor house prices will go down at some point.

But a falling market is a concern for investors who are about to buy a house, because if you buy a property for $1,000,000 and the market falls 1%, you’ve just lost $10,000.

Whereas, let’s say you bought a property 10 years ago for $500,000, and it’s now worth $1 million, it’s less of a concern if the price then drops by $10,000. You’ve already made $490,000.

That’s exactly what happened to me. I signed up to buy a property in Rangiora, Canterbury, in 2007.

And I got my parents to invest with me. Together we agreed to pay $390,000 for the property. But by the time it was actually built, the market had dipped, and it was only worth $370,000.

I felt terrible. I’d got my parents to buy their first investment with me, and at that point it hadn’t worked out.But there is good news: 15 years later, we sold it for more than double what we bought it for. But, in the short term, it wasn’t great.

You can’t avoid a falling market. That’s the roller coaster you have to ride when you invest.

The good news is that over the long term prices tend to recover and increase, so your first major protection if prices fall is – don’t sell.

If you sell your property after it’s dropped in value, you have “crystallised” your losses.

Let’s say you buy a property for $1 million. It then decreases in value by $20,000.

If you sell now, you have lost $20,000. This is a real loss that you have to face.

But, let’s say you continue to hold that property. Perhaps in 2 years’ time it’s worth $1.02 million.

Sure, you made a temporary loss – on paper – when the property’s value fell, but because you continued to hold, you never actually faced that loss in reality.

But, in some rare cases, you can’t avoid losing money. Some times investors have to sell. For example you might lose your job or go through a relationship breakup.

But generally, if the market drops the only thing you can do is hold your nerve, like I did in the above example.

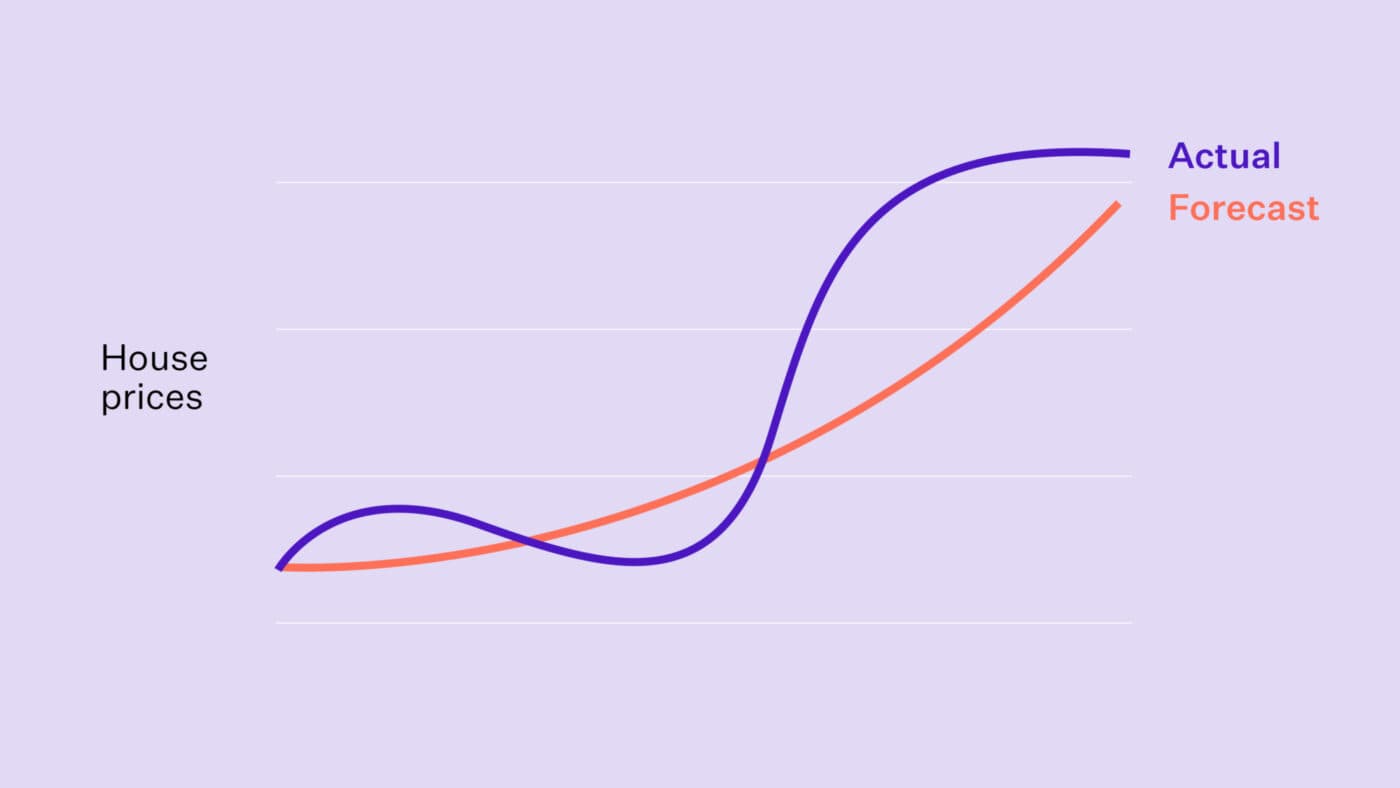

When you create a property portfolio you’ll often forecast your wealth. You might ask: “How much wealth will I have if the price of this property increases by 5% a year?”

That’s a normal (and industry standard) way to forecast your investments. You then use these figures as part of your retirement or long-term financial planning.

But the truth is property values don’t increase in a straight line; they’re not easy to predict. And while property prices have increased quickly in the past, there is a chance they won’t increase as quickly in the future, or as quickly as you forecast in your plan.

That can create an issue if you get to retirement and you don’t have as much money as you thought you would have.

The first thing you can do is to use a lower capital growth rate.

For instance, over the last 25 years (Jan ‘00 – Mar ‘25), the average property value in Mangere Bridge, a suburb in Auckland, increased 6.74%.

However, when you’re forecasting your property portfolio you might use a more conservative figure.

Here at Opes we use a 6% growth rate for a New Build in Auckland. This means that even if the property market doesn’t perform like it did in the past, you’re more likely to meet the projections you’ve written down.

The next option is to aim for more wealth than you actually need.

For instance, if you think you’ll need $1,000,000 by the time you retire, you might aim to create $1.1 million of wealth.

So then even if you under-shoot your target you’re still within the ballpark of what you need.

Finally, you can strategically choose the right property in the right area.

Good capital gains are only half the pie.

Property investors have to make sure they receive regular income (in the form of rent) which covers most costs of owning the asset.

So some property investors worry: “What if my property has bad cashflow?”

This could happen because the property doesn’t earn a high enough rent, or has high expenses. That could be an expensive body corporate or high maintenance costs.

There are two ways you can guard against buying something with bad cashflow. The first is to know what yield you’re aiming for; the second is to make sure the numbers stack up.

The yield you should aim for depends on the properties you buy.

Let’s say you want to buy a growth property. That’s a property that increases in value more quickly, but it has a lower yield.

Here at Opes we aim for a gross yield of 4 to 4.75% for this type of property (depending on location).

Compare that to a yield property. That’s one that has good cashflow, but grows in value more slowly. In that case, I aim for a 6% to 6.5% gross yield.

The second thing you can do is run your numbers the right way.

This means doing a boatload of number crunching when eyeing up a new investment property.

You’ll need to consider things like the gross yield, the net yield, the property price and the current rent.

The best way to do this is using Opes+. This is free software you can use to run the numbers on your investment properties.

It forecasts your cashflow so you can decide if you can afford to hold the property in the future.

The next problem investors face is if there is something wrong with the building itself.

This can happen if the property was a leaky building or has bora or rot underneath the floors.

This can become an issue if the property then becomes structurally unsound. In that case, the property might not be habitable, so you can’t get a tenant. Or, in some cases, the value of the property might drop.

Here are three ways you can best protect yourself against buying a property that has lots of issues.

Properties built in the same decade tend to face the same issues. For instance, properties built before the 50s tend to have issues with electrical wiring.

Whereas those built in the 2000’s sometimes have issues with leaks or weather tightness.

The second option is to buy a New Build. Newly-built homes comply with the most up-to-date building codes, so tend to avoid mistakes made with properties built in prior decades.

They also come with a 10-year builders’ warranty, so if there is something wrong with the property structurally you are covered by the warranty.

Most investors who buy an existing property will also get a builder’s report.

This shows you the issues about the building itself. This will either make you feel comfortable or it could give you cause for concern.

They usually cost around the $700 - $1,000, and are well worth it.

Many first-time investors are terrified they will get a bad tenant. You know, the sort who would feature on the show Renters.

The truth is there are bad tenants out there.

There are tenants that pay the rent late (or not at all) and tenants who are anti-social and who’s behaviour will annoy and disturb neighbours.

This can have a real impact on your money if your tenants don’t pay rent or you need to repair the property.

To give you a sense of how often that happens, between 4% and 6% of properties go to the Tenancy Tribunal each year.

So, there’s about a 1 in 20 chance you will go to a tribunal in a given year.

If you’re in the market for 10 years, there is a 40% chance you have to deal with the Tenancy Tribunal at least once.

Here’s our top 4 things to do to make sure you avoid bad tenants.

The best way to steer clear of any potentially unruly tenants is to get your property manager to screen them properly.

For example, you want your property manager to conduct:

These three checks will confirm your tenant can afford the rent and is of good character.

You can be more choosy over tenants if you invest in an area where there is high rental demand.

Let’s say you invest in a place where there are lots of tenants like Addington in Christchurch. There are many tenants who live in Addington, so you are likely to find and choose a good tenant quickly.

On the other hand if you invest in a small town of 1,000 people, there are so few tenants you’ll likely be forced to choose the first one that comes along.

You can check how many tenants live in an area by using our Area Analyser tool.

To get a good quality tenant you’ve got to buy the sort of property they want to live in. If you only buy old, run-down, cold properties, you are going to attract a certain type of tenant.

But if you purchase a better maintained or New Build property, you are likely to attract a premium tenant.

This is one of the reasons here at Opes Partners we tend to recommend New Builds because they tend to attract low-hassle tenants.

If the worst comes to the worst, your final safety net can be landlord’s insurance.

This means if your tenants do consume the wrong type of substance (meth) in your property, damage appliances, or maliciously damage your property, the insurance company will cover the cost of what you’ve lost.

Mortgages are expensive.

But if you want to buy a few investment properties you probably will take on quite a bit of debt.

If you think about it, an investor with 3 to 4 properties will have more assets than most small businesses in New Zealand.

Many Auckland properties are worth over a million dollars. So if you have 4 properties, you might have $3-4 million worth of debt … that’s a decent-sized business.

But not everyone should keep taking on more and more debt.

If you’re an older Kiwis, who doesn’t have long before retirement, you probably shouldn’t take on a mega-mortgage. You might have to sell that property when your income drops if you stop working.

If you want to make sure that you’re taking on the right amount of debt for you it’s best to speak to a financial adviser or mortgage broker about your personal situation.

Nobody plans to be made redundant, or have their business fall over, but it does happen.

Earthquakes, Covid-19, an accident at work … these could all stop you earning.

This is a problem for investors when property is negatively-geared. That means the rent coming in doesn’t pay for all the property’s costs, so the investor has to top up the bank account.

If you then lose your job, this could become a struggle. And the other issue with property is that it is an illiquid asset – it takes time to sell. That means you can’t get rid of it quickly if you do face tough financial times.

Here are 2 things you can do if the worst-case scenario happens.

A classic strategy investors use is to set up a revolving credit. This is like a big overdraft secured against your home.

So, let’s say you set up a $50,000 revolving credit – and you don’t spend any of the money. If you then lose your job, you have a $50,000 line of credit you can use if cash is tight.

But, you MUST set this up before you lose your job. If you try to do it once you’ve lost your job, there’s little chance you’ll get the lending approved.

The second option is income protection insurance. This is where if you are unable to work (temporarily or permanently) an insurance company will pay you a portion of your salary.

This means if you can’t work, you still earn a living.

Property investment regulations constantly change.

Not only does that impact how easy it is to get a mortgage, you could also get taxed more.

In the last few years property investors have faced:

These rule changes can feel intimidating. And you can bet that these regulations are likely to change again in the future.

If you enter investing with the mindset that rules will change you’re off to a good start; it does no good to be spooked by them.

Rather, you want to work with the changes and inform yourself on how best you can still achieve your goals.

You don’t need to become a tax expert or mortgage broker either, but you do need a team of professionals around you who can help you respond to all of these changes.

Phew! We hear you – there really are a lot of things that can go wrong.

But, while there are things that can go wrong, it’s highly unlikely everything will go wrong.

If you invest in property the right way you probably won’t buy a property that immediately falls in value, has bad tenants, and turns out to be leaky, all while you lose your job.

This list isn’t to scare you, or make you think property investment can’t work. After all, here at Opes Partners we are a property investment business.

No, this list is to help you become a better property investor. Because if you understand what can go wrong, you’ve got a much better chance of making sure these things don’t happen.

15 years’ experience in the industry. Active property investor with $6 million+ portfolio. Financial adviser at Opes Partners.

Lance has over 15 years’ experience in the property industry. He became a property investor at 22, and has since built a personal portfolio worth over $6 million.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser