Property Types

Houses vs townhouses vs apartments - Which goes up in value faster?

Want to know what sort of properties you should invest in? See the data about which grows in value faster – houses, townhouses or apartments.

Property Types

16 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Reviewed by: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

In a cross-lease property, you and your neighbours share ownership of the entire land.

Each owner holds a separate lease for their individual house or flat, but the land itself is co-owned.

Originally, cross leases were a quick and cost-effective way to develop properties without having to jump through annoying council hoops and having to pay expensive fees. However, these days cross-lease properties are – somewhat ironically – notorious for issues, require a lot of paperwork, and can devalue your property.

In this article, you’ll learn just exactly what a cross-lease property is, and what you need to know before buying or selling one – to ensure you don’t trip on commonly found issues.

A cross lease is one of the formal structures of land ownership in New Zealand, whereby multiple people jointly own a section of land.

The properties built on that land are leased from the joint owners for a period of (usually) 999 years.

For example, let’s say there are two flats next to each other and they are on a cross lease. You decide to buy one of the flats. If you do that, you will:

You collectively own the land and then you lease your part off one another.

Because you collectively own the land, a cross lease effectively puts restrictions in place about what you and your neighbour can do with your properties and the land beneath them.

Cross leases became a big thing in the 50s and 60s (around the time the Auckland Harbour Bridge was being built) as a quick and easy way to get another dwelling on a piece of land without having to do a full subdivision.

In other words, it side-stepped a lot of the subdivision rules and council contribution requirements at that time. This is why it is sometimes known as a “poor man’s subdivision”.

Currently, there are about 200,000 cross leases in New Zealand – of which 100,000 are in Auckland. Most Auckland cross leases are on the North Shore.

This is because when the Auckland Harbour Bridge was built cross leases provided that easy ticket to getting more people living on the other side of the bridge.

A cross lease is one type of property ownership in New Zealand.

The other 3 main ones are:

This is the most common (and usually most simple) way to own a property. This is because you own the land, and everything built on it. Any alterations you want to make are up to you – subject to council and building consent.

Contrary to freehold, a leasehold ownership is when you buy and own the buildings on a property, but someone else owns the land. You therefore pay ground rent to the land owners.

When you buy a leasehold property you purchase the right to possess the land and the property on it for a set period of time on the lease.

This is most commonly found in an apartment building, or the like. So, in a unit title you own your apartment and then you collectively own the land underneath your apartment and any common areas.

While they may have been the bees knees once, cross leases are less desirable in today’s market (compared with freehold properties).

This is because cross-lease titles can come with restrictions.

That’s the reason in today’s market many cross-lease owners will convert their titles to “fee simple” (more on how to do this below).

Because several people own the land, any alterations to the footprint of the property must be approved by all members on the cross lease.

In other words, if you wanted to bulldoze your house and build another one, you will need your neighbour’s permission for things, where you might not otherwise need this permission if you had a freehold.

This may not be so much of an issue if everyone agrees … but can be awkward and frustrating if not.

For example, any alterations to the property (even something as simple as changing a window to a French door, or extending the deck) could require your neighbour’s consent. If they say “no”, then that’s the end of your plans.

If you don’t get permission from your neighbour and proceed anyway you can end up violating the flats plan.

A “flats plan” is a core document with any cross lease title.

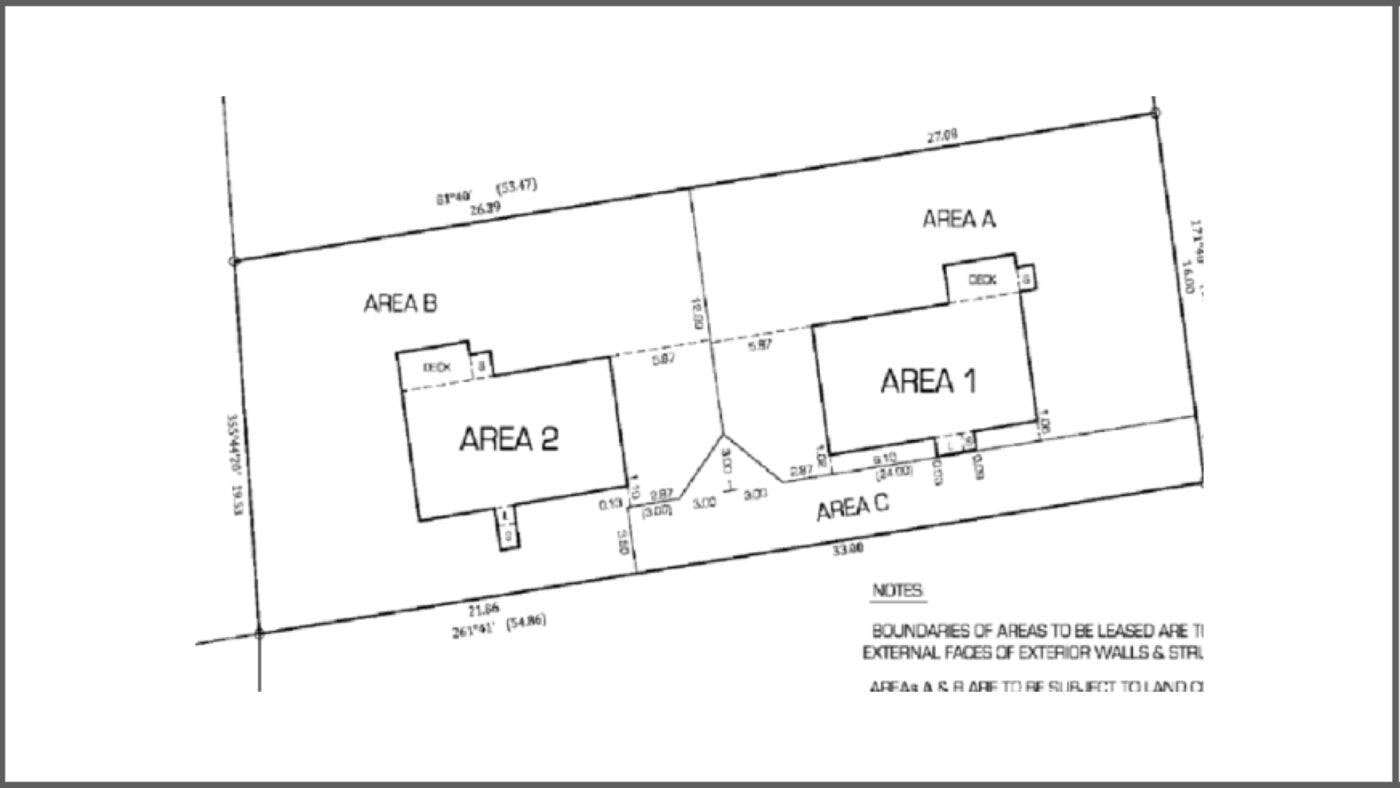

A flats plan is a birds-eye diagram (drawn by a surveyor) that shows the outline of the buildings on cross-lease land. This flats plan is attached to the legal title (description) of the land.

Here is an example of a flats plan:

The flats plan is specific and rigid. And if you want to alter the original building (e.g. an extended deck, a new carport) you need to hire a surveyor to update the flats plan.

This requires permission from all people on the cross lease, i.e. you need neighbours’ consent.

So … why not just go ahead and build the new deck anyway? Neighbours be damned. Then you run into another issue – if you do this you will create a “defective title”.

If your flats plan does not match the properties on the cross lease, and we mean match exactly, your cross-lease title will likely be defective.

This becomes an issue if you eventually want to sell your property.

When you sell your cross-lease property the lawyer of the person buying it will check the flats plan. And they will make sure that the flats plan matches buildings that are there.

Sometimes this is as simple as a look on Google Maps to see if there is an extension to the house or the deck. Or, sometimes a professional surveyor may come to double check the site.

Either way, the person you want to sell your property to will pick up a defective title during the due diligence process.

This creates two issues:

Of course, you can update the flats plan. But the process can take 3-4 months and you will need to engage the help of a land surveyor and your solicitor.

A few years back, I was trying to sell an old Christchurch villa. It was on a cross lease, and I couldn’t convince the neighbour to convert the title to a fee simple.

Nonetheless, I continued with the sale on the cross lease.

I found a buyer for the property, but then the buyer’s lawyer discovered the villa’s carport was not on the flats plan. That meant the title was defective.

And the banks wouldn’t lend money to the purchaser. So, the new purchaser couldn’t buy this property until the title was rectified.

In the end, I had two options. I could either engage a surveyor to update the flats plan, which would cost money, or I could tear down the carport so the building matched the flats plan.

I chose to take down the carport, but in doing so I had to reduce the selling price since the new owner was losing out on the carport no longer being there.

So, not only was it challenging to navigate, the cross lease also resulted in a lower sale price.

It’s important to say that cross leases aren’t all bad news – with everything, there are positives and drawbacks to owning this type of title.

Let’s go through the pros and cons.

Cross leases tend to be cheaper than fee simple titles, since they have some limitations. So, there can be a slight affordability advantage for buyers.

Cross leases are notorious for having issues. Amber Arkell, of Survus Land Surveyors, says it’s not unheard of for a seller to lose $100k on a sale simply because it was a cross lease property.

Some cross lease property owners have seen the value of their properties increase by up to 17-18% after converting their Auckland-based properties to a freehold title.

This is because cross leases are less known in today’s market, and commonly have defective titles. In turn, this usually decreases the value of your property because of the issues they bring to the table.

Cross leases come with several box-ticking exercises – when trying to work within the parameters of the cross lease and when trying to convert them to a fee simple title.

This complexity is ironic, given they were initially created to avoid more paperwork.

The common mistake cross-lease owners make is thinking they can make easy changes to a property, which turns out to require:

Even once you want to convert to a fee simple title, you still require:

Because you jointly own the land with others, you must get neighbour consent for any and all renovation plan that impact the exterior of your property.

Some lawyers would say even internal renovations need neighbour consent, but generally it’s the external alterations to the build.

For example, you might have a small deck, and would like to extend it. Or perhaps you would like to build a carport – your neighbour can say “no” to any of these additions to your property.

These days it’s becoming more common for people to want out of cross leases. In this situation, they will convert them to fee simple titles.

Generally, this happens before a person wants to sell their property.

Here are some of the common reasons property owners give:

There is no set fee for converting one title to another, because it differs depending on a) the location b) the size of the cross lease being converted.

But, as a ballpark a 2-lot cross lease conversion will cost:

This cost includes surveying fees, legal fees and council LIMS.

Now, as a property investor you might look at that and say: “Boy, that’s a lot of money … is it worth it?”

This question has to be considered within the wider context, taking into account the value uplift it adds.

In Christchurch, the value uplift to your property is what you spend. In other words if you spend $20k converting your property, the value goes up by roughly $20k.

But, in Auckland, you often double your money. So if you spend $40k converting your property, it may increase in value by $80k.

As we’ve mentioned earlier, a lot of the cross leases in Auckland are on the North Shore. Some of those properties, particularly in Takapuna, are worth a lot of money in today’s market. So converting the title can be worth it.

The process of converting your cross lease title to a fee simple is lengthy, and can take 8-9 months.

Amber’s advice, from a land surveyor’s opinion, is to first discuss any conversion plans you may have with your neighbours.

If all parties are on board, the process is more straightforward.

Here are the steps involved:

It’s a misconception that if there are two owners of a cross lease that you both get half the land once you convert the property to a fee simple title.

In practice, this often isn’t the case.

Why? Because the current “occupying area” of the property becomes the legal boundary.

So, for instance let’s say Bob and Shirley are neighbours on a 900m2, 2-lot cross lease.

But, where the fence currently sits Shirley’s property takes up 550m2 and Bob’s property takes up a 350m2.

Bob might think that after the conversion he’s going to get 450m2 worth of land (half the original plot of land). That’s not the case. He gets the 350m2 slice on his side of the fence.

Yes, they each own a half share in the underlying use of the land, but the legal boundaries when you convert from cross lease to freehold are your current occupied areas.

It’s not uncommon for neighbours to work around this by coming to an agreement. For example, Bob could try and negotiate for a bit more land.

This is a lot easier when you and your neighbours are on good terms, and have good communication skills. Remember, Shirley could simply say “no” and that’s the end of it.

Cross leases do come with a bit of a stigma, particularly for people buying them. They are less common, and less understood.

Not all cross leases end in disaster. Some people live very happily in their cross leases, but there is a portion of the market who will not buy a cross lease.

This is because there can be issues with cross leases – either with a defective title (or a hard-to-work-with neighbour), although there is an immediate increase in the value of your property if you convert it to fee simple.

The key message is rather than sweeping cross leases totally off the table, just be aware of all the problems you could be buying into.

Or, if you have some old cross-lease properties already in your portfolio, it is worth having the conversation with your neighbours to work around it. Because even the council generally agrees that cross leases are a pain in the neck.

1. If you plan to convert your cross lease, get conversations started with your neighbours ahead of time. Don’t wait until there is a looming deadline e.g. an impending sale date.

2. Always, always, always find out if your cross lease title is defective before starting any renovations or buying a cross lease property.

3. Before purchasing find out if the neighbours would be open to converting the cross lease. If they are, get that in writing first.

4. If you are looking to sell a cross lease property that you are converting, you can market your property and tell people it will be converted to freehold. But, settlement can’t take place until that title change is completed.

5. If you are going to convert your cross lease property to freehold, be clear with your surveyor about your future intentions for the land. That way they can make sure that these things are made possible further down the line.

6. During a conversion, while you should have open communication with your neighbours, it’s a good idea NOT to share all your personal plans with them for what you’ll do once the land is freehold. Neighbours have been known to make things difficult and try and run you up for money, just because they know they can hold your plans against you.

Write your questions or thoughts in the comments section below.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser