Case Studies

Case study – retire comfortably at 55

Here’s how they plan to use investment properties to replace their current income before they hit early retirement.

Case Studies

9 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Reviewed by: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

How do you figure out whether a property is a good investment or not?

This year, I want to make property investment as practical as possible.

A part of that is showing you real properties, and how I evaluate them ... to see if they are any good (or not).

In this article, you’ll see an example of a real property that has been popular with the investors I’ve been working with this week. You’ll learn the 3 things I look for, and how you can do this analysis yourself.

One of the properties investors I’m working with have liked this week are these 2-bedroom townhouses on Cross Street in Christchurch.

This is a development of 8 townhouses – 2 bedrooms, 1 bathroom and off-street car parking. This is being developed by Aventus Projects.

Aventus Projects Limited is a relatively young company. But, although the brand and company are still young, the team behind it are experienced.

Here’s what the property looks like. But don’t spend too much time looking at the pictures; they won’t tell you whether it’s a good investment or not.

The number one factor to look at is price. That’s most important.

You need to ask yourself, “Is it a good price compared to what else is on the market?”

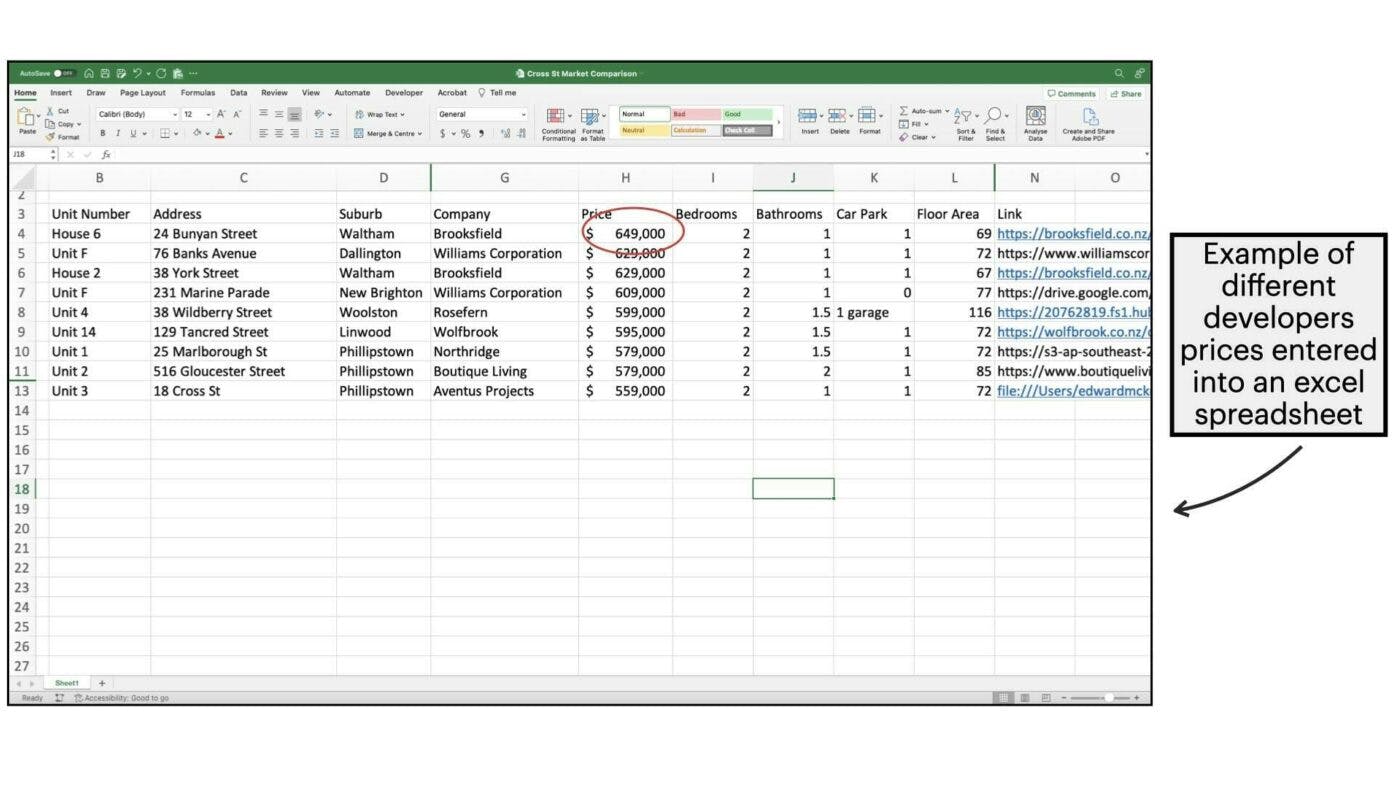

That’s where you can create a table like the following. This compares Cross St with 6 developers building similar properties in comparable areas.

You can see that some other properties can be up to $90k more expensive.

Of course, there are always going to be differences in price and reasons one property is more expensive than the other.

But the key message here is that Cross Street is very well priced.

But, when thinking about price, you also need to consider location. And in this case, I often look at a map to consider “is this property more affordable because it’s in a worse location?”

Here is a map, which gives a wider look at the developments in the area.

In this case, this potential investment property is the lowest priced, but is also closest to the city.

There is no secret formula to find this sort of data, and it won’t cost you anything either.

All I did was Google “Property developers in Christchurch”, and then downloaded each of the property packs, then used the information to fill in the table, above.

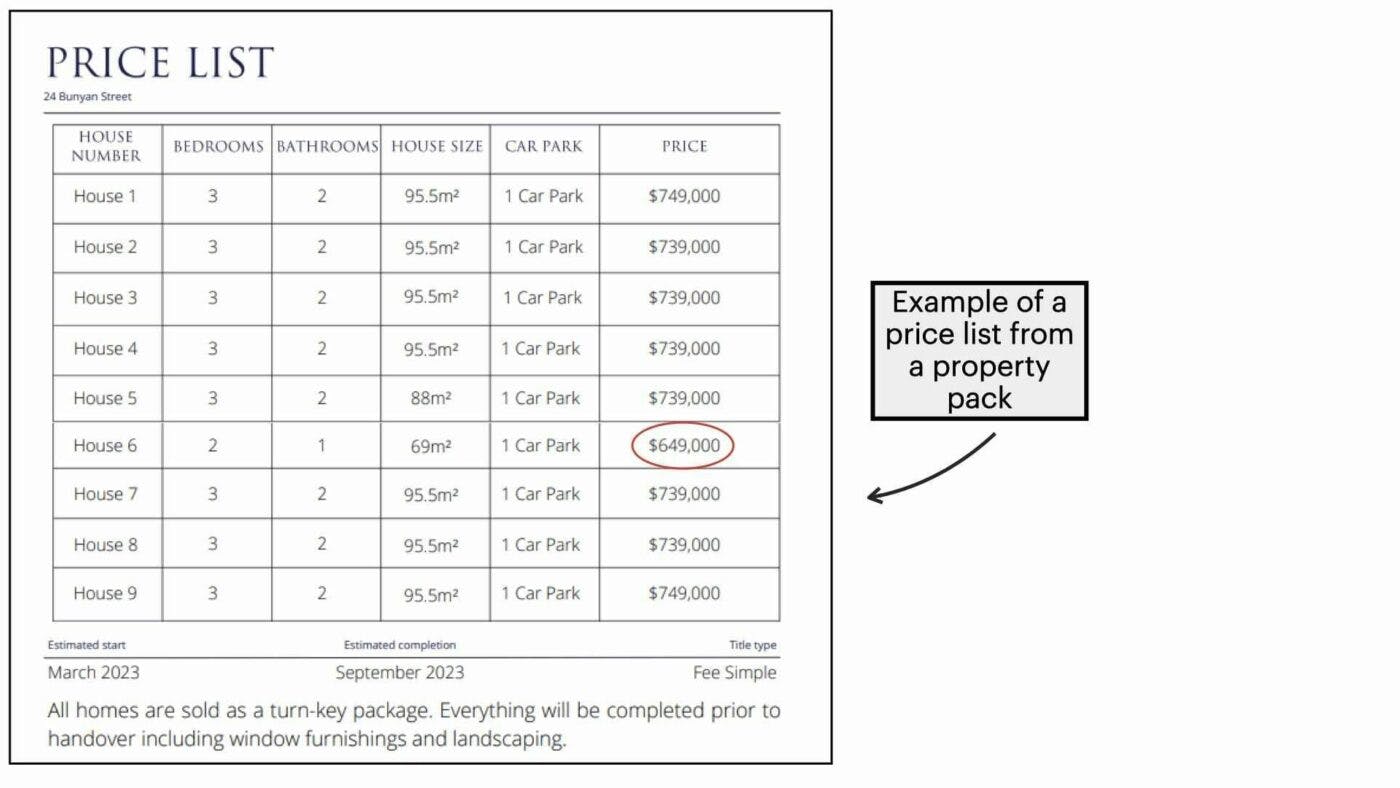

For example, take the data from a property pack like this:

And enter it into an Excel spreadsheet like this:

This can be replicated for any property in any city.

To be fair, I personally don’t do this for every single development I review for the investors I’m working with.

Because my team is looking at developments every day we’ve got a good sense of what is well priced … and what is not.

Important tip: When comparing properties … make sure you are comparing the same thing. For example:

The second factor you need to consider is the pros and cons of any investment.

And you need to be honest with yourself.

Straight out the gate, this New Build property is almost complete.

It’ll be ready for tenants to move in within the next 3 months. This is a big plus.

Typically with New Builds, there's a one to two-year gap between signing the contract and when the property is built and you pay for the property (settlement).

That sometimes causes issues, because banks often won’t give you a pre-approval that lasts that long.

So you sign a contract to buy a property, but you don’t have the finance 100% locked in until a little later.

This can get a bit complicated.

So, the fact that this property is already completed guards against:

Because banks often change their lending criteria. So just because they’d lend to you today doesn’t mean they will in a year.

But because the Cross Street property is almost complete, your finance pre-approval will last from when you commit to the property through to when you need to get the money to pay for the property.

Another fear is that the property will fall in value while it’s being built, which can again cause issues with getting money from the bank.

But since the property’s almost built, you can get a valuation before committing to purchase the property. And no matter what happens to the value of the property over the next 3 months, the bank will still lend the money based on today’s value.

As we saw above, Cross Street is cheaper than comparable properties on the market.

In addition, out of all of these properties Cross Street is the closest to the central city.

As we’ll see below, the cash flow on this property is better than comparable New Build properties on the market.

And when you run the important numbers – like return on investment – they stack up well (keep reading to see what I mean).

But, you also need to look at the cons.

The property is going to be negatively geared initially (if borrowing all the money to buy it).

This is because of higher interest rates and is very common for most properties today.

However, there are some investors out there who take a very active strategy (or who have a lot of cash to invest). For those types of investors, this wouldn’t be the sort of investment they’d buy.

Instead, this sort of property would suit someone who wants to take a passive strategy focused on New Builds.

Again, because you are buying a New Build it’s a brand new, completed product, so there isn’t the opportunity to renovate.

That means for renovation-focused investors, they wouldn’t buy this sort of property.

Creating a list of pros and cons can be subjective and comes from experience.

Someone who doesn’t know anything about property might not notice that an almost complete build can come with pros.

So the best way to do this is by reading and learning as much as possible, or work with a financial adviser who can help talk you through the pros and cons of an investment.

That's what I (and my team of financial advisers) do with investors here at Opes Partners. But you can use other companies too.

Disclaimer: This is where we start to get a bit nerdy.

There are two main numbers you need to know when you invest in a property:

Cashflow is the amount of money you need to top-up the property by per week, or that is coming to you per week.

Return on investment asks: “For every $1 I invest into a property, how much do I get back?”

And you need to compare this to other properties to get a sense of how the one you’re looking at sits in the market.

Let’s start with Cashflow.

For instance, here is the cashfow again for Cross St:

The property is initially negatively geared by $375 a week while interest rates are high. That averages out to $151 over the whole time the property is negatively geared.

How does that compare to similar properties on the market?

When you compare that with other potential properties, you see that Cross St has better cashflow than other potential New Build investment properties.

This is because this property is more affordable than those alternatives, but property managers say it won’t get substantially less rent.

But … if you want to know which property is the better investment, you’ve got to run a return on investment.

To calculate the return on investment for a property you need a spreadsheet. For this we’ve used the Opes Return on Investment calculator, which you can download for free. Though you can use any other spreadsheet that does that same calculations.

Here’s what it looks like when you dig into the details:

What does it show? For every dollar you put into:

So, from this financial modelling you’d say “Cross Street is the better investment.”

You can do this analysis yourself for free. The most accurate tool we’ve found is our return on investment spreadsheet. I use this for all the investors I work with.

It’s free to download, and over 8,000 investors across New Zealand are using it to forecast their investment property’s cashflow.

Though, if you’re not a big Excel fan, no trouble. If you’re working with a financial adviser from Opes, they will create these forecasts for you.

If you’re looking to invest in a New Build property like this, there are three ways to get one:

#1 – First off, you can use the information in this article to go out and find a property yourself

#2 – Or, if you want to buy a New Build property (and you aren’t already working with Opes Partners) your next step is to book a portfolio planning session. This doesn’t cost anything, and we can help you build a plan and then look for New Build properties.

#3 – Or, if you are already investing with Opes and you want a property from this specific development, give your Property Partner (financial adviser) a call, and they can see whether it’s the right fit for your portfolio.

For anyone new, it doesn’t cost anything to work with Opes Partners to build your property portfolio. Here’s how we get paid.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser