Developers

The developers Opes recommends (and the ones we don't)

Who are all the developers you work with? Well, we counted them. In total there are 123 developers that we have had a relationship with over the last 3 years.

Property Investment

7 min read

Author: Derry Brown

Financial Adviser in industry since 2007. Investor in Auckland & Christchurch. Previous COO of Global Brand

Reviewed by: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Commercial and residential properties can have similar prices. Some investors wonder, “Should I invest in commercial or residential property?”

Often, commercial properties make more money. But they have more risk, and you need more money to invest. Higher risk = higher reward.

Here at Opes Partners, we help investors buy residential properties. That means I am incentivised to write a biased article … to tell you that residential properties are the best investments.

I’m not going to do that. Residential property isn’t for everyone. Some investors should buy commercial properties.

That’s why this will be an honest comparison between commercial and residential property. This includes the 4 main differences and the pros and cons for each.

A residential property is a home somebody can live in.

Whereas commercial property is for businesses.

There are three main types of commercial properties:

To give you a feel for what you could buy:

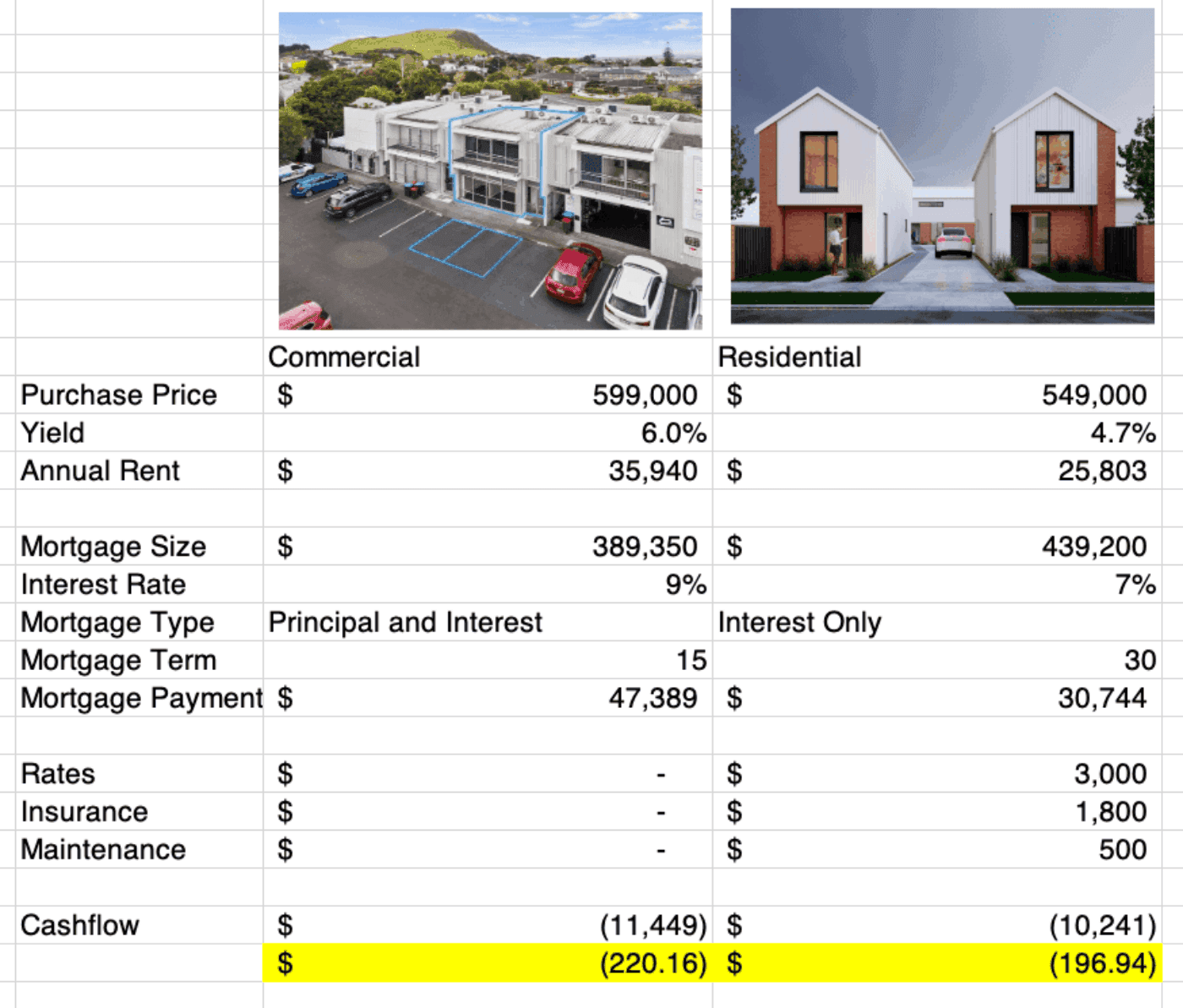

Commercial properties usually require a higher deposit of 30-40%. It depends on what the bank needs.

Let’s say you wanted to buy that Mount Wellington commercial property. It’s $600k. So, if the bank wants a 35% deposit, you'll need $210k to buy this property.

In this case, the residential property is a New Build. These properties only need a 20% deposit. That means you need a $110k deposit for the Christchurch townhouse.

Out of the 2 options, you need almost an extra $100k to buy commercial rather than residential.

It is important to point out that if you buy an existing residential property, you’ll need a higher deposit. Currently, that is 35%. Similar to a commercial property.

Commercial properties tend to get higher yields.

For example, the Mount Wellington commercial property might earn a 6% yield.

And you don’t tend to pay as many operating costs. Usually, the commercial tenant takes care of insurance and local council rates. That improves your cashflow as a commercial property investor.

The bad news is that you'll pay a higher interest rate, and your mortgage will be on principal and interest. This means your mortgage repayments are higher.

What does the cashflow look like on this Mount Wellington (commercial) property?

The rent wouldn’t cover all the costs. You’d need to top this property up by about $220 a week. Some of that money goes to paying down debt.

Residential properties have lower yields, closer to 4.7% for this New Build property.

But you'll get a lower interest rate, and many investors can get an interest-only period on their loans.

This means the mortgage payments aren’t as high. But remember, you’ve got to cover all the costs yourself.

All these differences aside, the final cash flow position isn’t all that different.

Both are down $190 - $220 a week at today’s interest rates.

The value of your commercial building will likely jump around a bit more. On the otherhand, residential properties go up in value fairly consistently.

Over the last 30+ years (Jan 1992 – Feb 2024), house prices in Auckland have increased by 7% a year (on average). Properties everywhere except Auckland increased by 6.2% per year.

These increases come from changes in supply and demand. How many people want a house, how much they can afford, and how many properties are available for sale.

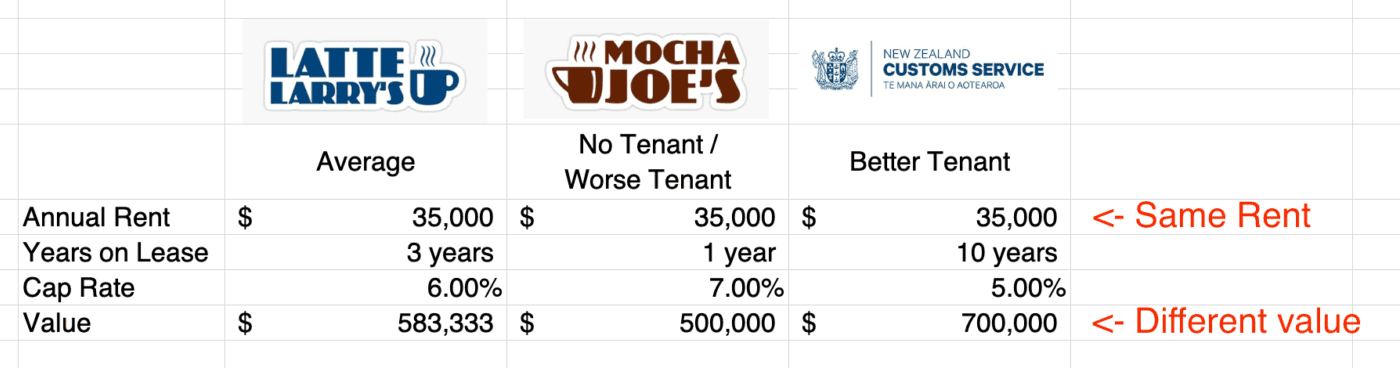

Commercial properties are a bit different. You value commercial properties on the rent they get and a capitalisation rate (or cap rate).

Let’s go through an example to see how this works.

Sam buys a commercial property. It has a tenant paying $35k a year.

If Sam rented it to Latte Larry's (a stable New Zealand company) on a 3-year lease, she could expect a 6% return per year. That's the cap rate.

How much is her property worth?

Property Value = Annual Rent / Capitalisation Rate

If Sam was expecting a 6% yield, and the property was renting for $35k. That's worth about $580k to her. ( $580,000 = $35,000 / 6% )

If Sam wants her commercial property to go up in value, she has 2 options.

She can a) raise the rent or b) decrease the capitalisation rate.

That’s right. Decreasing the capitalisation rate increases the value of the property.

Let’s take a look at what happens if the capitalisation rate goes up.

What if Sam rents to Mocha Joe’s – a competing coffee bean company. They don't make as much money.

Sam thinks: "If this company falls over, I won't have any rent."

Because she's taking on more risk, she wants a higher return. So, she would need a cap rate of 7%.

Now, that same $35k rent means the property is only worth $500k. ( $500,000 = $35,000 / 7%).

The value of her commercial property fell by $80,000 simply because she changed the tenant.

The value of your commercial building is tied closely to the income and the stability of that income.

In this case, Sam is better off renting to Latte Larry’s rather than Mocha Joe’s.

The capitalisation rate is impacted by:

This might be new to some people. So let’s go through one more example:

I once worked with Jodie. She bought an office building in Auckland’s CBD.

She divided up the space so she could fit more tenants in. This meant she could charge more rent, which made the property more valuable.

But she did a few other things, too. She got her tenants to sign longer leases. This locks in the income for longer, which usually decreases the cap rate.

If you can increase the income (and the security of that income), you can increase the value of a commercial property. This brings us to our next difference.

Use this tool and find out in 2 minutes if you can afford an investment property

Find out nowResidential properties are usually easier to rent. That’s because there are lots of people looking for places to rent all the time.

There were 4.6k new Auckland listings last month (Trade Me Rental Index). Properties spend a median of 17 days on Trade Me before renting.

So aside from a few weeks of vacancy (that you'll have planned for), you can be pretty confident you’ll find a tenant.

With commercial property, it’s more complicated. There aren’t as many businesses looking for commercial space at any time.

So commercial buildings can be empty for longer.

Even though the higher commercial returns look appealing, what if you don’t have a tenant for a year?

You'll still have a big mortgage with a high interest rate. But you might not get any rent.

That’s the reality for some commercial property investors.

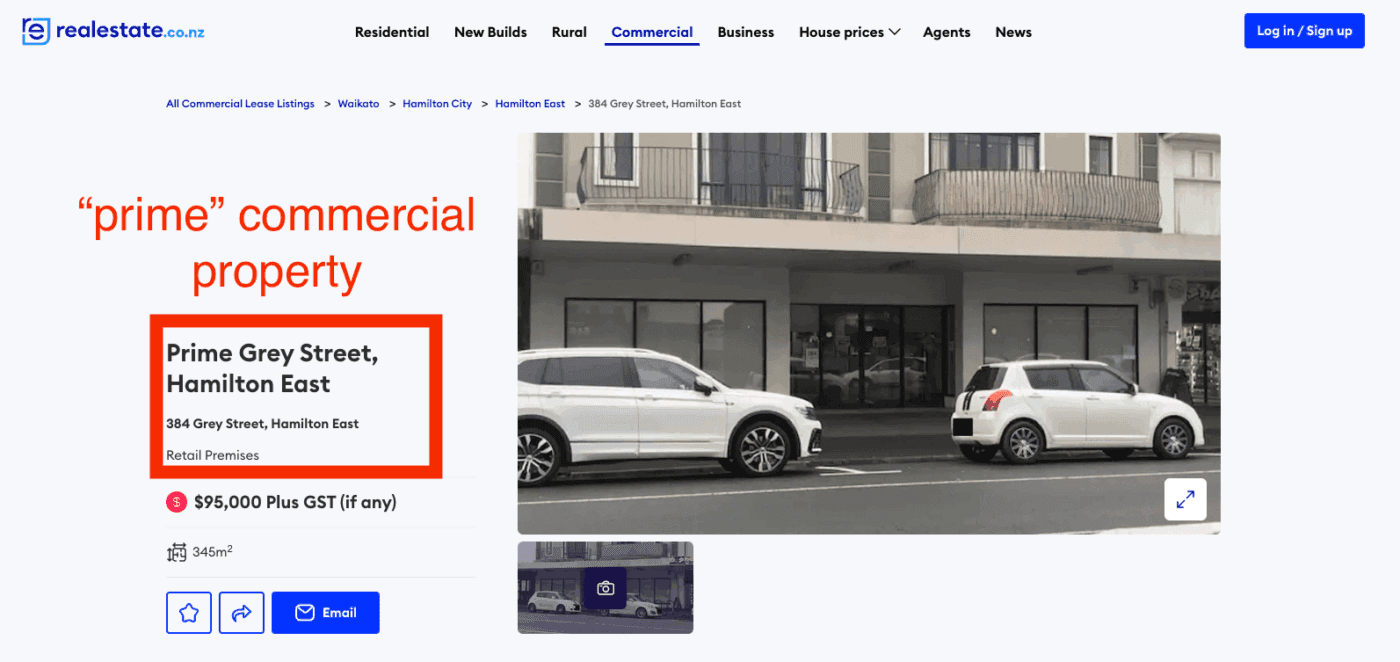

Here’s an example of a retail property in Hamilton East. It is a retail, commercial property in the middle of a decent set of shops.

This property has been listed as available online for the last 3 years. It has swapped agents over that time. But, to the best of my knowledge, it has been empty for 3 whole years.

Imagine that. You buy this property thinking it will give a better return than residential. But you don't get much return if you don’t have a tenant.

Technology is changing. Shopping is moving online. At the same time, more people also work from home.

That means the demand for commercial property is less stable, so you might struggle to find a tenant.

But, with residential, no matter what happens with AI, people still need somewhere to live.

So, expect more vacancy (tenant risk) in commercial properties.

Should you invest in commercial property or residential?

If you’ve read this article and think: "Yup, I know this already. I know what I’m doing.” Then, commercial property could be the right fit for you. You may already know what you’re doing.

But if some of this was news to you, I would be careful with commercial property.

Many inexperienced commercial investors end up on the dinner menu. It is an 'eat or be eaten' kind of market.

Financial Adviser in industry since 2007. Investor in Auckland & Christchurch. Previous COO of Global Brand

Derry has been in finance and property since 2007 and was at the coal face through the Global Financial Crisis. I have helped Opes clients invest in over 140 Million Dollar’s worth of residential property. In investing my passion is for data and demographics.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser