Developers

How does Opes tell if a developer is good or not? (8-step process revealed)

Before any property reaches an investor, Opes puts each developer through a strict 8-step review to make sure only top-quality projects make the cut.

Developers

15 min read

Author: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

If you’re searching for a company to build your own home, chances are you’ve heard the name Golden Homes.

This is for a good reason – this national design-build company is one of the busiest developers on the market. All up they build a similar number of properties as G J Gardiners, Fletcher and Signature Homes.

But Golden Homes aren’t the cheapest; they charge more than some other developers.

They attribute this to a difference in build quality.

But is that true? And if it is, how does this impact the rent? And does that mean they are a good or bad investment?

These are great questions, and ones we here at Opes Partners get asked all the time.

So, in this article you’ll learn the pros and cons of Golden Homes and whether this type of property is right for your portfolio.

Disclaimer: Here at Opes we recommend New Build investment properties to investors. While we have recommended Golden Homes in the past, we haven’t for some time.

This could mean we have an ulterior motive at play to slag them off. But that’s not the case because even though there is an incentive for us to be biased, we’re still going to be fair, honest, and fact-based. This way you can decide whether they’re the right fit for you. The answer may be ‘yes’, but it could also be ‘no’.

Golden Homes is a design-and-build company.

According to the Companies Register, Len and Jill Helms have been directors for 24 years since it was incorporated in 1998.

It was founded in Rotorua and has since grown into a national franchise with 24 offices working throughout 10 regions.

Len and Jill remain company directors for the national franchise, alongside CEO and Auckland licensee Shane Helms. However, each region has its own licensee and operates a separate building company that carries the Golden Homes name and IP.

For example, Dean McGuigan is the owner of the Christchurch office. It’s registered as NDM Construction Limited, but trades under the Golden Homes name.

BCI has Golden Homes ranked in 8th place as one of the country’s busiest home builders. They are just ahead of Wolfbrook, and behind the likes of G J Gardiner Homes, Williams Corporation and Fletcher Residential.

However, it’s important to note that since each business is owned independently, there will naturally be variability between how each individual office works (and their standard of work).

Golden Homes primarily builds standalone properties, either as design-and-build or a house and land package.

Design-and-build is where a client already owns a piece of land and wants to build a house on that land, whereas a house and land is where a purchaser buys a turnkey property off-the-plans from the builder.

A Golden Homes spokesperson said that often customers use the design-and-build service to personalise their new home to suit them.

What this means is the customer chooses one of the 30 plans available on the Golden Homes website. The design is then customised and built for them.

This is offered under a progressive payment contract. As the name suggests, this contract means you pay the amount in increments as the build progresses.

This differs from developers like Brooksfield, Wolfbrook or Williams Corporation who primarily focus on turnkey contracts. That means these other developers own the land during construction, and you own it once the contract settles.

Said another way, if you are going through Golden Homes you’ll often hire them to build a property, rather than buying a finished already-built product off them.

So, Golden Homes would be ideally suited to someone who already owns a piece of land and would like to build a home on it.

Golden Homes does have house-and-land turnkey packages on offer, but on a “when and where available” basis.

For those looking at this option, prices begin at $420K for a 2-bed (59m2) home on 150m2 of land.

This is the smallest property featured on its website, and is a 2 bed, 1 bath home in Kingston, Queenstown.

However, prices can go as high as $1.8 million. This price point would fetch a 4-bed, 228.3 m2 property on a 573 m2 section in Tauranga.

The largest property is a mammoth 5 bed, 3 bath property spread over 429.2m2, which includes a triple garage.

At the time of writing, Golden Homes is not a registered Master Builder. Rather, they offer a Gold Seal Warranty, which is a 12-month maintenance period guaranteed by the company.

Golden Homes properties are built to a higher standard than “just” what the building code requires. This means the structure of the building is higher spec than some other properties.

For some people this will be a big selling point. However, this does come at a cost.

Our understanding is that this adds about $50,000 to the build.

This does mean they can be a more expensive option than what you would otherwise pay for building with another developer.

But this extra price could be worth it in the long run, depending on your own preference and your plans for the property.

Here are the main points that differentiate Golden Homes from its competitors.

There is an entire section on the Golden Homes website dedicated to how good they believe their ZOG steel frames are from a construction, durability and environment viewpoint.

In particular, steel framing is the preferred material in an earthquake-prone environment, having proven robust enough to withstand the Christchurch earthquakes.

It’s a less common material in New Zealand, compared with timber and brick.

However, talk on Facebook’s Property Investors’ Chat Group would suggest there are mixed reviews on the material, usually because it is more expensive.

Golden Homes have fire retardant components in the roof and wall boards. This is stuff that isn’t required by the building code and so most properties aren’t built with it.

However, if the Auckland Sky Tower fire told us anything, future proofing against a roof fire can only be a good thing.

Some could see this fire retardant addition as a way to future-proof the house. For instance, just because it isn’t a building code requirement now doesn’t mean it won’t be in 5, 10 or 20 years’ time.

So, if you're selling this property in 20 years and all of a sudden the building code has been lifted, that could be a consideration for a future purchaser.

Another example of a better earthquake-faring material is the RibRaft concrete floor, a method where foundations sit directly on the ground.

All Golden Homes properties have a RibRaft foundation, which is a higher quality product because it has reinforced steel in it.

This means if you do have a slight earthquake or some movement in the house – which is completely natural – you typically have less cracking with this kind of foundation.

So, you don’t have things like joins showing cracks later on that need to be fixed or repainted.

For this we aren’t just talking about the fancy benchtop or the best washing machine.

This applies to the actual fixtures and fittings … hinges and skirting boards, LED lighting and long-wearing paint.

These are things you don’t ordinarily notice, but they are things you may have to fix as wear and tear.

So these details can make a difference when you look into the cost of future maintenance.

For instance, better hinges and skirting might mean doors don’t come loose so easily, or skirting boards might not swell in high humidity.

Secure a comfortable retirement with 3 easy steps

Book your free sessionThe thing to note here is, while all these factors do equal a better quality home, it doesn’t necessarily add up to more rent coming in for the investor.

Why’s that? Well, because most of the additional cost in a Golden Homes' property is built into the bones of the house. So neither you or the tenant will notice until maintenance is required.

For example, you can’t charge more rent just because your skirting boards are top notch and the framing (which you’ll never see) is made of steel.

So, in that sense it could seem to some investors that all this extra money isn’t worth it without the guarantee of a higher rental outcome.

However, there is a counter argument to consider. Some would argue that because these higher-specced options could potentially save on maintenance costs further down the line, it may work out to be cost neutral.

In other words, by paying a bit more up front you might be saving on capital maintenance in the long run.

Therefore, the debate could be between:

Here at Opes Partners we believe the additional cost is probably not worth it for an investor who focusses solely on the numbers, while the additional cost could make sense for an owner-occupier who is going to live in the property for the next 10+ years.

For those looking for a design-build option, there are several plans to choose from, based on how large you want to go.

All share a familiar floorplan, of what you would expect a standalone property to be. This is a garage attached, open plan living/dining and kitchen area.

All the nice-to-have options really come down to how much space you are buying.

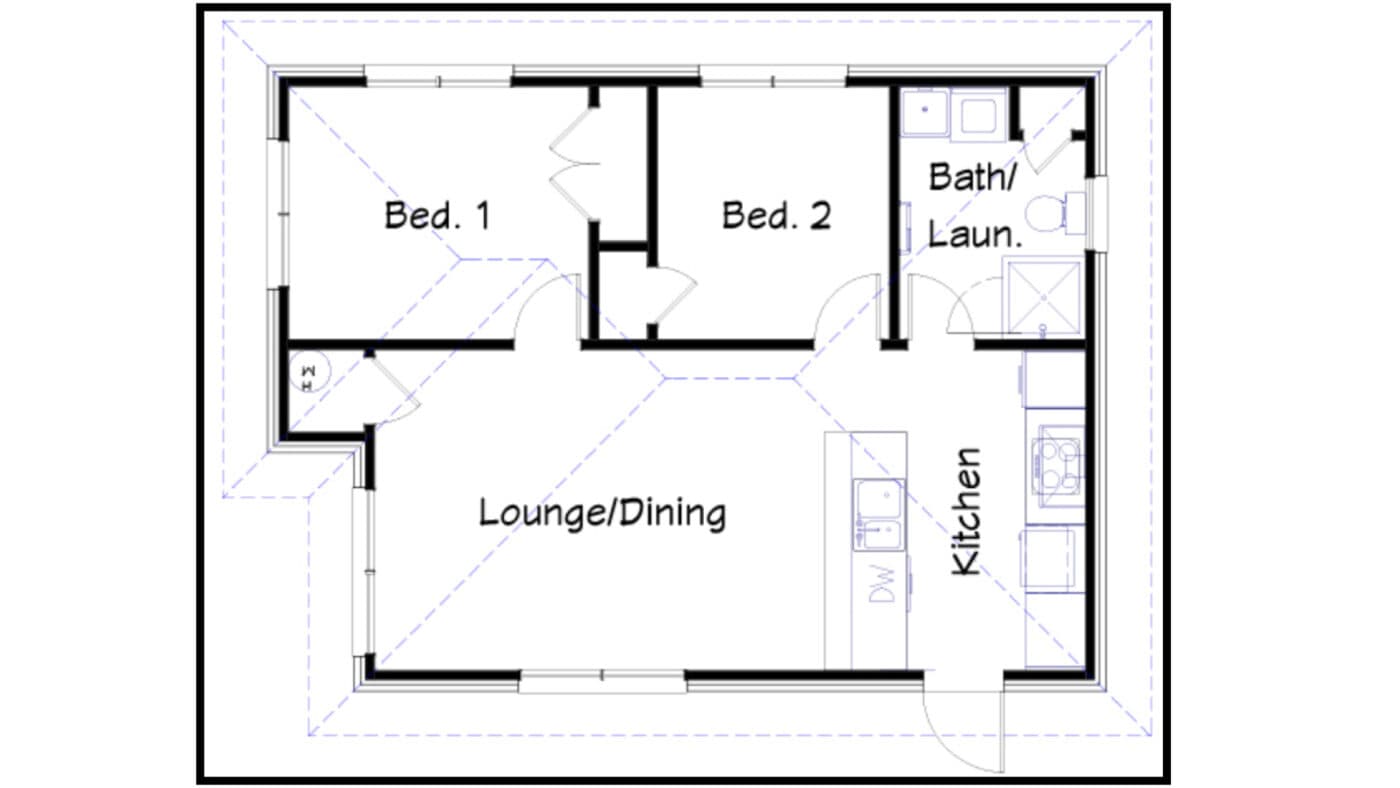

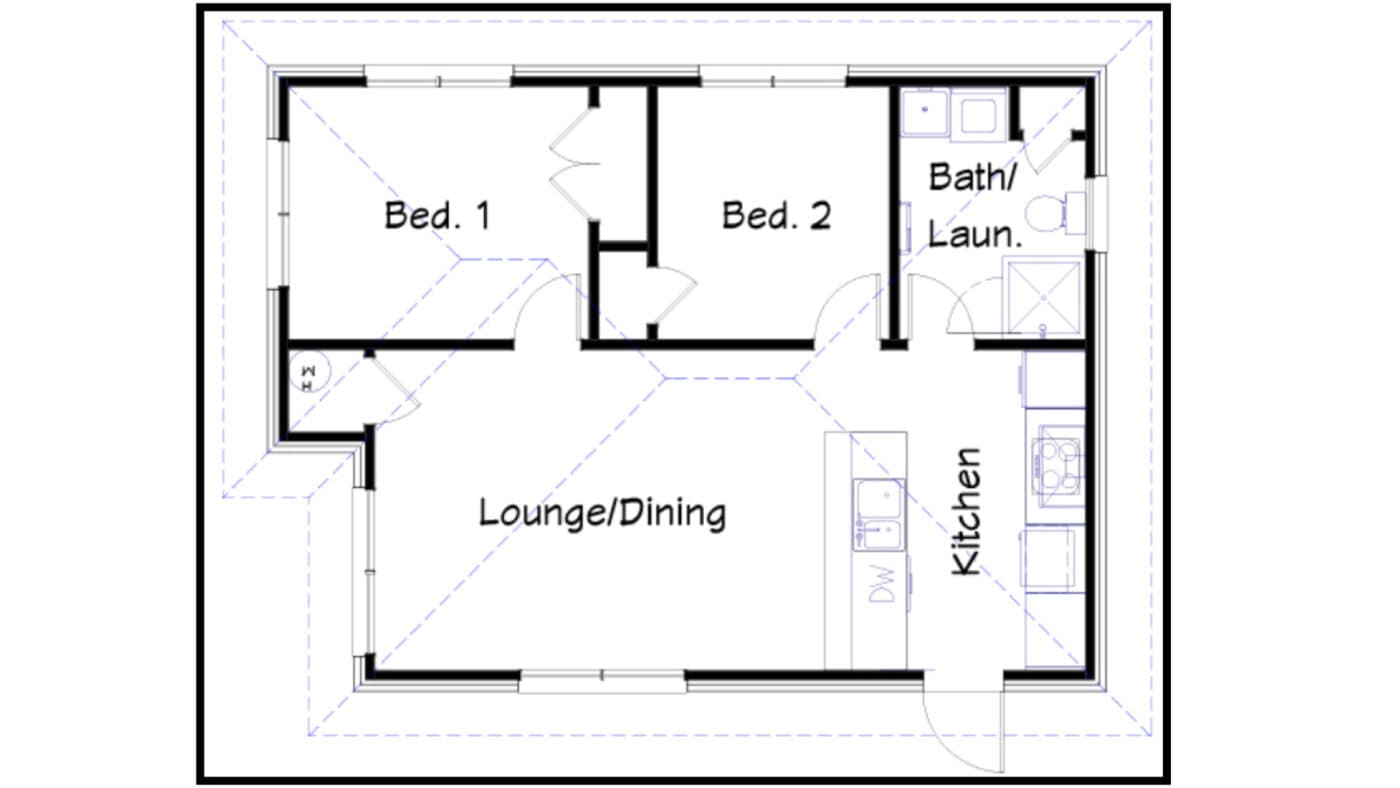

For instance, here’s an example of a plan in the “150m2” section.

Of 6 types, 5 are 3-bed and 1 is 2-bed.

The smallest is a 60m2 2-bed home in Kingston. This does not have a garage attached.

The other 5 have floorplans between 118m2 and 145m2; each has a garage and 3 bedrooms.

For the Pacific plan, there is a double garage but no second bathroom. The slightly smaller Newhaven has a single garage, but the master bedroom has an ensuite, in addition to a main bathroom.

All share a similar open-plan kitchen, dining and lounge area.

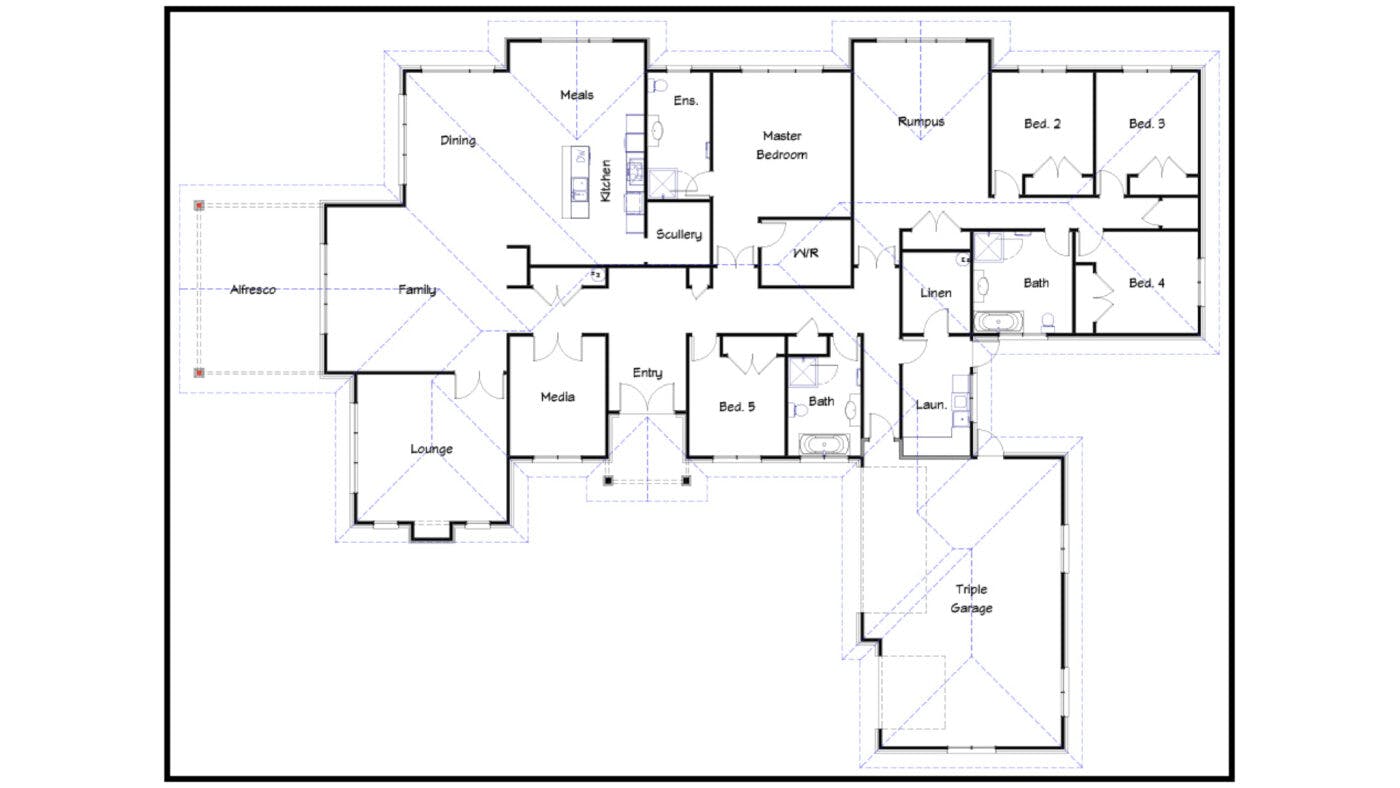

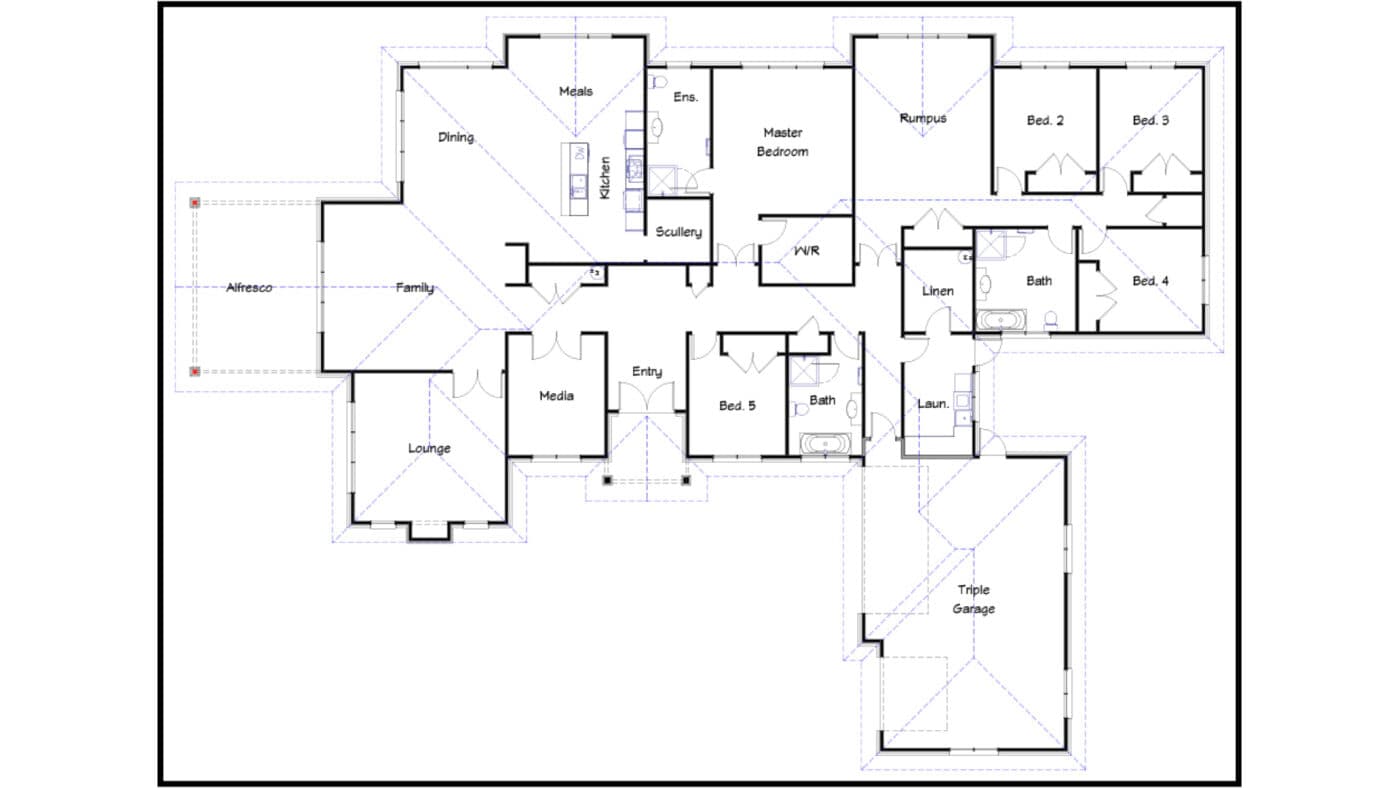

House plans in the “300m2+” section are more grandiose.

For instance, the Cascade plan has five bedrooms, three bathrooms, a triple garage, media room, open plan kitchen/living/dining, plus a rumpus room and lounge.

As with everything, there is a scale of what you can expect to pay for a Golden Homes property, depending on what you want to invest in.

It is even more difficult to give a price point for house plans because of how they differ between regions.

So, we won’t go into them in this article. For more information, get in touch with your regional Golden Homes office to find out about prices.

However, house and land packages are listed on the website with prices.

There is a large range, depending on what and where you are buying.

For instance, at the least expensive end, a small 2-bed property on 150m2 of land in Tauranga starts at $420,000.

Conversely, a 4-bed property on a 573 m2 section (also in Tauranga) will cost upward of $1.8 million.

In the middle ground, there are 3-bedroom homes across Canterbury being advertised at $749,500 a piece. These are in suburbs such as Rangiora, Sheffield, Woodend, Rolleston and Halswell.

However, these vary greatly in size.

For instance, for $749,000 in Sheffield you’ll get a slightly bigger house of 168.4m2 on 1000m2 worth of land.

But in Rangiora you’ll get a smaller home of 126.5m2 on only 375m2 worth of land.

Let’s take a closer look at these packages in Canterbury, since this is one of the only areas in the country where family-sized houses are still a popular option for some investors (think Rolleston, Kaiapoi, Rangiora and Woodend).

This is because the relatively cheap land means investors can purchase a standalone house at a reasonable price that makes sense.

Outside Canterbury, we at Opes Partners don’t tend to recommend house and land packages because the land (and therefore properties) are expensive. So standalone houses in other large centres often don’t earn enough rental return to be viable.

Here’s how a 4-bedroom Golden Homes property compares with Freedom Built, another developer based in the Canterbury region.

In this example the properties have the same number of bedrooms and bathrooms. However, the floor plan of the Freedom Built property is slightly smaller and comes in over $70,000 cheaper.

All investors need to run the numbers when making an investment decision.

A 3 to 4 bedroom standalone property (with a double garage) in Canterbury is priced around $850,000 to $1 million.

The same 4-bedroom house can be rented for anywhere between $600 to $650 a week. In Rolleston this has shot up from $500 a week in just a few months.

Demand is being driven by a lack of stock in the area because less housing has come to market in the past 6 months.

As stated above, Golden Homes sells and builds standalone homes on a progressive payments contract.

So here are 2 things to think about, if considering working with Golden Homes.

These higher-priced, family home houses would be considered growth properties for investors.

So, Golden Homes aren’t going to be a good fit for those investors looking for yield-focussed properties to invest in.

If a yield property is what you are looking for, and you have this sort of money to play with, you might like to look for a dual-key property in order to see the high yield.

To see if the dual-key is right for you, head to our article here.

While there are certainly pros to signing up for a house under a progressive payments model, it is not without its share of risk.

Let’s start with the pros.

Because you are starting to draw down the loan straight away, there is no risk of having to reapply for your finance – which you have to do with turnkey properties.

In this instance, turnkey properties carry the risk of you having to reapply for finance and having that application rejected.

To be fair, usually this isn’t an issue. However, if you’ve had a change of circumstances (a baby, redundancy) it is possible your finance will not be reapproved.

From this standpoint, a progressive payment contract can be a bit safer, although you do have to pay more interest the longer the build takes.

However, if your builder goes under halfway through you are stuck with a half-finished house.

Under a turnkey contract, if the developer folds you take your deposit back and walk away. In a progressive payments model you’ve got an unfinished house you’ve half-paid for.

A registration with the Master Builders’ Association is a way to mitigate some of the risk in this situation because it would mean that someone else has to step in and complete it at the same price.

But Golden Homes aren’t registered Master Builders’ members.

This doesn’t mean it’s an automatic “no go”, but it is something to consider when weighing up your comfort level for investment risk.

For an owner-occupier looking to build a property for themselves to live in, a Golden Homes property could be a great option.

This is because you might not mind spending the extra bucks on a better quality, higher-specced “forever home”.

As a rule, New Build standalone properties tend to be a good fit for investors who can afford to spend a bit more on an investment property.

Because the 4-bed standalone tends to attract a family as a tenant, it could be a good option for an investor who wants the security of tenure.

And if you are a seasoned investor with a lot of 2-bed or 3-bed townhouses, you might consider your next purchase in the wider context of your portfolio.

On the other hand, while there are great positives to Golden Homes, in our eyes many of their properties are not the right fit for investors.

This is because these more expensive properties, while superior in material, don’t necessarily equate to a higher rent.

And that’s what investors base their figures on.

If we take our assumption that Golden Homes adds an extra $50K onto any New Build – why not take that money and put it towards an existing home in a renovations project.

For instance, a BRRRR project.

Or, rather than spending an extra $50k at the start on the structure of the build, why not spend that $50k on renovating the property cosmetically before you sell it?

All things considered, Golden Homes can be a great option for an owner-occupier looking to build their forever home for their family.

As a primarily design-build company, if you're an investor with your own land ready to build on, Golden Homes could be the answer for you.

But for investors, in our view, they may not be the right fit right now.

This doesn’t mean those homes are bad. Not at all.

All that means is not every property is a good investment. And this is true of most things.

Yes, it is likely a better quality product and this could possibly save you dollars in future maintenance. But you wouldn’t see the benefit of this higher quality in the immediate years of cashflow.

So, whether or not one of Golden Homes’ properties is the right investment for you will hinge on the figures standing up and the deal you are evaluating.

That’s why many investors who purchase New Build investment properties use our service at Opes to evaluate many developers and find the right properties to suit their portfolios.

Write your questions or thoughts in the comments section below.

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Laine Moger, a seasoned Journalist and Property Educator holds a Bachelor of Communications (Honours) from Massey University and a Diploma of Journalism from the London School of Journalism. She has been an integral part of the Opes team for four years, crafting content for our website, newsletter, and external columns, as well as contributing to Informed Investor and NZ Property Investor.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser