Developers

How does Opes tell if a developer is good or not? (8-step process revealed)

Before any property reaches an investor, Opes puts each developer through a strict 8-step review to make sure only top-quality projects make the cut.

Developers

14 min read

Author: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

If you’re looking for a property in South Auckland, you probably have already heard about Du Val.

It’s a well known brand … but are their properties a good investment?

Because we work with 97 developers here at Opes Partners, investors often ask “What do you think of Du Val?”

That’s especially true because it can be hard to find information about their properties online.

Because we’re never ones to shy away from answering investors’ questions, here’s our honest review.

In this article you’ll learn the pros and cons of the Du Val, and whether their properties are right for your investment portfolio.

If you have any questions or thoughts, please share them in the comments section below.

Disclaimer: Just before we get into it, you should know that here at Opes we recommend New Builds to investors. At the moment we don’t recommend any Du Val properties. This means there is an incentive for us to say their properties are bad, and you should buy a property from another developer that we recommend.

But even though there is an incentive for us to be biased, we’re still going to be fair, honest and fact-based. That means you can decide whether they’re the right fit for you. The answer may be ‘yes.’ Du Val was approached for comment and fact-checking before publishing this article.

Du Val is a residential property development company in Auckland, founded by current CEO Kenyon Clarke.

It describes itself as a specialist in investment-grade properties in areas that line up with infrastructure and population growth.

It has a team of around 15 property advisers, but overall Du Val employs 120 people in its Auckland offices.

Du Val claims to build properties where they are genuinely needed, in areas of high population growth such as South Auckland.

It has tried to position itself as a one-stop shop for all property investors.

This means they have several other divisions, including a property management company – Du Val Portfolio Management; gyms – Du Val Clubs; and a nutrition company – Du Val Health.

Du Val Portfolio Management is there to help investors manage the day-to-day oversight of investment properties, keeping things relatively hands-off for the investor.

They charge a 9%+GST monthly management fee; 9%+GST repairs and maintenance; $20+GST per month management fee.

Kenyon Clarke is a public speaker and commentator and he founded Du Val (property development) with his wife, Charlotte, in 2013.

Du Val is Kenyon’s second development business, after his first (based in the Waikato) business went into receivership. More on this below.

In terms of finding details on up-and-coming properties, information on their website is limited. If you’re interested in a property you are invited to hit an “enquire now” button – and then talk to a member of their sales team before receiving details.

This does mean that prices, property layouts and descriptions are not easily available. But, with some internet sleuthing, we’ve been able to get a good understanding of their properties.

Currently, Du Val has projects underway or planned in South and West Auckland, which are areas it focuses its developments in.

These 2 areas are also our top picks – here at Opes – for investors looking to buy in Auckland. This does mean we think they are building in good areas for investment.

Historically, Du Val was better known for its apartment developments. But these days the focus is more on townhouses.

Du Val really made its name with apartment blocks.

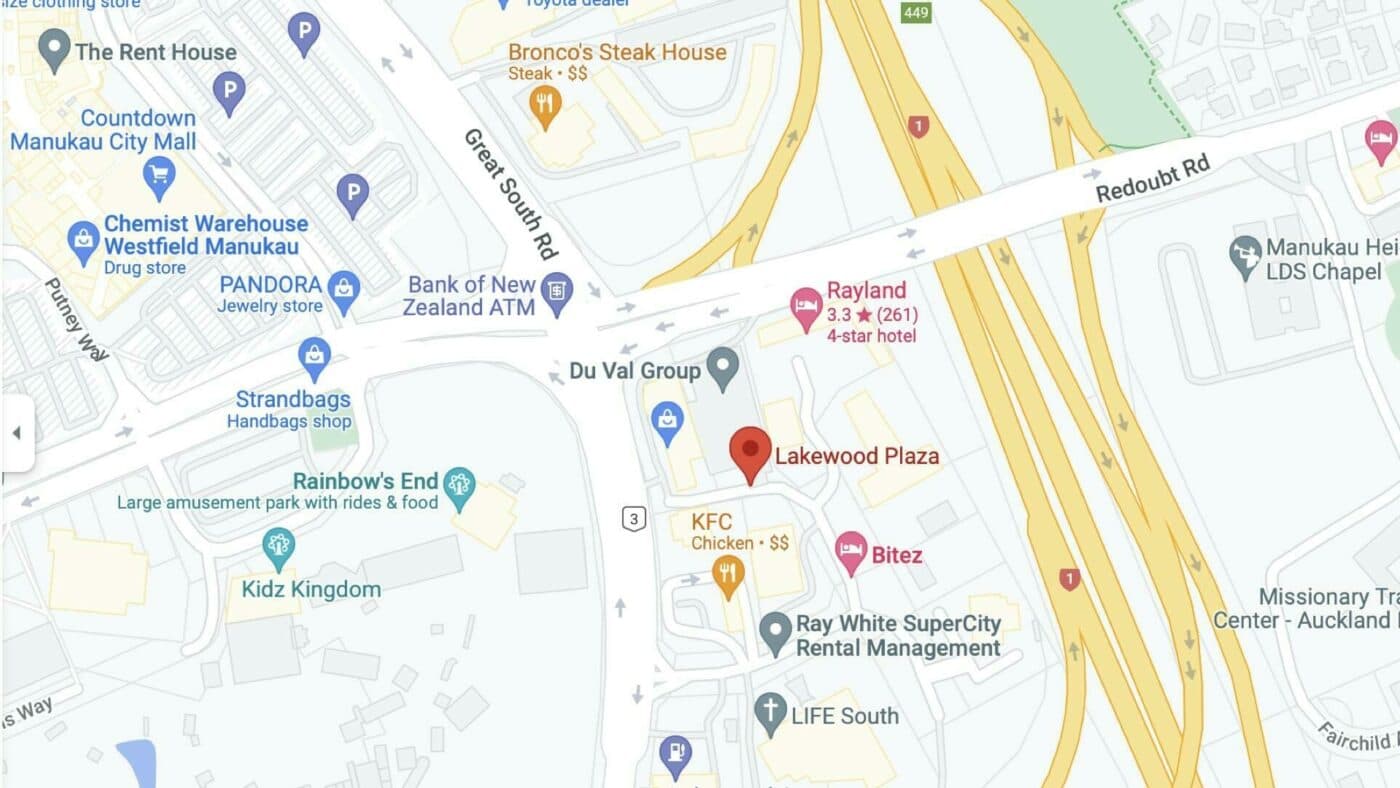

For instance, its best known development is Lakewood Plaza – a 15-storey mixed-use apartment block in Manukau.

This project was Du Val’s flagship development and contained a number of dual-key apartments, which tend to be higher yielding.

To give an example of what this layout looks like, here is a floorplan for a dual-key apartment in Lakewood Plaza.

Essentially, a dual-key apartment is two separate but adjoining units held under one legal title.

For a property investor this means the two units can be rented separately to two different households under separate tenancy agreements. So, you have two sources of income, which maximises your rental yield.

From the tenant’s perspective, apart from a shared entrance way, they are totally separate.

More on this Lakewood Plaza development below.

Du Val tends to build 2-bedroom, 1 bathroom townhouses (with a car park). They are positioned at the higher end of the market – in price and specification.

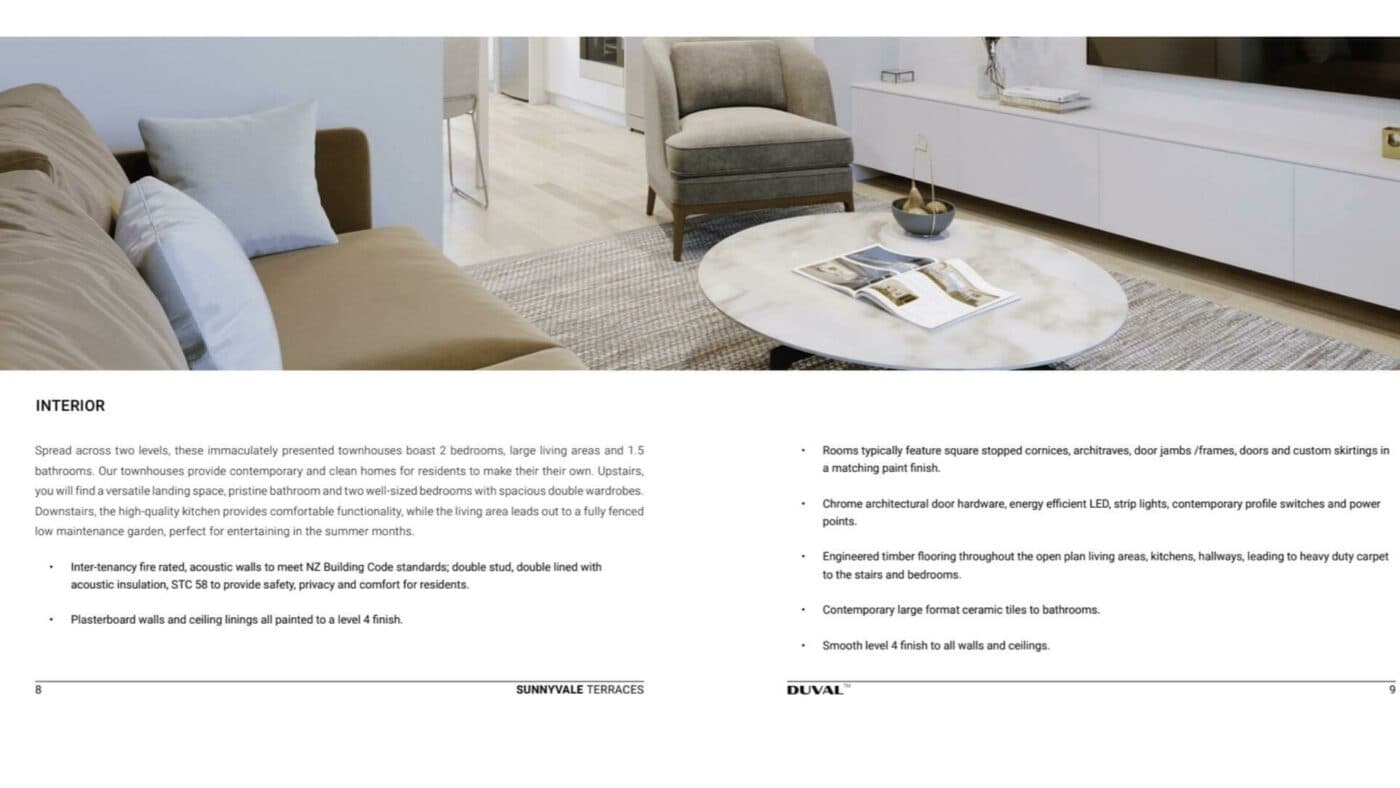

To give an example of one of the properties currently advertised, take a look at this photo of a 2-bed townhouse being built in Sunnyvale, West Auckland.

The layout is a standard 2-storey property, featuring an open plan living area on the ground floor, and 2 bedrooms sharing a bathroom on the first floor.

From the brochures we’ve seen, Du Val properties tend to be advertised and positioned as if they are slightly higher-spec than what some would expect to see in an investment property.

For instance, on one of these Auckland developments it boasted:

From our experience, it’s reasonable to assume that these additional specs are typically going to be built into the purchase price, decreasing their desirability as an investment property. That is because they make the property more expensive, but do not increase rent that can be charged to the same degree.

Because of that our view is that Du Val townhouses are likely to be more expensive and lower yielding than alternatives that could be invested in. More on this below.

Let’s take a closer look at the Lakewood Plaza development in South Auckland, which had its grand opening in 2021.

The 15-storey apartment building is located beside the southern motorway interchange at Manukau city. Or said another way, it’s directly opposite Rainbow’s End.

The development is comprised of the following apartment types:

Du Val’s in-house property management service gave the following rental appraisals for each apartment type in March 2021 (at the time of completion):

In terms of the 2-bedroom apartments that does mean rent charged for these properties are in the top 25% most expensive 2-bed rental apartments in the area.

That does make us question whether the property has been made too high a spec (i.e. luxury) for Manukau, which is a relatively lower socio-economic area.

For example, in their marketing brochures Du Val claimed that the plaza would include a concierge service, available for making travel arrangements and dinner reservations.

On the Property Academy Podcast, Opes Partners Managing Director Andrew Nicol questioned whether tenants would be willing to pay extra money for these services … or whether they just make the property a lower yielding investment.

In addition, there are 2 aspects of this development, which are worth flagging.

The Body Corporate fees for these apartments are expensive compared to those we have seen in other apartment blocks.

For instance, one dual-key apartment (unit 1208) attracted levies of $4,620 per year. This is according to the pre-sale disclosures received from Barfoot & Thompson.

To give you a comparison, the body corporate fees for Safari Group’s (a developer we do recommend) apartment block in Ellerslie are $3,569 per year. And that is for a larger 2 bed +1 bed dual key-apartment. Compared to Du Val’s 1-bed + studio dual-key.

Bear in mind that Safari Group’s apartment is due for completion in 2023.

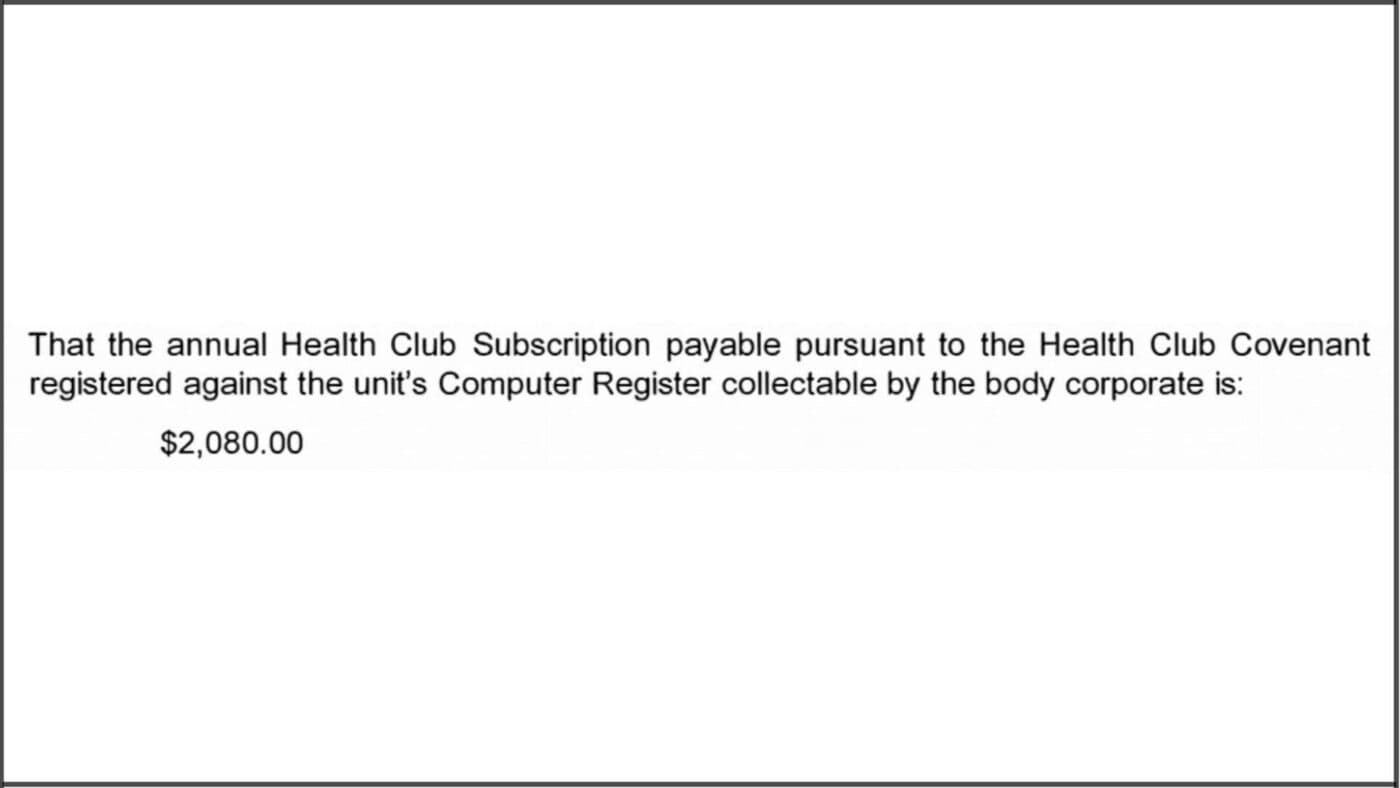

In addition to the base body corporate fees, some owners of the Lakewood Plaza developments are required to purchase 2 Du Val Club gym memberships each.

The unit mentioned above was charged an additional $2,080 per year for these memberships. That means the total fixed building costs (body corporate + gym memberships) are at least $6,700 a year (October 2020 - 2021).

The combined amounts, so the total fixed fees associated with that property, are high for a body corporate fee.

For a property investor to make the additional gym memberships worthwhile, a tenant would have to pay an extra $40 a week just for that gym membership.

The question here is: Are tenants really going to pay that extra $40 a week to have the gym membership?

Here at Opes we suggest “no”, because those searching for apartments on Trade Me are not expecting to pay for a gym membership.

This makes the apartment lower yielding compared with what it could have been.

Lakewood Plaza dual-key apartments are small compared to similar apartments available.

For instance, Lakewood Plaza 1-bed + studio apartments are about 63m2 (unit 1208). That compares to 75m2, which is the size of a similar 1-bed + studio dual-key in the Safari Group developments in Ellerslie.

That’s a 12m2 difference, which is quite sizable considering it’s about the size of a bedroom.

There are other drawbacks to this smaller floor size – the furniture might not fit right.

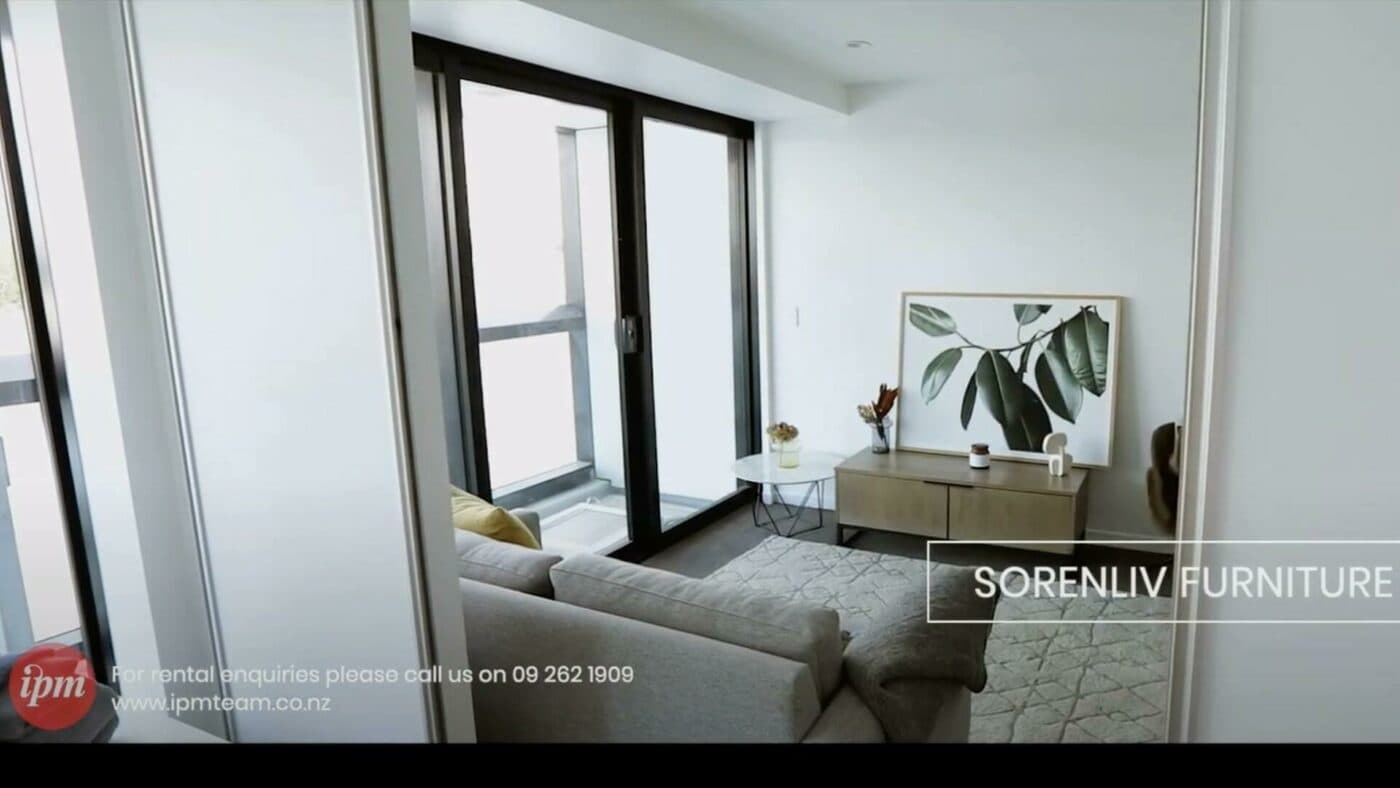

Some of Lakewood’s dual-key apartments came with a Soren Liv furniture package (e.g. TV unit, armchair, coffee table and 2-seater sofa).

But take a look at the floorplan. The couch doesn't quite fit … and needs to be placed in front of the bedroom door.

This is also able to be seen in one of the online videos produced to tenant the property.

It is clear that the 2-seater couch juts out in the doorway – at least halfway.

This doesn’t mean that all Du Val properties are small and have pokey floorplans. But, this will be something to note when looking at other Du Val properties.

A townhouse from Du Val is likely to be over the $800,000 mark. It’s hard to have more confidence in this answer, because the prices of projects aren’t always advertised.

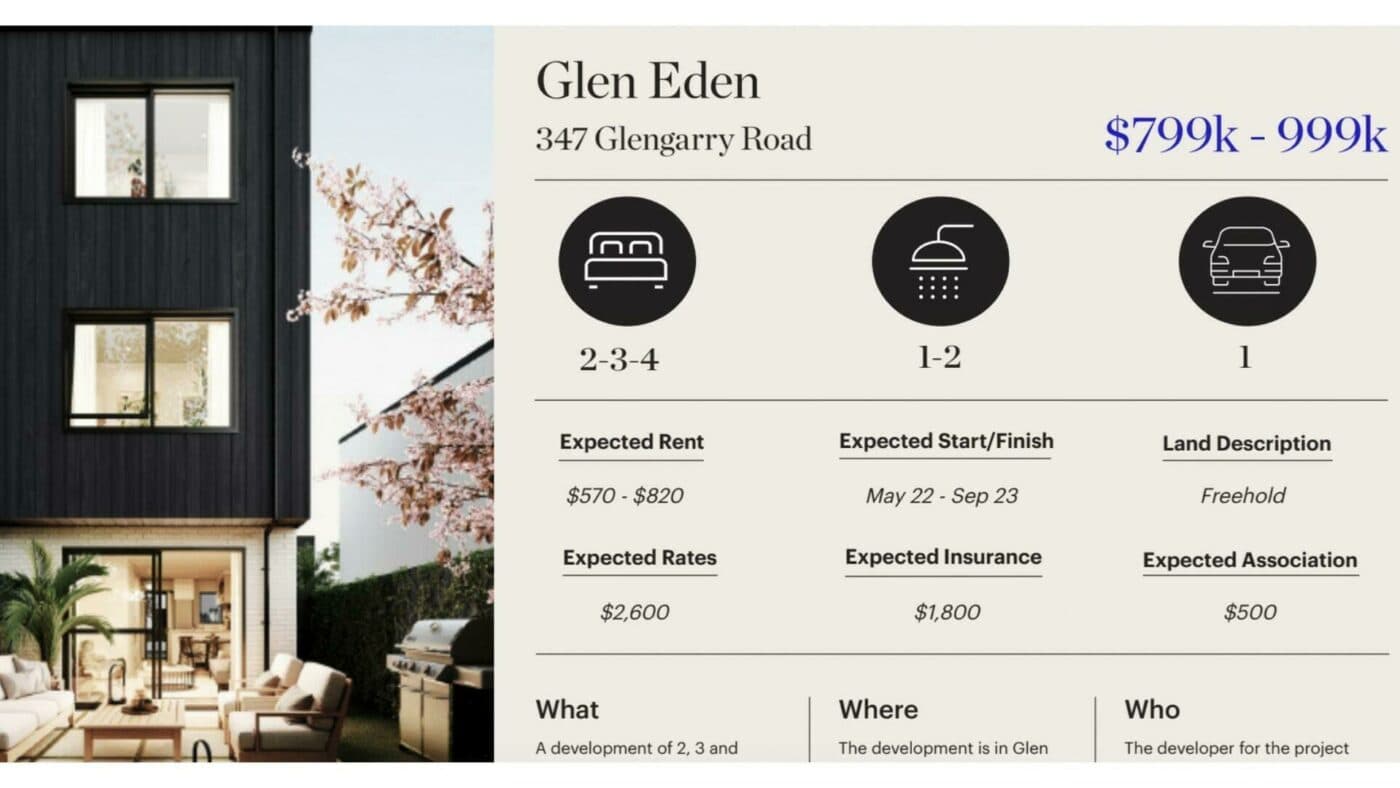

However, there are currently 3 projects being advertised. The following prices are all for 2-bedroom townhouses:

If we compare the price of Du Val properties with similar properties built by other developers, Du Val properties do tend to be more expensive.

Let’s take a look at these examples of current Du Val projects, and compare them to current development Opes is recommending in the same area:

One recent Du Val development is Sunnyvale Terraces in Glen Eden. This is a development of 46 townhouses due to be finished in mid-to-late 2023.

The 46 properties are all 2-bed, 1.5 bathroom townhouses (65-69 sqm2) with a car park, which are being advertised online from $865,000, rising up in price to $945,000.

The rental appraisal says these properties will fetch $620 a week, and gives a 4% gross yield.

In the same neighbourhood, 2.8km away, Aedifice – another developer that Opes does recommend – is building a 69m2, 2 bedroom, 1 bathroom (with 1 car park) townhouse for $799,000 as a part of the Selo Development.

This is due to be finished around the same time. And this represents a $66K price difference.

It is a similar story for other projects, which we will discuss below.

To give another example, Du Val is also advertising Te Awa Terraces in Mangere East – 2 bed/1 bath townhouses – priced from $829,000.

Again, only 2.8km away, Ceta Development is advertising a similar property (but with a study and another half-bathroom) for $725K. This property is also due to be finished around the same time.

So, for $104,000 less, you can get a slightly bigger townhouse in the same neighbourhood. There will always be differences between developers, and the properties aren’t identical.

But as a purchaser you should be making these kinds of comparisons so you can decide if you are getting value for money.

If we look at the prices of these properties it’s fair to say that Du Val properties tend to be more expensive, on the whole.

One fair question to ask is “Perhaps the Du Val properties are of a much higher standard?”

This could be the case. If you’re seriously considering purchasing a Du Val property it would be a good idea to go through a townhouse and compare it to others on the market. That way you can make the decision yourself.

But, price does matter when it comes to investment properties because you need to ask, “Am I going to get additional rent for the extra spend.”

There is a very real risk (with some properties) that investors pay extra money for a house, but don’t get the equivalent amount of rent back.

This can mean they’re left with a lower-yielding property. This is something first time investors may not be aware of.

If you Google “Du Val” you’ll find the majority of its reviews are positive, and it is obviously well-known in investment circles.

However, there are a few things prospective property investors may need to be aware of.

Kenyon Clarke, Du Val’s CEO, openly speaks about how he ran into financial trouble, resulting in several of his companies going into receivership, in 2009. According to an article: “Clarke has more than 27 companies listed with the Companies Office and 12 were placed in receivership last week under the instructions of the Bank of Scotland. It is understood that Mr Clarke was several hundred thousand dollars behind in interest payments”.

As a property investor purchasing a New Build, you want to have the confidence that if you sign a contract to buy a property it will be completed by the end of a certain time frame.

Sometimes a developer will go into liquidation and not be able to complete a development.

We’re not saying that is going to happen with Du Val, but it is worth asking yourself whether you’re comfortable purchasing this sort of property from a company who’s directors have run into financial trouble before.

In October 2021, the Financial Markets Authority (FMA) directed Du Val’s capital division to remove advertising material from social media platforms. Check it out here.

That’s because the regulator deemed these advertisements were likely to mislead or deceive investors.

To be clear, the direction order was for the capital division of Du Val (not the property development arm).

But, as a property investor looking at Du Val advertising, it is worthwhile casting an eagle eye over any marketing claims. This is especially because, from their website, it appears that one marketing team provides support for the entire group.

Du Val challenged the direction order, but the High Court dismissed the appeal in July of this year.

Finally, as a property investor you want to ensure the property you purchase has a solid foundation and that the property is sound.

In November 2021, 500 people had to evacuate their Lakewood Plaza apartments due to a burst water main.

Du Val Portfolio Management company (who oversees the building) put the affected residents in temporary accommodation while repairs were underway.

While this appears to be a one-off event, if you’re considering purchasing a Du Val property, this is something you may like to be aware of and dig further into as part of your due diligence.

If you are an investor looking to break into the Auckland market, Du Val is building in the right locations.

Both South and West Auckland have a lot of potential.

However, here at Opes Partners, Du Val is not one of the developers we recommend to investors.

Opes Partners Managing Director Andrew Nicol says: “For me, there are too many question marks around Du Val. The properties are more expensive, the director has a history of business failure, some of the layouts are a bit pokey. There’s the burst water mains, and I think the body corporate fees are far too high. Du Val would benefit from focusing on what is important to an investor (cashflow) rather than making gym fees compulsory.

“Investors often ask what I think of Du Val, so there it is, that’s what I think.”

To be clear, we’re not suggesting you shouldn’t buy a property from Du Val. Some people will and if held for the long term some investors may do well out of it.

But, our advice, if you are looking into a Du Val property, is to keep your eyes open, do your due diligence carefully, and fact check.

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Laine Moger, a seasoned Journalist and Property Educator holds a Bachelor of Communications (Honours) from Massey University and a Diploma of Journalism from the London School of Journalism. She has been an integral part of the Opes team for four years, crafting content for our website, newsletter, and external columns, as well as contributing to Informed Investor and NZ Property Investor.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser