Property Market

What is the average house price in New Zealand?

Find out the average house prices by council area in New Zealand in 2026. Here's everything you need to know including what factors make house values go up.

Property Market

5 min read

Author: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Reviewed by: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

New Zealand house prices are expected to rise in 2026.

After falling for a while, prices hit their lowest point in May 2023 and have now started to recover. With prices still lower than the 2021 peak, it's a good time to buy while the market is in the buyer's favour.

In this article, you'll learn:

This is all to keep you informed about what's going on in the property market.

And if you have a question, write your questions or thoughts in the comments section below.

New Zealand's median house price is $786,977

As at December 2025, the median house price in New Zealand is $786,977. This is up from $462,300 10 years earlier. That means that the median New Zealand property increased in value by 5.46% each year, or $32,468 on average.

This table shows the median sale price for a property in every region in New Zealand. Use the search bar to find you region. This includes data up to December 2025.

For instance, if you look at the Auckland Region, this table shows that the median sale price for a property is $1,015,000. That is up 0.89% year on year ($9,000).

Compare that to the Wellington Region, which is also up 0.59% year-on-year. The median sale price has gone from $765,500 to $770,000 (+$4,500).

Looking to the South Island, the median sale price for properties in Canterbury is up $25,000 (3.57%). The median sale price in the region now stands at $725,000 (December 2025).

Just keep in mind what this data is really saying. This shows the price that people are actually paying for properties. But you shouldn't look at this and say, "ok, this means that property prices are going up or down."

That's because the median sale price is heavily impacted by the properties that are sold month to month.

So, if more expensive properties sell one month, that will pull the median sale price up. But that doesn't mean that property values are rising. It just means that higher-priced properties happened to sell that month.

Let's say the month after that, a whole heap of cheaper properties sell. The median sale price will go down. But that doesn't necessarily mean that your property's value has gone down.

So, if you want to see how property values are changing month to month, I recommend reading the rest of this page too.

Some people also often ask me – "Ed, are those squiggly blue lines actual house prices?" The answer is yes. Those blue lines do show house prices over the last 12 months. They're called sparklines. And I like to include those to give you a quick sense of how the median sale price is moving.

Although the median sale price may have gone up 2% (or down 5%) over the last 12 months, that doesn't tell the whole story. It doesn't show what is happening month to month. So, those sparklines help to give you more context about what's happening in your area.

Property prices across the country are currently recovering ... in most places.

Up until recently New Zealand house prices had been falling.

House prices peaked in Nov 2021. They then fell 17.80% and appeared to bottom out in May 2023.

Since bottoming out NZ house prices have increased 2.50%. That includes REINZ house price index data through to December 2025.

Let's say you owned a $1 million property in Hamilton (at the peak of the market).

If it followed the NZ market perfectly, it would now be worth $843k.

That's a loss of $157k, at least on paper.

However, house prices fall at different rates around the country.

This graph shows how far prices have fallen since their peaks in different areas of the country.

House prices in Wellington have fallen fastest. Prices there are down 26.92% since house prices peaked in Oct 2021.

Auckland house prices peaked in Nov 2021. Property values there are down 23.05% since the peak.

The third fastest house prices falls were in Manawatu-Wanganui. House prices are down 16.53%.

House prices in Southland on the otherhand are down not much at all compared to the peak. In fact, house prices have fully recovered and are now above their peak in Jan 2022.

Otago prices are up 2.99% since the peak. And Canterbury house prices are down 1.84% since they peaked in Feb 2022.

So your properties might have done better or worse than the national average. It all depends on where your property is.

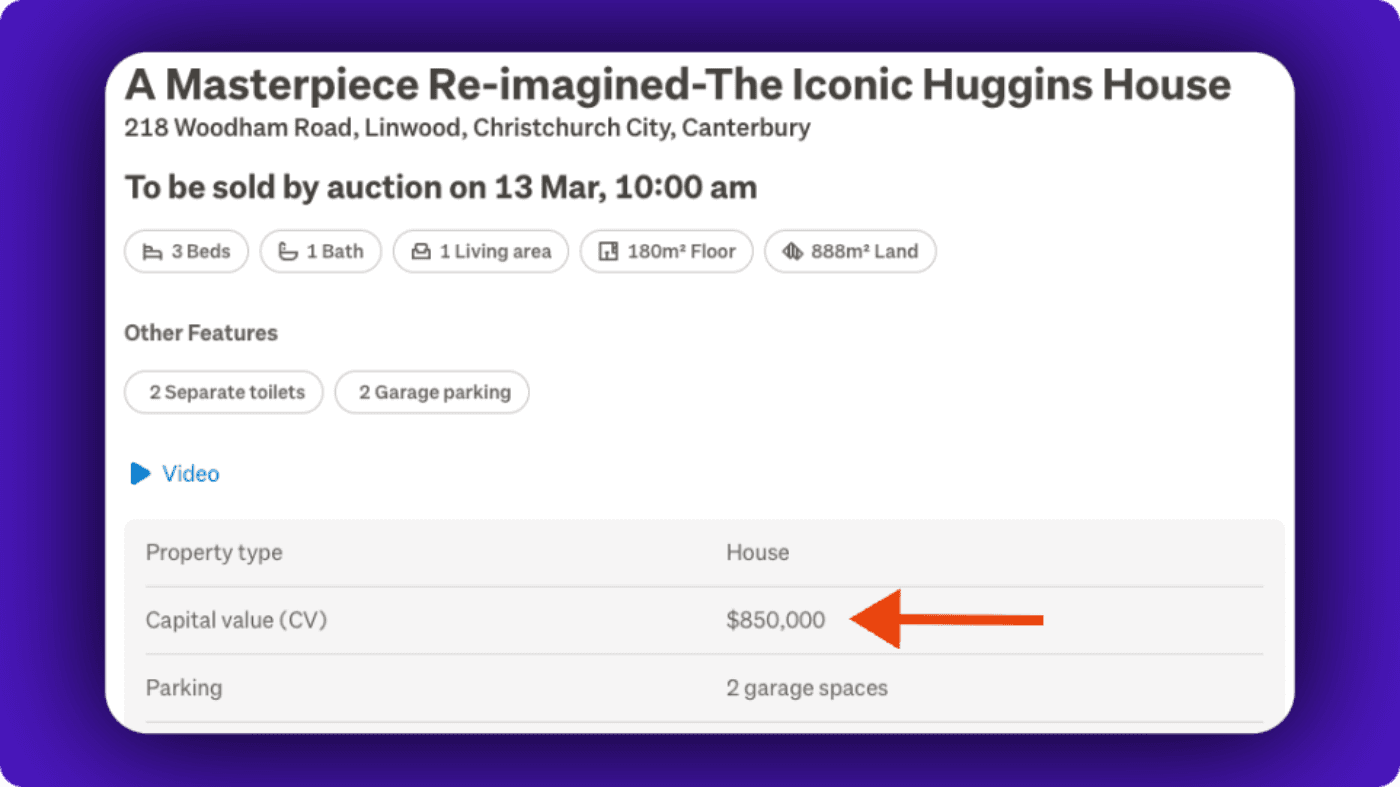

One of the most common questions I get asked is: “Ed, are properties selling above or below the Council Valuation (CV)?”

Some call it the RV (Rateable Value) or GV (Government Value).

Why do people care? Well, if you go on TradeMe (or another website), you’ll almost always see the council’s valuation for the property.

So, people use this as a guide to what the property is worth.

But, sometimes, properties are selling above CV. Other times, properties are selling below CV.

I've discussed this with many investors, and here's what I've found: people often rely too heavily on these valuations because they seem like an easy, objective measure of a property's worth. But they can be inaccurate.

That’s one reason I don’t suggest people pay too much attention to these valuations. After all, they are only updated every 3-ish years. On top of that, they’re just generated by a computer.

But people pay attention to them anyway. So here is a list of every council area, with whether properties are selling above or below CV.

Looking at the table above, properties in Westland District are selling the most above CV. In December 2025 the average property sold 41% above its capital value.

On the other hand, properties in Grey District are doing the opposite. Properties there are selling the most below CV. Over the same period, the average property in this area sold for 12% below its capital value.

Sometimes, there are big swings in how far above or below an area is selling compared to CV. Over the last 12 months, Westland District had the biggest swing.

Properties went from selling 4% above CV to selling 41% above CV just 12 months later.

This can happen if an area is small. In that case, there aren't that many properties selling. So, the median price can jump around a lot.

Other times, the council might have updated their CVs midway through the year. In that case, the ratio between prices and CVs changed because the capital values changed.

If you want to know how the property market is going, look at the number of property sales per year.

Property sales peaked at 100,108 in Jun 2021. They then fell to just 58,763 in May 2023.

That's right, here in New Zealand we were buying 41.30% fewer properties per year compared to the peak.

Today the number of property sales has started to recover. In the 12 months to Dec 2025 we bought 79,497 properties. So we are currently buying 20,734 more properties per year compared to the bottom of the market.

Loading...

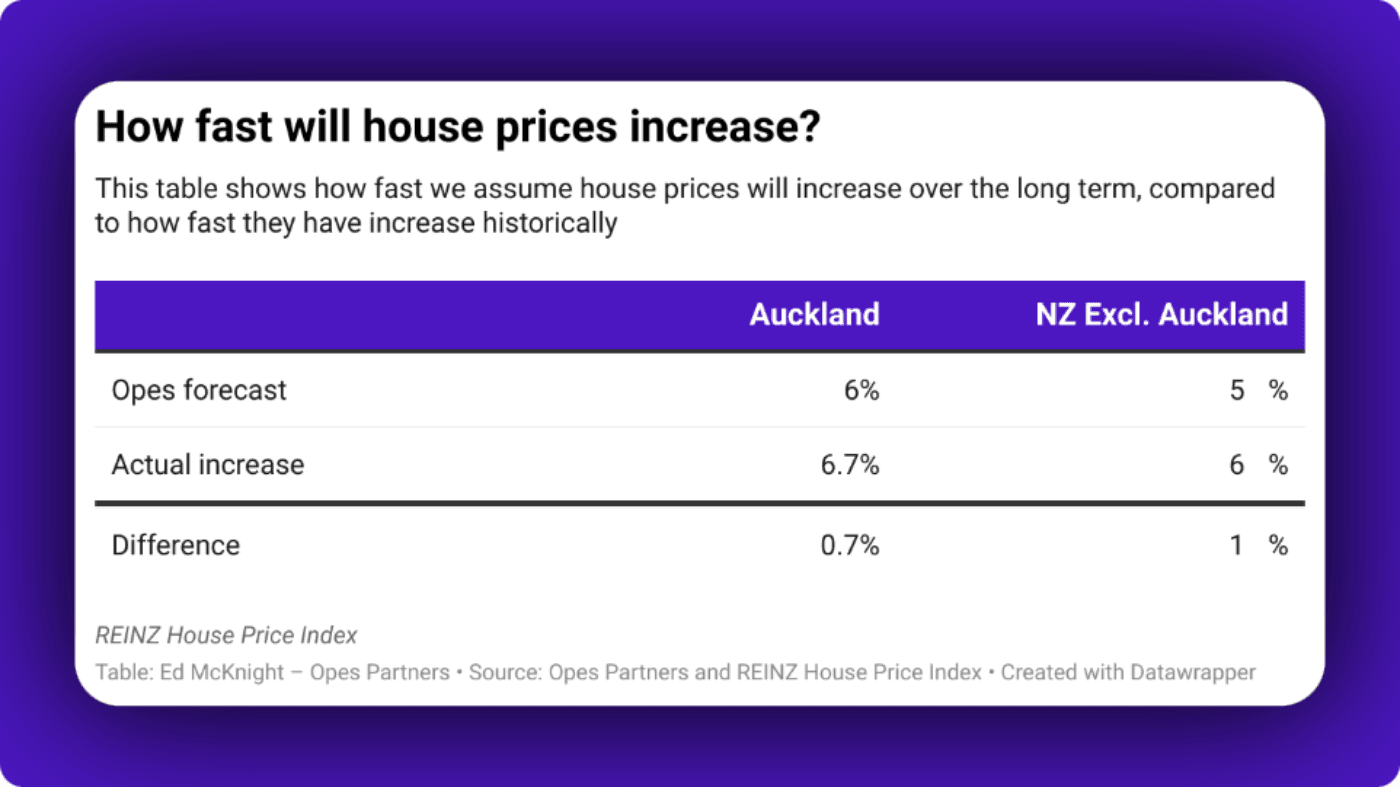

Our standard assumption at Opes Partners is that Auckland house prices will increase 6% per year over the long term – compared with 5% for the rest of the country.

This is a slower rate than the market has experienced in the past.

Over the last 30+ years (Jan 1992 - Dec 2025) NZ house prices, excluding Auckland, increased 5.9% per year (on average). House prices in Auckland increased 6.4% per year (on average).

So the capital growth rates we use are ‘discounted’ by 0.4% - 0.9% percentage points.

These forecasts are roughly in line with independent economist Tony Alexander’s thoughts.

“It pays to remember that the long-term trend in prices is upward. Since 1992, on average New Zealand house prices have risen 7% per annum. I think we’re looking at 5% per annum going forward.”

To answer this question we look at where prices are higher or lower than we would expect them to be.

The blue areas are those where house prices are below where we would expect them to be. These areas are currently undervalued and will likely increase in value faster.

The red shows areas where house prices are higher than we'd expect them to be. These areas are currently overvalued and will likely increase in value more slowly.

The 3 most undervalued areas appear to be Wellington City, Auckland and Nelson City.

The most overvalued areas are Mackenzie District, Queenstown-Lakes District and Kawerau District.

Wellington City property prices appear to be 15.28% undervalued.

This suggests there is more potential for capital growth in Wellington City compared to Mackenzie District.

You can read about how we calculate this data on any of our property market pages. Like this one on the Auckland property market.

All investors know – there are lots of factors that influence the surge and sag of the property market.

One of the main ones is higher interest rates.

Right now interest rates, like the prices of everything else, are high.

Why?

Low interest rates during Covid-19 lockdowns sent inflation soaring above the norm.

On top of this the labour market was tight and international supply chains disrupted.

There was too much demand and too little supply in the economy.

It overheated.

Inflation peaked at 7.3% (June 2022), well outside of the Reserve Bank's 1-3% target band.This forced the Reserve Bank to increase the OCR in an attempt to temper the economy.

The aim of hiking interest rates is to slow the speed of spending and let the pressure out of the economy. And there's more to come.

This forced the Reserve Bank to increase the OCR in an attempt to temper the economy.

The aim of hiking interest rates is to slow the speed of spending and let the pressure out of the economy. And there's more to come.

Loading...

Read more about our interest rate predictions here.

Sure, it’s a tough market at the moment. Interest rates are high. House prices have stopped falling – but, they're not increasing much either. But, it’s not all doom and gloom. There are pros and cons in every market.

Or said another way, there is always something working for and against you in any market.

For example, working against investors in the market currently are:

On the flip side, the positives are:

And remember, it is likely that over the long term, property prices will increase again.

Here's how house prices have changed year on year since REINZ started tracking that data in 1992.

As you can see from the above graph, property price growth regularly rolls up and down in cycles.

There is arguably nothing new about this most recent dip.

All stable asset classes – like shares and property – tend to go through cycles. Prices boom, peak, fall, and then recover and go through a boom again.

Now is a good time to buy a house in New Zealand.

Property prices are much lower than they were in 2021, and it is a buyer's market. That means that property buyers have the upper hand.

On top of this, property prices bottomed out in May 2023. We've hit the bottom of the market.

So if you buy a house today, there is less risk that your property's value falls dramatically in the near future.

Disagree with me? Good. Let's have a discussion. Write your questions or thoughts in the comments section below.

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Ed, our Resident Economist, is equipped with a GradDipEcon, a GradCertStratMgmt, BMus, and over five years of experience as Opes Partners' economist. His expertise in economics has led him to contribute articles to reputable publications like NZ Property Investor, Informed Investor, OneRoof, Stuff, and Business Desk. You might have also seen him share his insights on television programs such as The Project and Breakfast.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser