Property Investment

What should my retirement plan look like?

Thinking about retirement? The Epic Guide to Retirement Planning is the guide that will give you the knowledge so you can plan for your retirement in 2026

Property Investment

5 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Reviewed by: Dennis Schipper

Financial adviser for 3+ years. Helped nearly 500 Kiwis buy property.

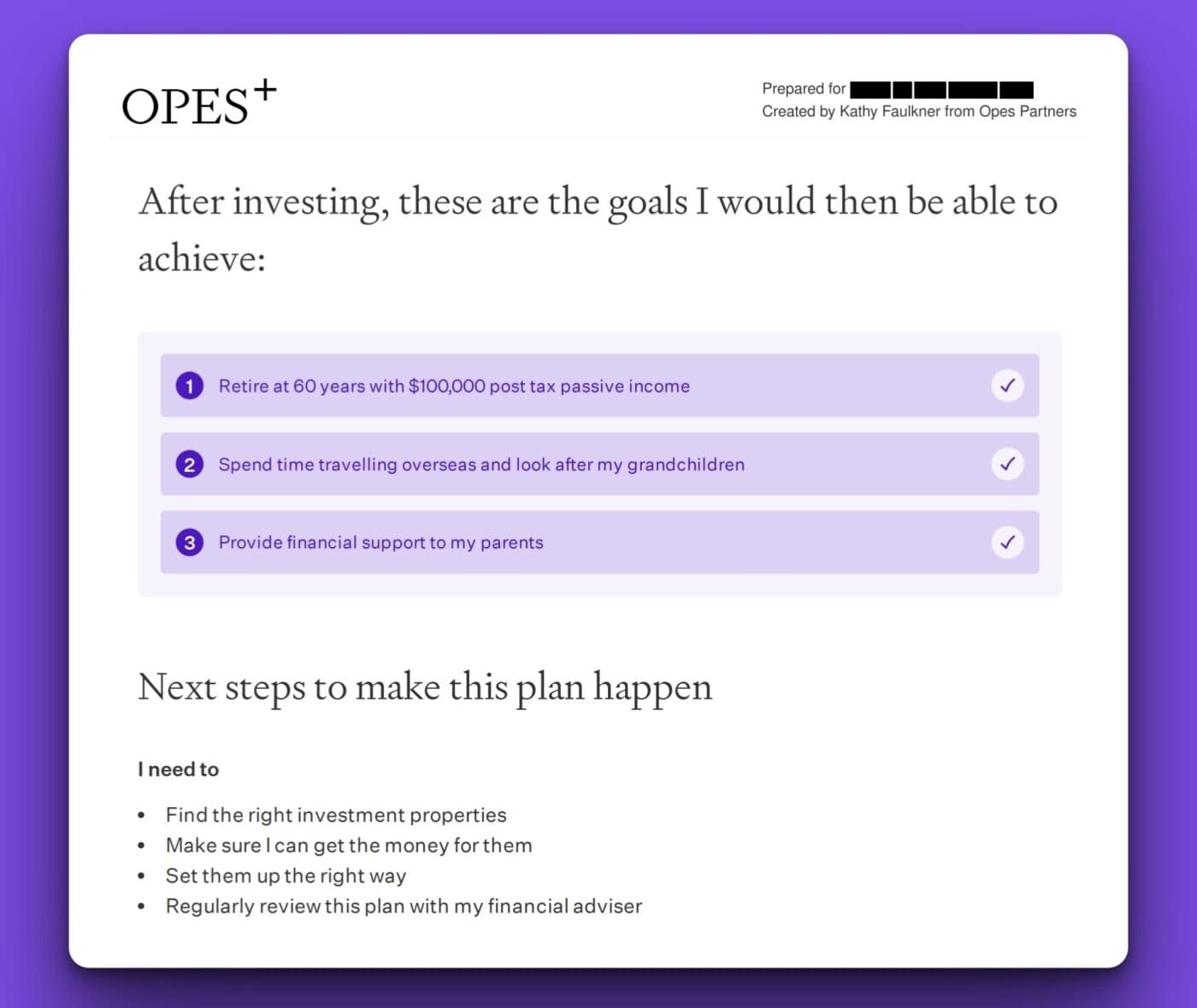

A Wealth Plan is a road map that answers one powerful question:

“Am I on track for the life I want? And if I’m not … what would it take to get there?”

We created this at Opes Partners to take your personal goals and turn them into numbers. That way you can do what it takes to turn your goals into reality.

That could mean you:

Used properly, a Wealth Plan isn’t something that sits in a drawer. It’s a living plan for how you can achieve what you want out of life.

In this article, you’ll learn what a Wealth Plan is, how it helps, and how to get one.

A Wealth Plan is Opes' personalised roadmap that shows whether you’re on track to achieve your financial goals — and what changes you need to make to get there.

Your Wealth Plan is made up of 5 simple parts:

Everyone has goals. Whether it’s to retire on the same lifestyle, or quitting work early to travel the world.

The first step is to turn those goals into numbers. Ask yourself: “How much do I want to spend per year?”

You can then calculate how much money you’ll need in the bank to make that happen.

This means understanding how much you are worth today (financially). That includes your income, expenses, savings, KiwiSaver, mortgages, properties and investments.

Even if you don’t have lots of money today, that doesn’t mean you’re not doing anything about it.

If you’re contributing to KiwiSaver, own a rental property, or investing in a fund, your wealth should grow over time. You’re already investing for your future.

But you need to calculate where all that investing will take you. Will it be enough for the future you want? All this can take a fair bit of number crunching.

Once you’ve figured out how much money you’ll need … and what you’re on track for … you can then see if there’s a difference.

If you’re current investing isn’t likely to get you to your goal, then you have a Wealth Gap. It’s OK … many New Zealanders do.

That often means you either need to decrease your goals or invest more.

This is the interesting part. If you decide you want to close your Wealth Gap, then the answer is often to save (or invest) more.

This is where you look at different scenarios to change your outcome.

For example, what happens if you repay debt faster? Or what if you buy an investment property or invest more in KiwiSaver?

Or what happens if you do nothing and just ride it out?

Two investors want to spend $120,000 a year when they stop working and they want to quit their jobs at 65.

But if they just keep paying their mortgage and contributing to KiwiSaver at current levels, they’ll be able to spend about $92,000 per year.

That’s good, but it’s still $28,000 less spending than they ideally want.

As part of their plan they might:

Now they don’t have to guess what their retirement looks like. They know.

Short answer: almost every Kiwi needs a Wealth Plan.

If you’re starting out on your career, it clarifies for you what matters most and what to do next.

If you’re mid-career, it shows how today’s choices affect freedom later.

And if you’re approaching retirement, it stress tests your retirement income plan.

That way you will know if you are on track for your goals.

Plenty of advisers create financial plans for their clients.

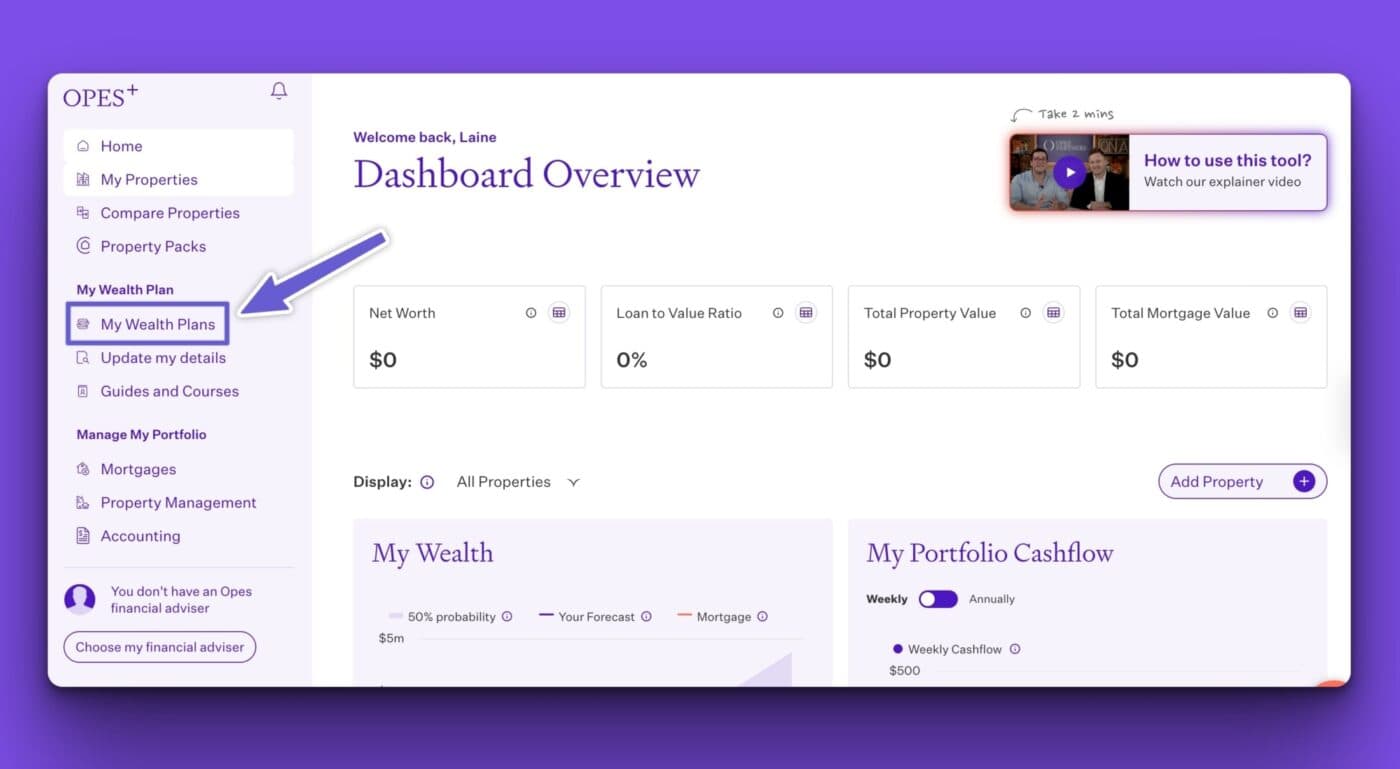

However, a Wealth Plan is created by Opes Partners’ software: Opes+.

A Wealth Plan is different from a normal financial plan in three important ways:

#1 – It’s built with you, not for you.

Many advisers’ financial plans are created in Excel behind closed doors. The adviser then presents the plan to you a few weeks later.

But when you use a Wealth Plan, your adviser at Opes builds the plan with you (in the meeting).

That way you can see the numbers and ask questions along the way. You can also challenge our future assumptions and understand why the numbers say what they say.

#2 – You can change it yourself.

Many financial advisers won’t give you the spreadsheet that runs your numbers.

But with a Wealth Plan you can update it (or create a new one) in Opes+. That’s a free platform we created for property investors.

So, you can log in after the meeting to tweak whatever you like. So, if you decide you’d like to change the mortgage repayment amount, or the age you’ll retire, you can see how those changes impact your plan straight away.

You’re not reliant on getting someone to “update the spreadsheet” for you.

#3 – You can get suggestions for property investment.

Many financial advisers focus on investing in managed funds and shares. Nothing wrong with that, but often those advisers don’t specialise in property investment.

A Wealth Plan is created for property investors from the get-go.

There are two ways to get a Wealth Plan.

First, you can create one with a financial adviser (for free). Book a Portfolio Planning Session here. That’s a free meeting with an Opes financial adviser.

Or, you can create your own plan (free) within Opes+. You can create your free account here.

Here at Opes we think everyone should have a Wealth Plan. And no, that’s not just because we want you to work with us (because, remember, you can create your own for free).

And often life changes, so I recommend investors update it every year.

That way it’s kept up to date with all your latest investments and ambitions.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser